Driving the growth of India logistics property

India’s logistics property sector remains relatively underdeveloped, but the potential remains huge and it is attracting overseas investment.

IndoSpace, GLP, Logos and e-Shang Redwood, Firstspace, and several other large global and regional warehousing specialists, have all committed to develop their business in India in the past 18 months.

Anurag Mathur, CEO of Savills India, says: “India’s logistics market is expected to be worth $215bn by the end of 2019 from $160 bn in early 2018. This sunshine industry and the corresponding demand will transform from a real estate perspective as well. Additionally, technology continues to play a larger role in this industry with ever increasing leverage of data-driven decisions.”

There are five key factors behind the increased attention the sector is getting; legislation has been the most important catalyst, as several reforms by the government of Narendra Modi have changed the landscape for logistics. In 2017 a nationwide goods and services tax replaced a raft of taxes, including state-levied taxes which hampered the transport of goods between states. Other beneficial legislation includes 100% permitted foreign direct investment in e-commerce and the introduction of a real estate investment trust regime.

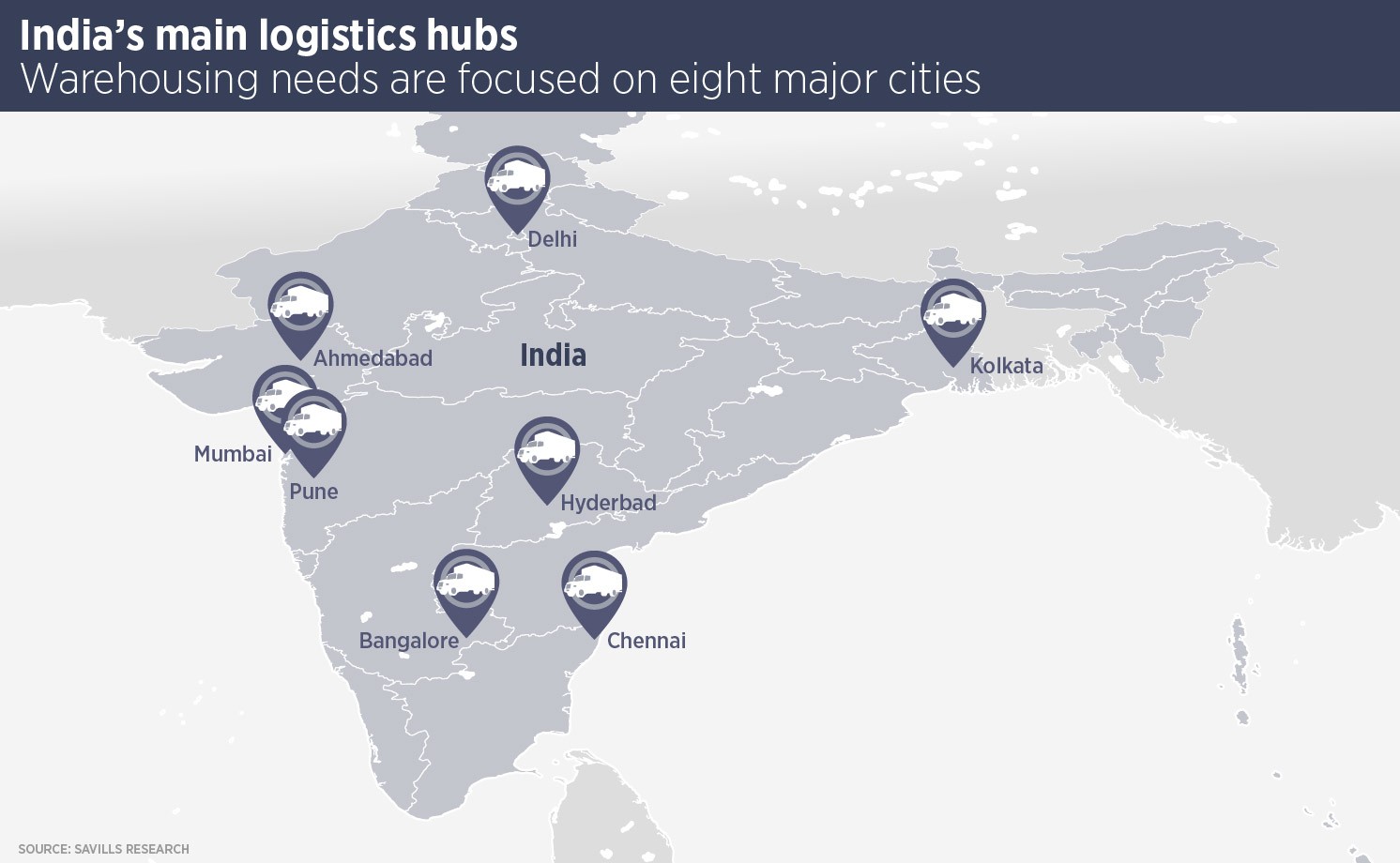

India’s demographics are positive for all real estate sectors, with the population set to hit 1.5bn by 2030. Furthermore, urbanisation will bring hundreds of millions of people to cities by 2030, creating natural logistics hubs. The UN estimates that India will have 71 cities with a population of more than 1m by 2030, up from 61 today.

As India’s urban population grows, so does its economy. The IMF predicts India’s GDP growth will average more than 7.5% for the next five years. More importantly for logistics, the nation’s consuming middle class is now 20% of the urban population and growing.

Compared with regional rival China, India lacks in infrastructure, but the government has pledged billions of dollars to build new roads, railways and ports. In the most recent budget, finance minister Arun Jaitely raised the infrastructure budget by 25%, focusing on delivering delayed projects. He said India needed $685bn of infrastructure spending.

In other Asian nations, the growth of e-commerce has been a major driver of logistics real estate and online retail sales will rise 31% to $32.7bn this year, according to eMarketer, with a quarter of the population buying online. By 2022, 42% of Indians will be shopping online, generating $72bn in sales.

While the top-down picture for Indian logistics real estate is overwhelmingly positive, one challenge for developers will be acquiring and clearing land for development and finding joint venture partners across the country. There is also a strong propensity for Indian logistics projects to be delayed: Prime Minister Modi unveiled the foundation plant for Navi Mumbai Airport in February 2018, more than 20 years after it was first conceived.

India is at the cusp of becoming a logistics hub driven by trade competitiveness, infrastructure development, tax reforms and technology adoption. Mathur says: “India needs to continue to focus on improving the material handling infrastructure and bring in higher levels of cost efficiencies. There is a target to reduce the logistics cost in India from the present 14% of GDP to less than 10%, by 2022. There is also a need to revisit the number of regulatory and policy making entities. A focused and integrated approach leveraging technology will bring significant efficiencies to the industry.”

Contact Us:

Anurag Mathur