Hotel investors target Asia’s largest markets

Discover how Asia Pacific's hotel sector is attracting real estate investors, with Japan, China, and Korea leading the recovery in tourism and hospitality investments.

As Asia Pacific tourism continues to recover, real estate investors are increasing their spending on hospitality properties in the region’s major developed markets.

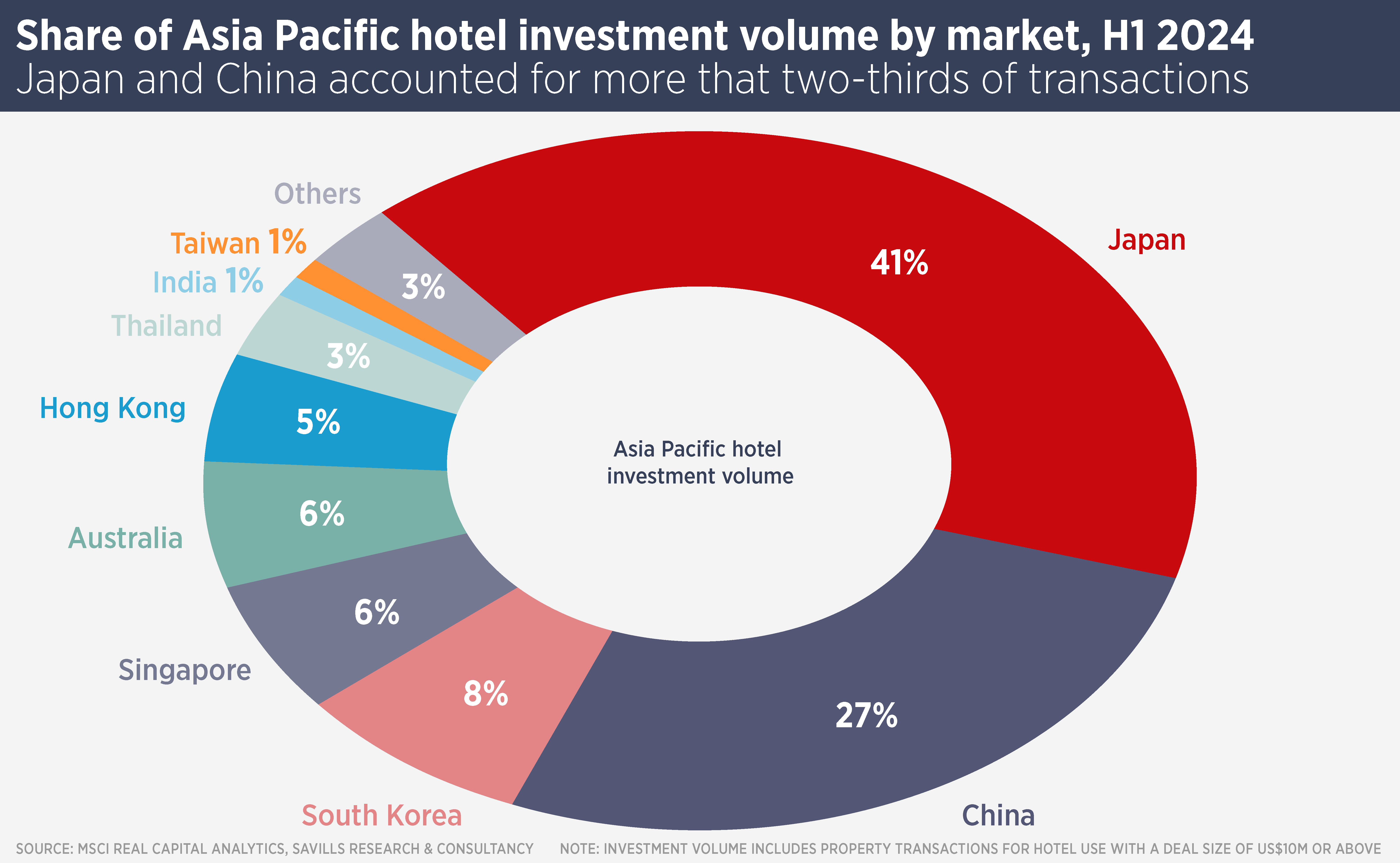

MSCI data show more than three-quarters of transactions in the first half of this year were in the three most active markets – Japan, China and Korea. The top five markets (also including Singapore and Australia) saw nearly 90% of transactions. The hotel sector was the only real estate segment to show rising transactions in the half-year.

Nancy Wong, Senior Manager, Regional Research & Consultancy, at Savills Asia Pacific, says: “The resilience and adaptability of the hotel sector, coupled with its ability to provide a hedge against inflation, have positioned it as a preferred investment choice in the current economic climate. Investors have also tended to target mature real estate markets, such as Japan, Korea, Australia and Singapore.”

China has also seen strong interest in hospitality properties, often acquired in distressed deals. Most of the activity in the first six months of the year was driven by domestic investors, primarily cash-rich state-backed or affiliated businesses. For example, a hotel project in Chengdu once owned by the collapsed Anbang Insurance Group, was sold to a consortium of state-owned enterprises for £369 million.

While China’s real estate sector continues to be troubled, overseas visitor numbers are up to 92% of pre-covid levels and domestic tourism continues to be strong.

Japan visitor numbers have exceeded 2019 levels and tourists are staying longer and spending more on accommodation. This, and the nation’s low interest rates, have attracted both domestic and overseas investors. Korea has also seen a strong post-covid recovery and, like Japan, managed to achieve this with fewer Chinese tourists, suggesting further growth once China outbound tourism recovers.

However, most Southeast Asian countries are currently experiencing a decline in transaction levels, primarily attributable to ongoing market adjustments stemming from both economic conditions and fluctuations in tourism performance.

Thailand has seen transaction volumes rise sharply this year, but from a very low base. Meanwhile, even though visitor numbers to Vietnam have recovered strongly, it has attracted little investor interest, most likely because of a lack of upmarket hotel stock.

“We expect to see these trends in hospitality investment continue in the near term,” says Wong. “Improving tourism fundamentals will support investment sentiment and sustain positive momentum across the region. Japan is likely to be the standout market again, due to the interest of both domestic and overseas investors.”

Further reading:

Asia Pacific Hospitality Spotlight

Contact Us:

Nancy Wong