City lowdown: Osaka

Osaka is big, brash and back with a vengeance; Japan’s second city is set for resurgence after a long stagnation.

Since the government of prime minister Shinzo Abe jolted Japan out of its long decline, the growth of Tokyo has grabbed most of the headlines, however Osaka is set to benefit from a number of new developments which will boost its economy and real estate sector.

“Osaka is in a unique position to leverage the nation’s ongoing growth, as a series of events including the Rugby World Cup 2019, a potential integrated resort development, and the World Expo 2025 could provide strong tailwinds for inbound tourism – a key driver of Osaka’s recovery,” says Tetsuya Kaneko, Savills head of research Japan.

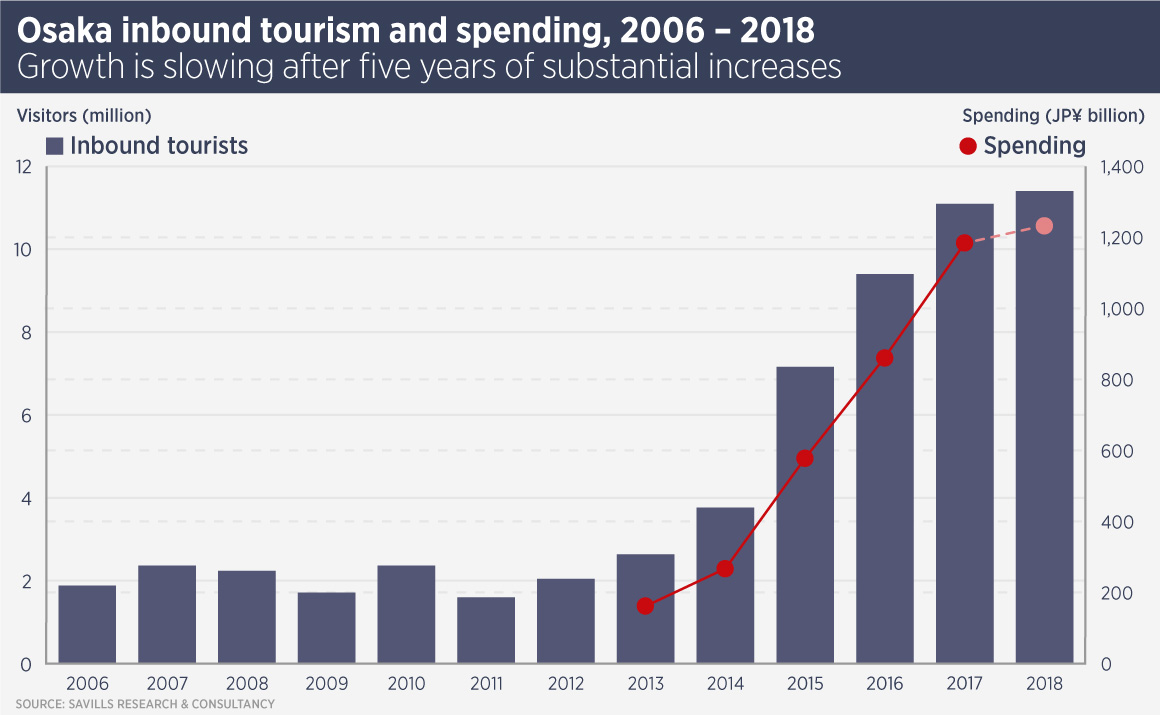

Famous for eating, shopping and stand-up comedy, Osaka has been a prime beneficiary of Japan’s newly booming tourist market, with visitor numbers rising six fold between 2012 and 2018. A number of natural disasters hit growth last year, but Osaka’s recovery is expected to be strong.

Osaka is one of a number of sites being considered for Japan’s first integrated casino resorts. The Osaka Prefectural Government estimates an integrated resort could draw 25m visitors a year and generate annual spending of JPY760bn ($7.2bn). Meanwhile the World Expo is expected to attract 28m visitors and create a positive after-effect for industry in the region.

