India’s retail property renaissance

Indian shopping centres have become hot property as international investors target the sector.

The Urban Land Institute’s Emerging Trends in Asia Pacific Real Estate 2019 report ranked the Indian cities of Bangalore, Mumbai and Delhi second, third and seventh in terms of their retail property sector’s attractiveness to investors.

The Indian retail sector saw huge oversupply in the past decade, however savvy investors are now picking the best properties in order to take advantage of positive economic and political changes. As in many emerging markets, Indian malls have tended to be poorly managed, thus offering a further opportunity to add value.

Arvind Nandan, managing director, research and consulting, at Savills India, says: “India’s growing middle class and the loosening of FDI restrictions on retail have attracted significant foreign investment into the sector. A joint venture with a local developer player is usually the preferred route to access the market and new entrants may choose to develop new malls which will be adaptable to the changing retail market.”

The key positive trends for investors in Indian retail property are increasing urbanisation and wealth. India’s middle class is predicted to rise from 80m people today to 580m by 2025, which means a population the size of Europe will be added to its consuming class.

Around one-third of Indian’s live in urban areas today, but the UN predicts this will rise to 42% by 2035, adding around 200m people to the current urban population.

Government policy has been positive for retail and retail investors in recent years. India allows 51% Foreign Direct Investment (FDI) in multi-brand retail stores, while 100% FDI is allowed in single-brand ventures. The introduction of a nationwide goods and services tax has made it easier to transport goods nationwide. The introduction of GST is also boosting the Indian logistics industry and more efficient transport of goods will help the retail sector.

India has a fast-growing e-commerce sector, however overall retail sales growth is so great, bricks and mortar retail does not look threatened. For example, the India Brand Equity Foundation predicts online retailing will grow from $18bn in 2017 to $60bn in 2021. Over the same period, the overall retail market will grow to $1.2trn, from $672bn.

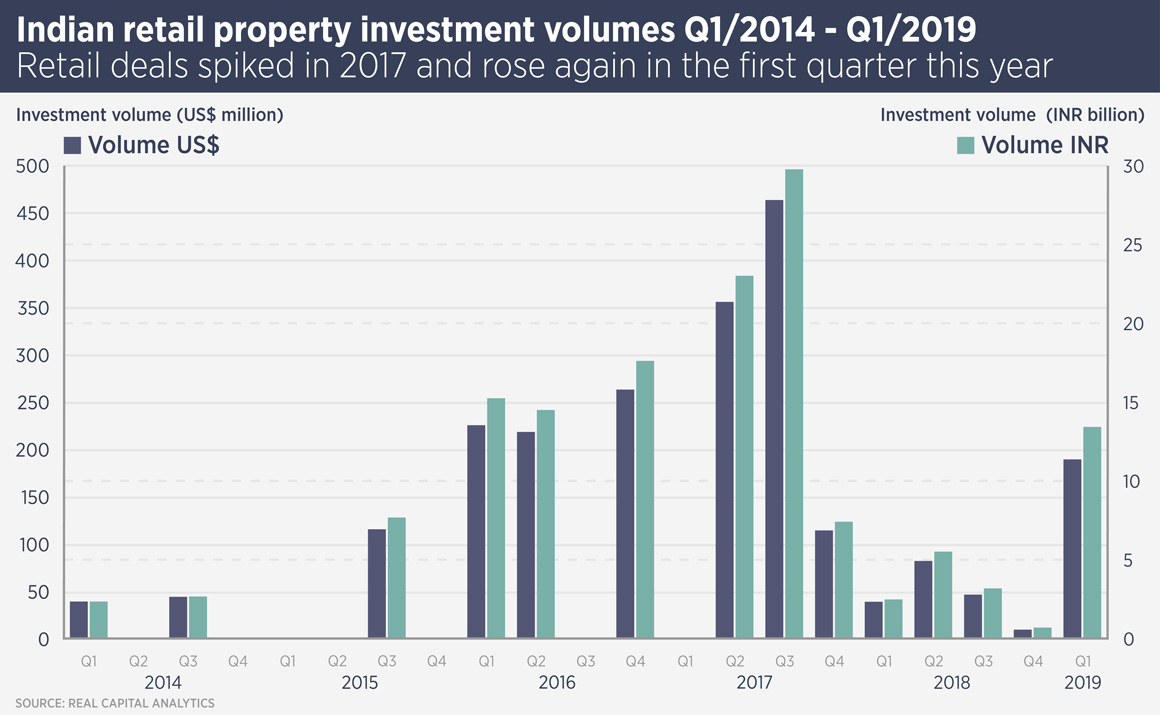

Data from Real Capital Analytics show a substantial increase in India retail property transactions over the past five years. In the run-up to the 2019 Indian general election the market was more muted, however the first quarter of this year indicates growing interest again.

The biggest overseas investor in Indian real estate is Blackstone Group, which has launched nine shopping centres through its Nexus Malls brand. RCA data show Blackstone has acquired more than $600m of Indian retail assets in the past five years.

Meanwhile, Warburg Pincus formed a $1bn joint venture with Runwal Group to develop shopping centres in first, second and third tier cities in India and Canada Pension Plan Investment Board has formed a retail JV with Indian group Phoenix Mills.

Further reading:

Savills India

Contact Us:

Arvind Nandan