Inbound tourism to drive Japan’s retail renaissance

Japan has seen dramatic growth in overseas visitor numbers in recent years and this could revitalise the nation’s retail sector.

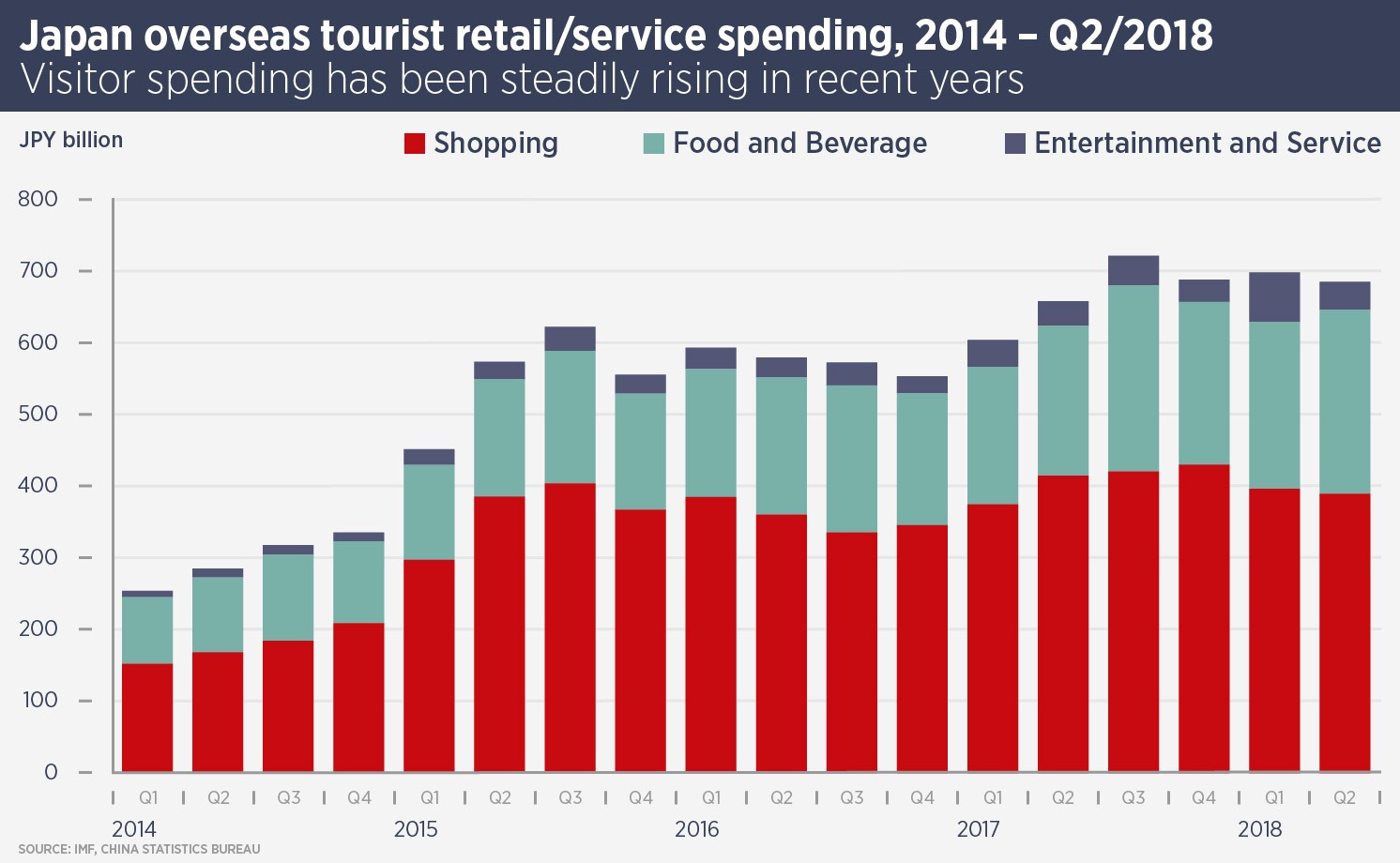

The number of inbound tourists has increased exponentially to 28.7m last year, up from 6.2m in 2011, and tourists spent ¥4.4trn last year. The government has set a goal of 40m overseas visitors and ¥8trn of spending by 2020. Japan is a huge retail market, with ¥140trn of annual sales; but retail spending growth has been low.

Increasing tourism ought to have a positive effect on retail property in popular tourist cities, says Tetsuya Kaneko, head of research and consultancy at Savills Japan. Savills data show average retail asking rents have been growing in Tokyo since 2013 but have been struggling in Japan’s regional cities since 2008.

