City lowdown: Shenzhen

China’s dramatic growth since beginning economic reforms can be summed up in a single word: Shenzhen.

The Southern Chinese city, located close to Hong Kong in Guangdong, was a market town in 1979 (not quite the fishing village of legend), with a population of less than 100,000. In 1980 it became one of China’s five special economic zones and was catapulted into the future.

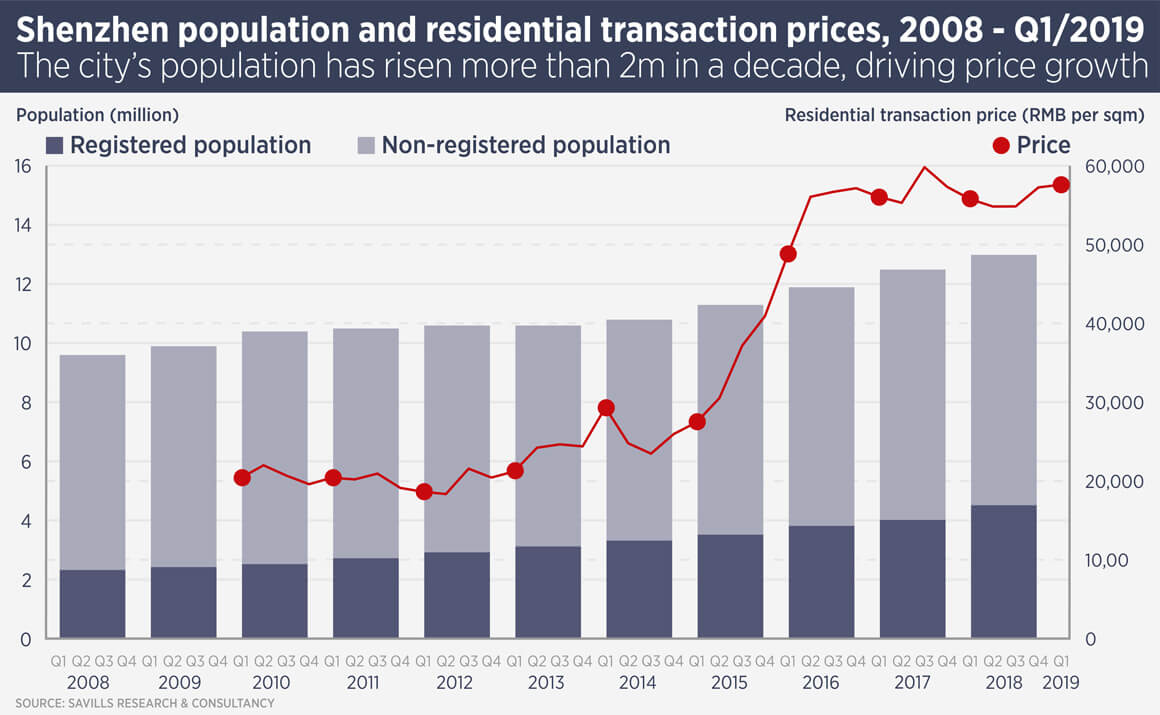

Today it is a gleaming modern technopolis with a total population of around 13m, although some claim the real number could be as high as 20m. Shenzhen is also one of China’s youngest cities, as it is a magnet for the nation’s young and ambitious.

It is also part of the Greater Bay Area, 11 cities which the Chinese government wants to become the world’s leading urban economic area. The outline development plan for the Greater Bay Area ranks Shenzhen as a core city with a focus on innovation and creativity.

Shenzhen hosts the Shenzhen Stock Exchange is an important headquarters location, with household names including Tencent, Huawei, SF Express, Shenzhen Airlines, Ping An Group and China Merchants Bank calling the city home. The city has 67 billionaires – ranking it equally with Hong Kong – and has more than 14,000 high tech firms. Last year, Shenzhen’s GDP grew to RMB2.42trn, surpassing Hong Kong’s for the first time.

As the city moves towards less-polluting high tech industries, it is becoming a more attractive place to live and indeed was ranked as China’s most liveable city by the Chinese Academy of Social Sciences.

