Capital homes in on Asia Pacific living sectors

Asia Pacific living sectors, such as multifamily and senior housing, show resilience with only an 8% investment drop, outpacing traditional real estate amid strong demand and diverse markets.

Investors continue to support the Asia Pacific ‘living sectors’, such as multifamily residential, student housing and senior living, despite a cautious overall investment market.

Data from MSCI show investment in Asia Pacific living sectors held up well in the year to June 31, 2024, falling only 8% on the previous period. In contrast, real estate investment volumes in traditional sectors fell 31% over the same period.

“Investors like the living sectors because of their resilience through cycles,” says Simon Smith, Head of Asia Pacific Research at Savills. “Everyone needs somewhere to live so the various niches within the living sector are underpinned by strong demand.”

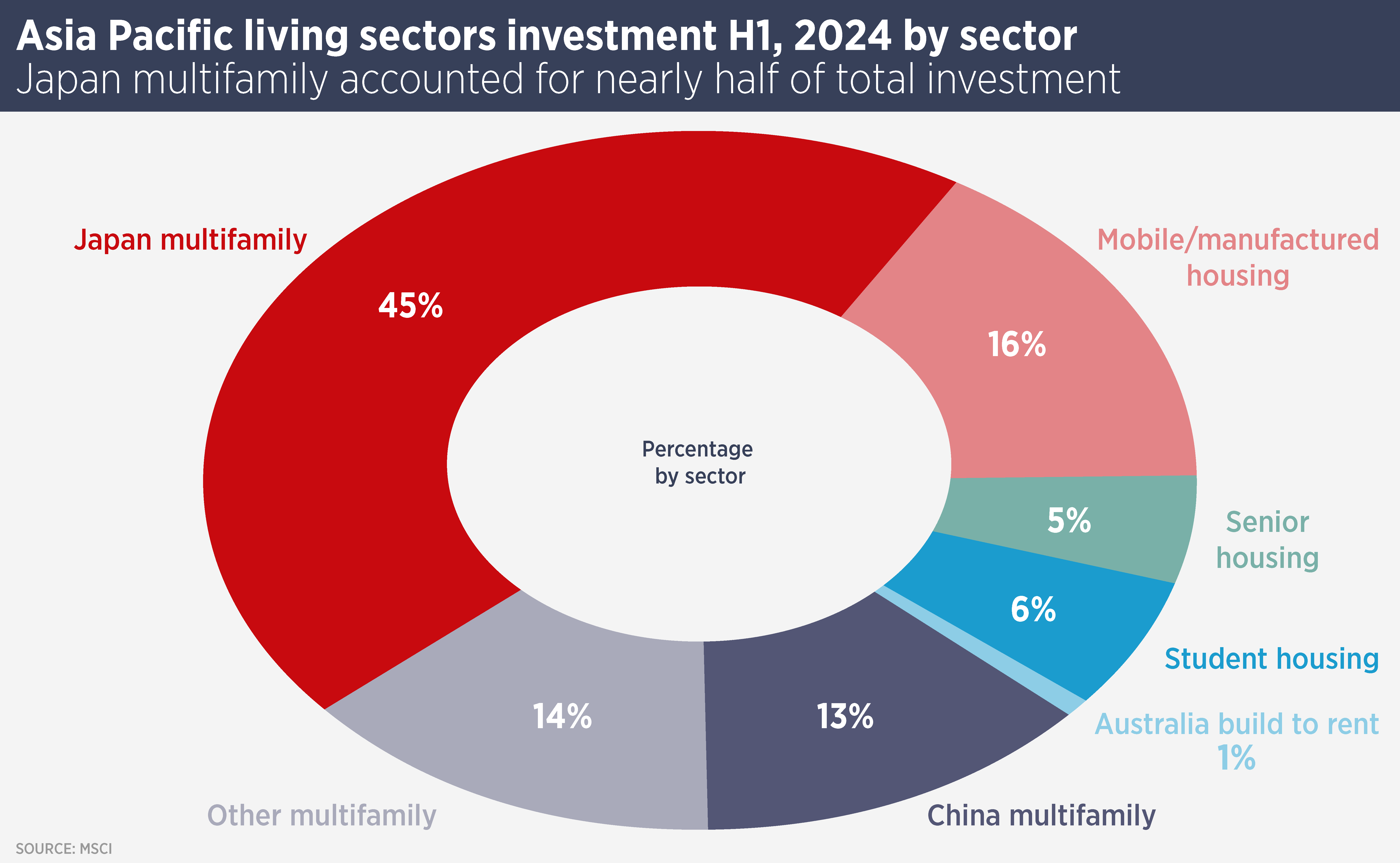

The living sectors in Asia Pacific are extremely diverse, with niches often only present in a handful of markets. Japan multifamily residential (pictured above) remains the most popular sector, accounting for nearly half of the capital invested in Asia Pacific living sectors in the first half of this year.

The multifamily market is smaller elsewhere but growing in both Australia and China. In China, Savills data show en-bloc transaction volumes for multifamily residential and serviced apartment properties rose 47.5% in the 12 months to June 15, compared with a fall of 11% in the wider en-bloc investment market.

In Australia, investors have been targeting the manufactured housing or land lease sector. In land lease communities, a buyer owns their home but leases the land where the home is situated from an operator. The buyer pays rent for the right to occupy the site with a manufactured home or moveable dwelling. The sector is popular with retirees.

The sector has seen record transactions this year, with both domestic and overseas investors buying. Earlier this year, Invesco Real Estate bought a 50% stake in three projects being developed by Stockland.

The multifamily market is also beginning to take off in Korea and has attracted investors such as KKR and Morgan Stanley, as well as domestic players.

Additionally, Savills data show prime residential rents are growing in most markets in the Asia Pacific region, with Bangkok one of the top three world markets for residential growth. Bangkok is leading the way with 9% rental growth in the first half of this year, but other Asian cities such as Mumbai and Kuala Lumpur are showing steady rental growth.

Rents have been falling in China’s major cities, with the exception of Beijing, which saw 1.6% rental growth in the first half. Hong Kong also saw rental growth. Meanwhile Singapore was the region’s worst performer as rents fell 4.5% as rents continued to slip from a post-covid boom period.

Smith says: “Prime residential property remains an investment favourite of Asian high net worth and family office investors and rising rents across most of the region’s markets will support further investor interest.”

Further reading:

Asian Cities Reports H1 2024

Contact Us:

Simon Smith