Kaneko suggests that tourists will look for particularly Japanese shopping experiences, so landlords need retail that offers “uniqueness and authenticity”.

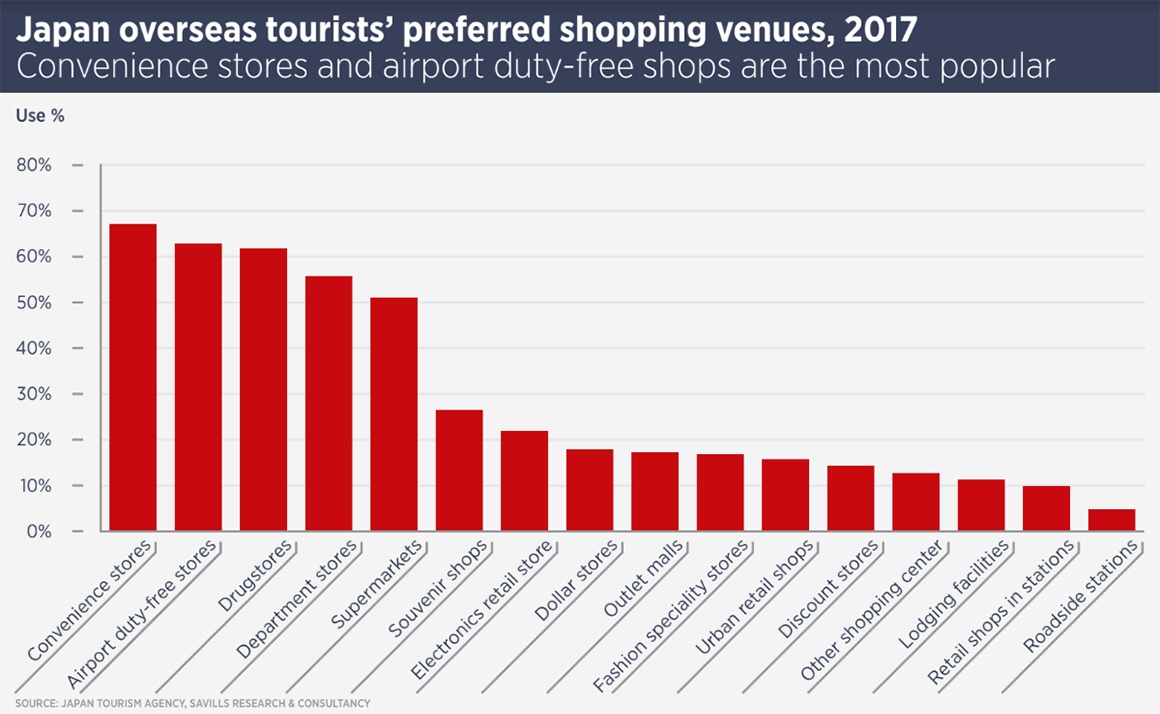

Certain retail sectors are also more popular with tourists, says Kaneko. “Inbound tourists shop at a wide range of venues and contribute to sales in various retail sectors. The ubiquity of convenience stores makes them the most frequented store types where tourists spend money. This is followed by airport duty-free stores, drugstores, department stores, and supermarkets.”

And while only 15-17% of tourists shop at outlet malls, fashion speciality stores, and urban retail shops, that nonetheless means nearly 5m visitors a year shopping at such venues.

An important trend in Japan tourism is the increasing number of locations visited by tourists. More visitors to Japan means more repeat visitors and these are prepared to go beyond Tokyo. Between 2011 and 2017, the total annual number of nights stayed by overseas tourists more than quadrupled to 72m from 17m. During this period, the share taken by the Kanto region, which includes Greater Tokyo, shrank its share to 37%, from 46%, showing how visitors are increasingly targeting provincial cities.

“Overall, the inflow of tourists and capital to regions should have a positive impact on regional retail markets,” says Kaneko. “Inbound tourism might be the last source of sustainable growth for some regional economies.”

High quality Japanese cosmetics are especially popular with Asian visitors and this has been demonstrated by retail sales, which increased for drugs and toiletries to ¥6trn last year, from ¥4.9trn in 2014. Duty free stores have been able to sell drugs and toiletries since 2014 and this is boosting duty-free sales growth (see below). More than 60% of visitors to Japan shop at airport duty-free stores.