An important factor in Osaka’s future growth is that its airport, with good links to North and East Asia in particular, is operating at only 80% capacity. In contrast, Tokyo’s airports are

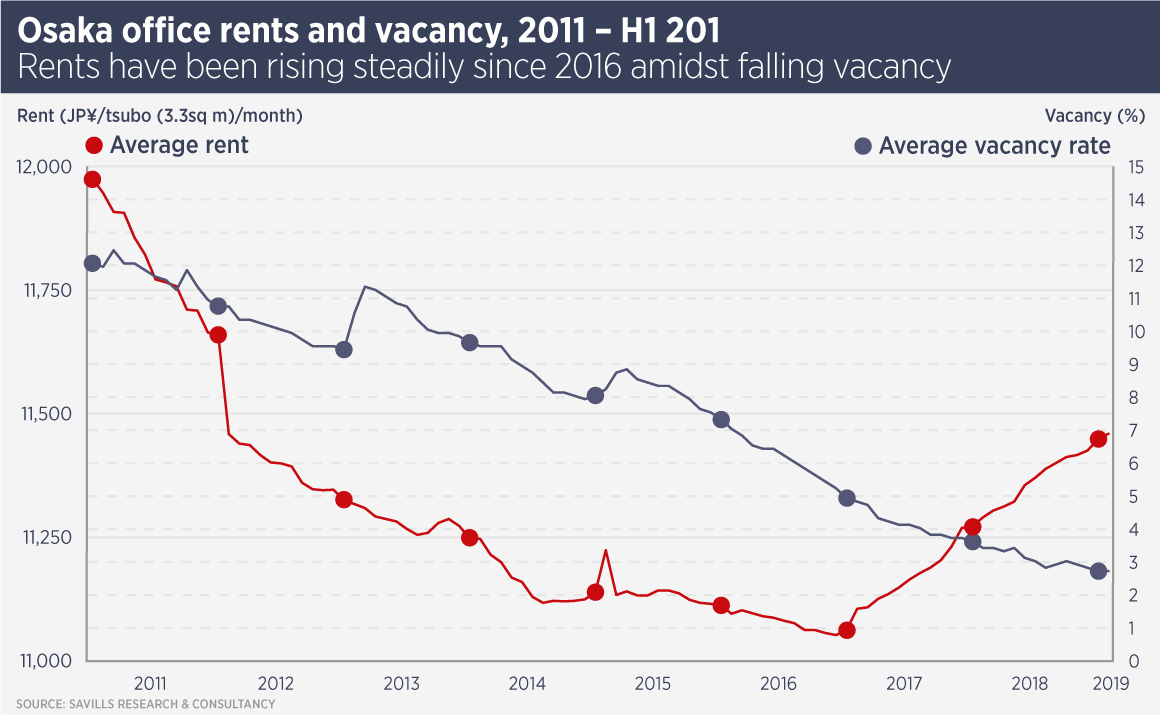

The Osaka office sector was hit hard by the global financial crisis but several years of minimal supply have seen rents recover strongly, although they remain well below pre-GFC levels.

Over the next few years the Umekita Phase II development, by Osaka’s main station, is expected to be a focus for commercial real estate growth, with 140,000 sq m being developed to provide space aimed at the pharmaceutical and biotech industries.

Like a number of Japan’s larger cities, Osaka is bucking the nation’s demographic trend and its population is rising, which is supporting the residential market. Umekita Phase II will also provide luxury residential, something of a new sector for the city’s real estate market.

Real Capital Analytics data show Greater Osaka transaction volumes account for around 10% of the total for Japan, well behind Greater Tokyo, which accounts for 68%. However, Savills Research & Consultancy data show the market size of Greater Osaka is still 1.7 times larger than the combined total of Greater Nagoya and Greater Fukuoka, which are the third and fourth largest markets in Japan.

Foreign capital has been investing steadily in Osaka over the past five years, with experienced overseas players such as LaSalle Investment Management, Blackstone Group, GreenOak Real Estate and Morgan Stanley Real Estate Investing all buying in recent years.

In the context of Japan’s maturity and economic stability, Savills’ Kaneko expects Osaka to continue to thrive. “As many investors perceive that the global economy is late in the cycle, Japan’s sound fundamentals and defensive nature are now even more appealing,” he says.

“Osaka in particular has an abundance of major growth catalysts over the next half decade. Socio-economic trends supporting Osaka’s real estate market are well- rooted and should drive long-term growth.”

Further reading:

Osaka Research Report

Contact us:

Tetsuya Kaneko