Storing up value for real estate investors

Rising incomes and shrinking living space in the regions major cities means self-storage should have a bright future in Asia Pacific.

Self storage firms rent or buy industrial buildings and fit them out with lockers of varying sizes, usually offering 24 hour access to tenants who might store anything from skiing equipment to household contents or retail stock. Some facilities have cold storage or units specifically for wine storage.

Some operators prefer larger facilities on the edge of cities, others smaller units or strata floors in more central areas and operators may either rent or buy assets.

The attractions for real estate investors are higher yields and secure income streams from mature assets. In Asia, the market is immature and so also offers growth and consolidation opportunities.

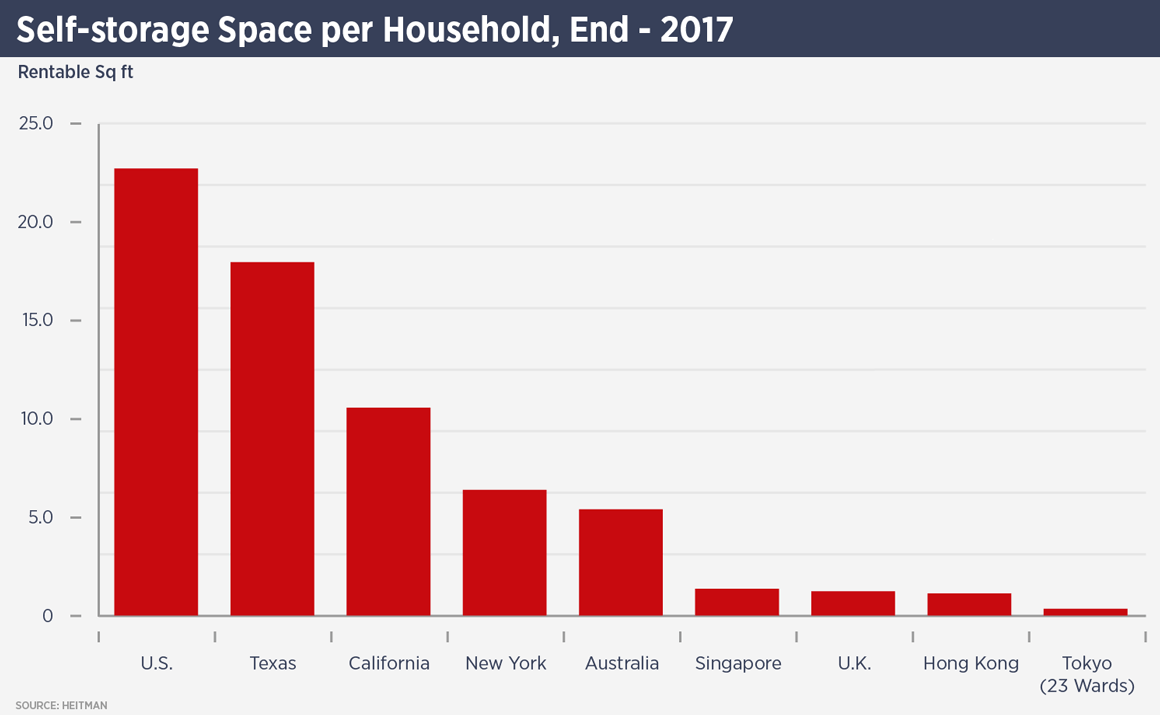

Skip Schwartz, managing director – Asia-Pacific private equity, at Heitman, which has been investing in self-storage in Asia Pacific since 2011, says: “If you look across Asia Pacific in most markets, the penetration of self-storage is closer to zero than the next whole number. Developed cities across the region have the same drivers – urbanisation, small living spaces, high incomes – but you need to recognise the different nuances in different markets.”

Simon Tyrrell, chief executive of Hong Kong self-storage operator RedBox, recently acquired by Infrared Capital Partners, says: “A mature self-storage asset is much like a hotel, running at a steady 85-95% occupancy but with a monthly churn of customers. The operating business drives net operating income and that in turn drives real estate values.”

Tyrrell says Hong Kong’s self-storage market offers “a consolidation opportunity” due to its fragmented nature and new regulations which make life difficult for smaller operators. RedBox is seeking strata shares of at least 20% in undermanaged industrial buildings.

Meanwhile Heitman, having invested in Australia and Singapore, is now also looking to Japan. Schwartz says: “In Tokyo there is an opportunity to capture and build scale without overwhelming the market.”

In China, Infrared has invested in China Mini Storage, taking a minority stake in the operator and a majority stake in a joint venture property company which will acquire self-storage facilities across first tier cities in China.

China Mini Storage’s innovative model relies on technology: a WeChat-based app which allows potential customers to make a real-time search and book space at any of its facilities. Once the transaction is complete, a digital ‘key’ is sent to the customer’s mobile phone and this can be used to access the storage locker.

The digital user interface means China Mini Storage does not need to have staff on site, which reduces costs. It also means the company can use smaller spaces – staffed operators cannot afford to run facilities below a certain size due to staff costs.

Infrared chief investment officer Hans Kang says: “E-commerce customers will be the next focus for us; there are millions of SME online shop owners who need to store inventory and to be able to access it when needed.”

The potential for self-storage in China’s major cities is enormous. Hong Kong and Singapore have around 1 square foot of self storage space per inhabitant, indicating potential for 25m sq ft in Shanghai.

There are a number of aspects to self-storage in Asia which investors frequently cite. Firstly, it is a business which requires patience; Schwartz says: “You can’t invest $200m right away and build a platform overnight. You need to get the technology and the marketing right. There is an opportunity to educate consumers in the Asia-Pacific region about the sector.

“Also, a self-storage facility is not like a warehouse, it might take 12-18 months to lease up a new facility.”

Secondly, the underdeveloped nature of the sector offers an opportunity. “Heitman has been investing in self-storage across the world since 1995 and so we’ve seen how the markets have evolved,” says Schwartz. “So for example it is a niche sector here in Asia, with development yields 200-300 basis points above other sectors but yields have compressed in the US to the point that the asset class is part of core portfolios.”

Tyrrell adds: “The exit yield for a Hong Kong asset should be about 100 bps over the equivalent industrial yield, but it is worth noting that US self storage REITs are lower-yielding than office REITs.”

However Asia is becoming gradually more familiar with self-storage. “Financing is becoming easier as the sector becomes more accepted and can demonstrate proof of concept to lenders,” says Schwartz.

Like many other real estate niches, self-storage is fundamentally a simple concept, but one which requires an intelligent approach. “It is not about renting out little boxes, it is about the provision of bespoke space solutions for our clients specific needs,” says Tyrrell.

Further reading:

Self Storage Association Asia

Contact Us:

Simon Smith