Alternative real estate piques investor interest

Real estate investors in Asia Pacific are increasingly turning to alternative or niche sectors in order to boost returns and improve diversification.

Real estate investors in Asia Pacific are increasingly turning to alternative or niche sectors in order to boost returns and improve diversification.

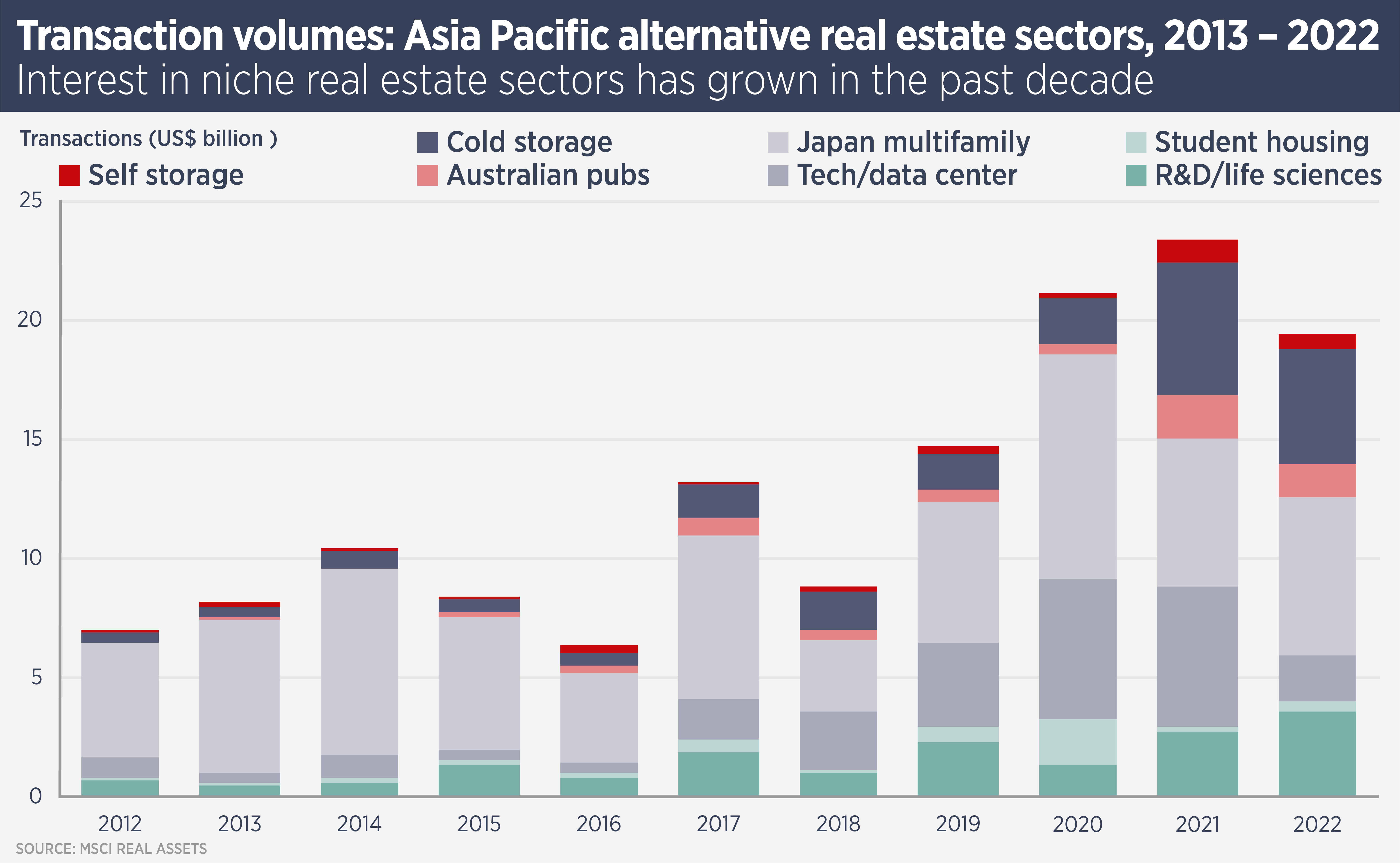

Data from MSCI Real Assets (above) shows the growth of investment in alternative sectors from life sciences to cold storage. Simon Smith, Head of Research & Consultancy at Savills Asia Pacific, says: “These alternative sectors are attractive for several reasons. In some cases, they offer higher returns thanks to higher entry yields, compared with mainstream sectors.

“They may also offer diversification benefits. For example self-storage assets tend to perform steadily through the cycle as they are less dependent on economic growth. Finally, newer alternative sectors offer the chance to build a platform, allowing investors to add operational value.”

Not all sectors require specialist skills: cold storage operations are similar to dry warehousing, although the tenant profile is different. Self-storage, however, is a consumer facing operational business.

The biggest alternative sector in the region – in terms of transactions – is Japanese multifamily residential, although strictly speaking it is only an “alternative” due to Japan being the only nation with a significant investable multifamily market. In the US, multifamily residential is a core property sector.

Alternative real estate sectors to watch in 2023 include:

Cold storage

Demand for cold storage is growing in Asia Pacific as rising prosperity continues to drive demand for fresher, better-quality food and the cold chain required to support this. The pandemic accelerated demand, due to an increase in grocery and cooked food delivery, as well as the need for vaccine storage.

Additionally, the stock of old storage warehouses in the region is too old and small for the demand, opening an opportunity to develop larger and more efficient facilities. Consolidation amongst cold chain logistics companies also supports larger warehouses.

Entry yields for cold storage facilities tend to be somewhat higher than for dry warehouses, boosting returns. Meanwhile, due to the cost of fit out, tenants are keen to take long leases.

Life sciences

A hybrid of office and high-tech manufacturing or lab space, life sciences real estate is an established niche in the US and is growing rapidly in Asia Pacific. Life sciences clusters are growing near leading universities in China and India, while the sector is also growing strongly in Singapore.

As Asia Pacific becomes wealthier, demand for the drugs and technologies produced by the life sciences sector is predicted to grow. Meanwhile global pharmaceutical companies have set up operations in India to take advantage of relatively cheap but highly skilled labour.

Last year, Chinese investment manager DNE Group formed a $1.2 billion joint venture with an Asian institutional investor to invest in Chinese life science parks in Tier 1 cities. Further institutional investment in the sector is to follow.

Self storage

Self storage has been established so long in the US that it is barely a niche. However, the business of providing storage units to retail customers looking for extra space or storage during moves and renovations is growing in Asia Pacific.

The region’s densely populated and often expensive cities mean a self storage unit is a cost-effective alternative to an extra bedroom. People store everything from winter clothes to sports equipment and units are also often used by small e-commerce businesses to store inventory.

Expensive cities such as Hong Kong, Singapore and Tokyo boast a number of operators and the market is fragmented but growing, including in Mainland China, considered to have significant potential.

Last year, Dutch pensions group APG and Singaporean developer CapitaLand formed a joint venture to acquire operator Extra Space Asia, which has 70 owned and leased facilities across Hong Kong, Kuala Lumpur, Seoul, Singapore, Taipei and Tokyo. The jv partners committed an initial S$570 million ($434 million) but could double this to fund the group’s expansion.

Further reading:

Asia 2023 Real Estate Investment Tips

Contact Us:

Simon Smith