Tourism recovery boosts Australia hospitality

Australia’s hospitality sector is thriving as post-pandemic tourism rebounds, with arrivals set to surpass 2019 levels by 2026.

With a protracted post-pandemic recovery finally restoring tourism in Australia to full health, the hospitality sector is looking attractive for real estate investors.

Tourist arrivals are on track to exceed 2019 levels next year and expected growth in visitor numbers and spending between now and 2029 is predicted to be strong. A relatively weak Australian dollar will make the country more attractive for tourists and for overseas real estate investors too.

“Australia’s hospitality sector is increasingly a focal point for investors, underpinned by the ongoing recovery in tourist activity, strong hotel trading performance, and global volatility reinforcing Australia’s appeal as an investment destination,” says Chris Naughtin, National Director, Capital Markets Research, at Savills Australia.

Tourism

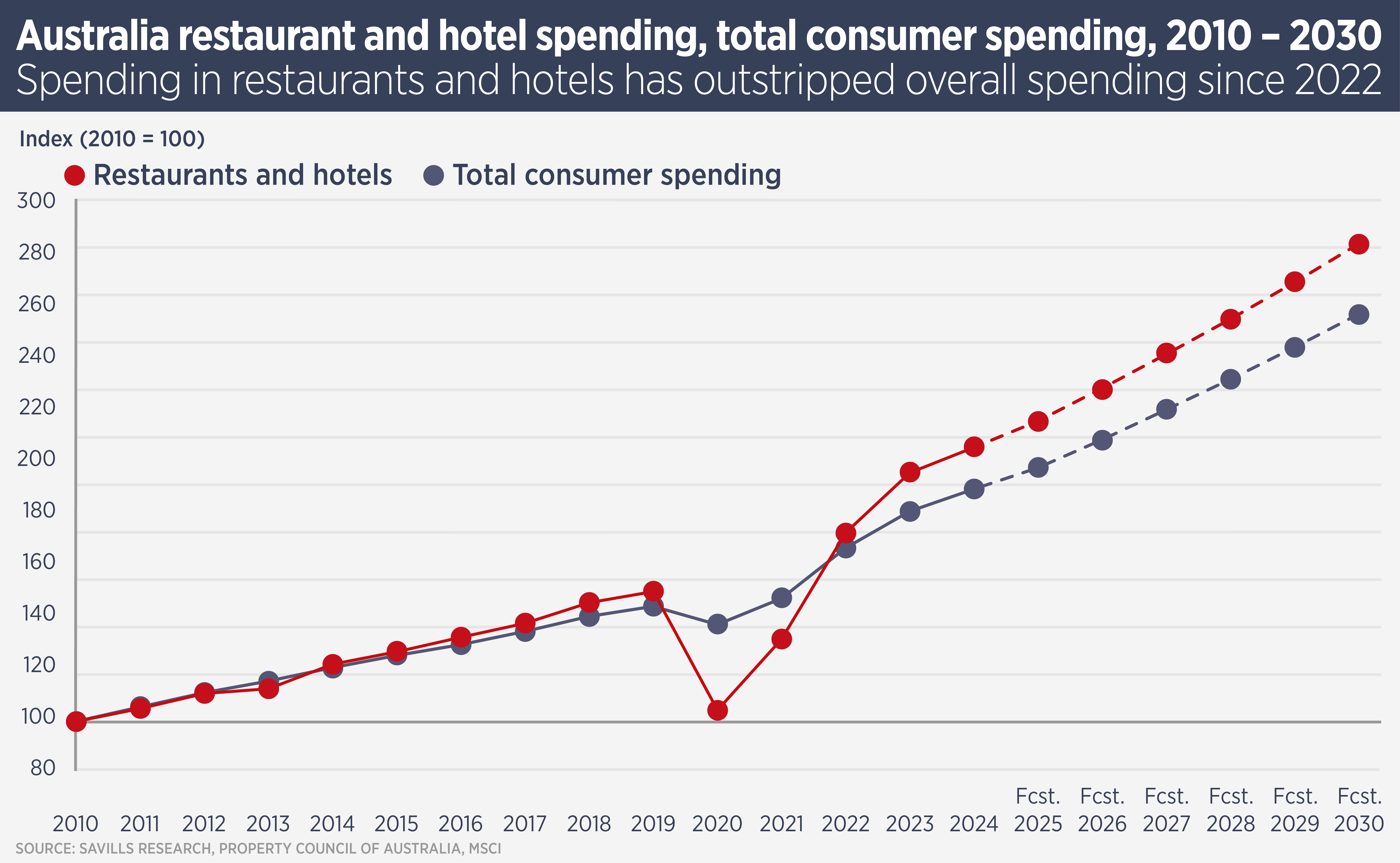

Research Australia forecasts that international arrivals will grow by 7.2% in annual average terms over the five years to 2029 compared with 6.5% average annual growth between 2015 and 2019, and 4.5% between 2010 and 2014. Furthermore, spending growth in hotels and restaurants is outpacing total consumer spending and this is expected to continue.

“Moderating inflation, wage growth, tax cuts, and lower interest rates are driving a recovery in real household incomes from 2023 lows. This is driving rising consumption, with hotels and restaurants particular beneficiaries,” says Naughtin.

The Australian hospitality sector is already seeing the benefits of a tourism recovery which started in 2022. Average revenue per available room – a crucial hospitality sector metric – from January to April 2025 was 3.3% higher than for the same period in 2024. Growth was particularly strong in Brisbane, Perth, Far North Queensland and the luxury segment in Melbourne and Sydney.

Savills expects Australia’s state capital cities will increasingly be a focus for investment in 2025 due to their high exposure to growing international tourism. “Australia’s relative economic and political stability further enhances its appeal to offshore capital,” says Naughtin.

Across the Asia Pacific region, the post-covid tourism recovery has been uneven. Japan has bounced back spectacularly, with visitor numbers hitting a record 36.87 million last year, up 16% from 2019. The pace of the recovery has boosted hotel investors but caused some concerns amongst citizens and the Japanese government is trying to boost interest in less well-known and visited areas. In contrast, Thailand visitor numbers in 2024 were still 19% below the 2019 peak of 39.92 million.

The recovery in Chinese outbound tourism has been a positive sign for all Asian markets. Last year Chinese outbound tourist numbers hit 90% of 2019 levels and the nation is still the world’s biggest spender on international tourism.

Further reading:

Australia Hospitality H1 2025

Contact us:

Chris Naughtin