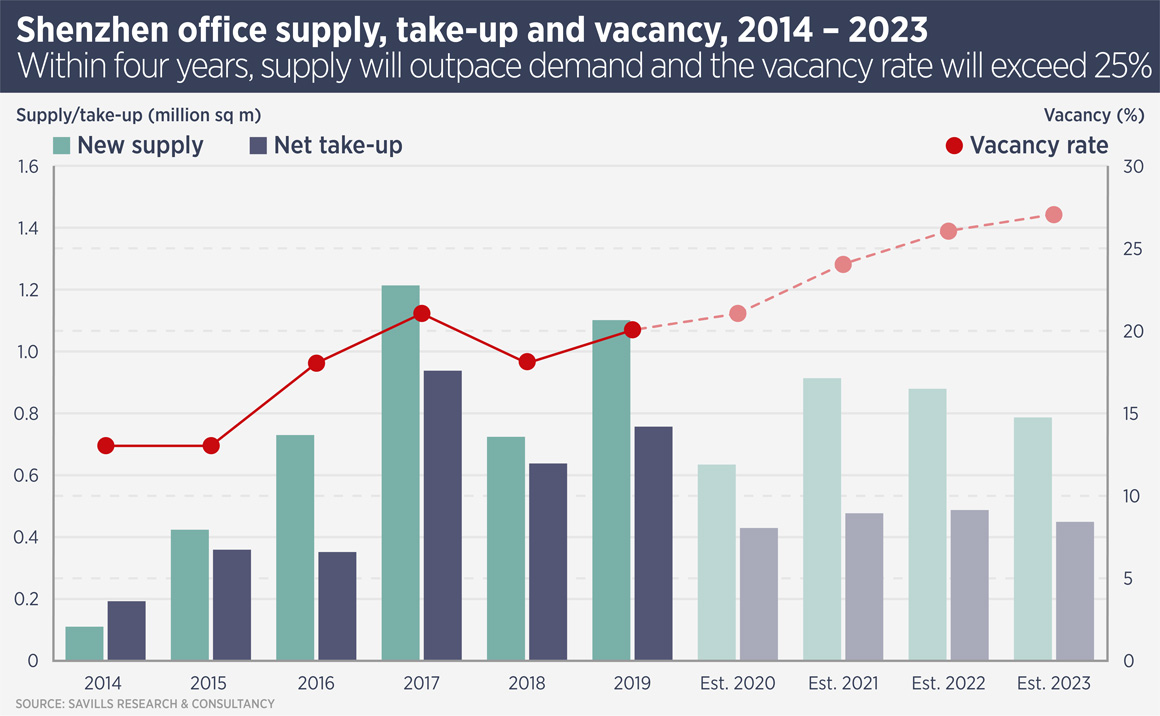

The city’s office market has weakened this year, due to slowing growth and the China-US trade war and Savills expects rents to fall 3% this year.

Carlby Xie, head of Southern China research at Savills, says: “The leasing market in the Shenzhen office sector is set to be even more competitive in the rest of 2019 as 15 Grade A office developments with a total combined gross floor area of approximately 1.09m sq m are scheduled for completion.”

However, in the longer term, Shenzhen’s office sector is expected to benefit from its links with the Greater Bay Area and its position as a hub for tech firms – it is ranked as one of the world’s top 30 tech cities by Savills.

The city’s main business district, Futian CBD, is located close to the border with Hong Kong and has the most office stock and highest rents.

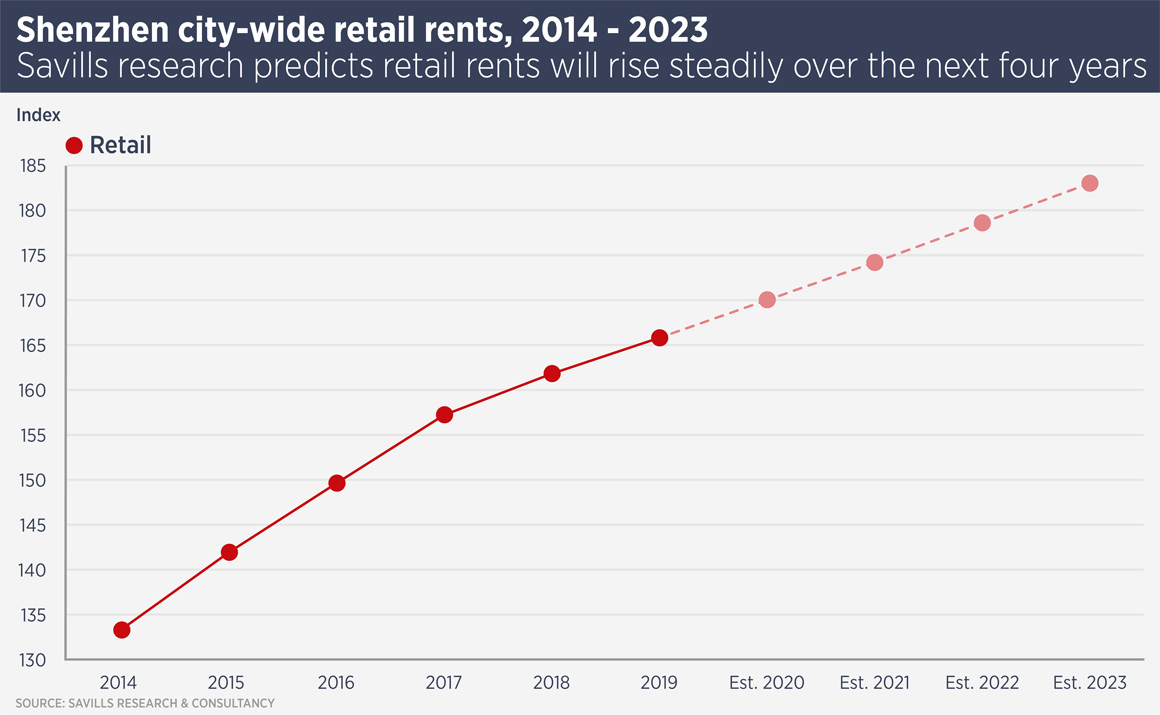

Shenzhen’s increasing wealth and growing population mean its retail market is set fair for the future, even with five new malls totalling 540,000 sq m of space hitting the market this year. Retail sales in the city grew by just under 8% last year.

Xie says: “The market continues to see a growing inquiry volume and interest for assets, especially those with prime locations and strong upside potential through an asset enhancement initiative programme.”

In February, Hong Kong’s Link REIT bought the Central Walk shopping mall in Futian for RMB6.6bn; its first purchase in Shenzhen. Link REIT cited the future growth of the Futian CBD and Shenzhen’s role in the Greater Bay Area as part of its rationale for the acquisition.

Lower mortgage rates and a stable policy environment mean Shenzhen’s residential market is expected to see rising transaction volumes and prices this year.

The city’s growing population has contributed to residential price growth as millions of people from all over China have moved to the dynamic city in search of prosperity and success.

Further reading:

Shenzhen research

Contact us:

Carlby Xie