Digital India’s growing demand for data centres

India's data centre market is rapidly expanding, driven by AI, cloud computing, and supportive government policies.

Growing demand from AI and cloud computing, coupled with supportive government policies, are driving a growing Indian data centre market.

Savills data show 71MW of IT capacity (data centres are measured by the amount of power they offer for usage, rather than floorspace) added in the first half of this year, bringing the Indian total to 942MW. Meanwhile 200MW of capacity was taken up by users, mainly ‘hyperscalers’ which provide cloud computing services.

Arvind Nandan, Head of Research & Consulting at Savills India, says: “India is well positioned to serve as a regional data centre hub in Asia. The adoption of 5G, increased use of internet services in Tier 2 and 3 cities, the Internet of Things (IoT) and Artificial Intelligence (AI) are likely to drive demand for data centres.”

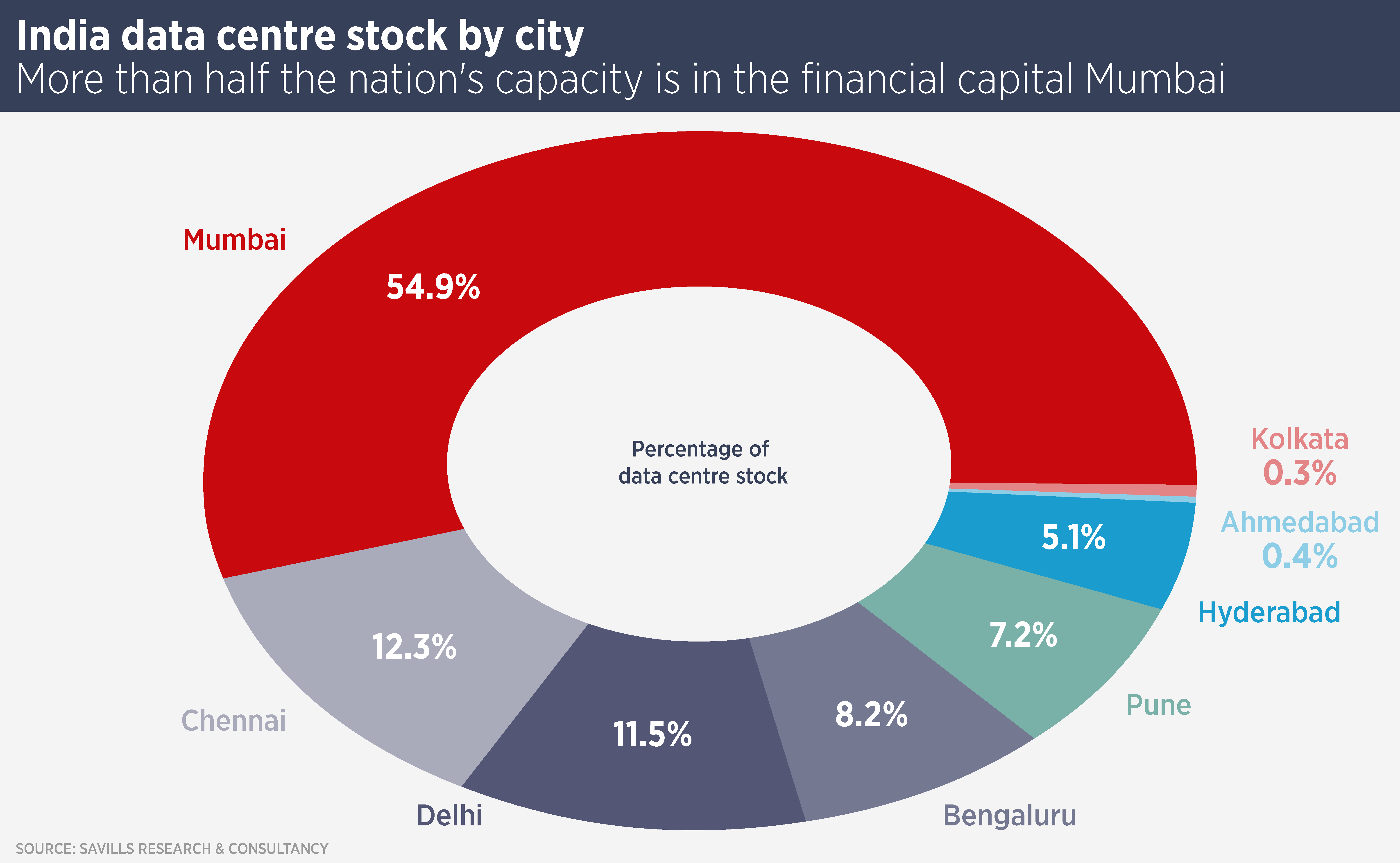

India’s total data centre IT capacity has grown at 22% each year since 2014, with the majority of capacity (517.2MW or 54.9% of the national total) located in Mumbai. The financial capital also has more data centre capacity underway (1209MW) than the rest of the nation combined.

Other cities are set for substantial data centre expansion; for example Hyderabad has 48.3MW IT capacity today, but 431MW in the pipeline, while Chennai has 115.5MW and 271.5MW of supply. Supply in excess of 2,000 MW IT capacity is expected between 2024 to 2030 across the major cities in the country.

Some market observers believe data centres used for AI training could be built in secondary locations with access to renewable power, as they do not require low latency (the delay in access digital information).

Data centres are being constructed by local and international sector specialists, but also is attracting real estate investors such as CapitaLand, which is building four data centres in major markets (Mumbai project pictured above).

Government initiatives such as Digital India, which seeks to bring digital services to a wider population and data localisation, which requires Indian consumer data to be stored within the country, are also expected to boost data centre demand.

While data centre development has focused on larger cities, Tier 2 and Tier 3 cities are expected to see developments as their digital economies and wealth grow. These cities also have growing demand for ‘edge’ data centres, smaller urban centres which are used to enable faster digital services.

Savills Research estimates demand for consumption by the end of 2024 will be around 400MW IT capacity, with supply of over 350 MW IT capacity during the same period, across major cities.

Further reading:

Data Centre Market Watch H1 2024

Contact Us:

Arvind Nandan