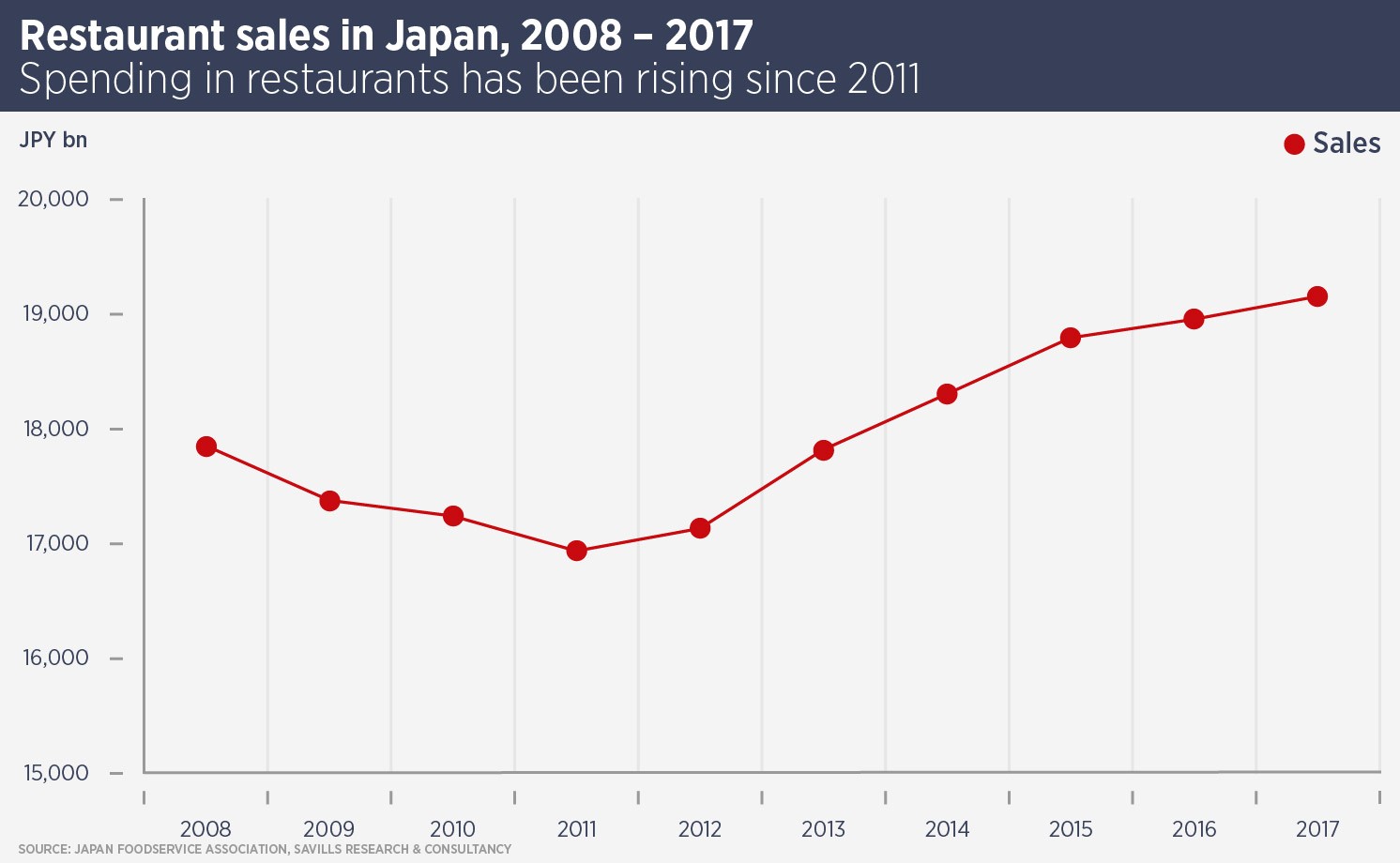

Every visitor to Japan says great things about the food, so retail with a strong F&B component will benefit from the growing visitor numbers. According to the Japan Foodservice Association, restaurant sales in Japan have grown steadily since tourism numbers started to rise in 2011. In 2017, tourists from Hong Kong spent the most on food and beverage per person per day, followed by Singapore and South Korea.

There are potential risks in the overall positive story, says Kaneko. The main one is that Japan is reliant on visitors from Asia. As South Korea found in 2017, reliance on Mainland China tourism can be dangerous. A political spat led to a ban on group tours and Chinese newspapers encouraged boycotting Korean goods.

However, events such as the 2019 Rugby World Cup and the 2020 Tokyo Olympics are expected to attract millions of visitors from Europe and the rest of the world and diversify Japan’s popularity.

Contact Us:

Tetsuya Kaneko