City lowdown: Ho Chi Minh City

Ho Chi Minh City is the financial capital of Vietnam, its richest and most dynamic city, and the perfect place to witness the emergence of a new Asian tiger.

Formerly known as Saigon (with the old name still in use), HCMC generates a fifth of Vietnam’s GDP and this is set to increase as the city grows. The population is set to rise to 14m by 2025, from around 8m today.

Troy Griffiths, deputy managing director, Savills Vietnam, says: “Vietnam’s march to prosperity continues with indicators such as GDP growth of 6.8%, foreign direct investment, retail sales and international arrivals all increasing at rates above their peer regional competitors.

“HCMC is undergoing massive change, through demographics, infrastructure and a burgeoning middle and affluent class. The future looks sound and the city will benefit from external drivers such as trade tensions, the domestic economy is in good shape and the government’s drive to improve governance is paying dividends.”

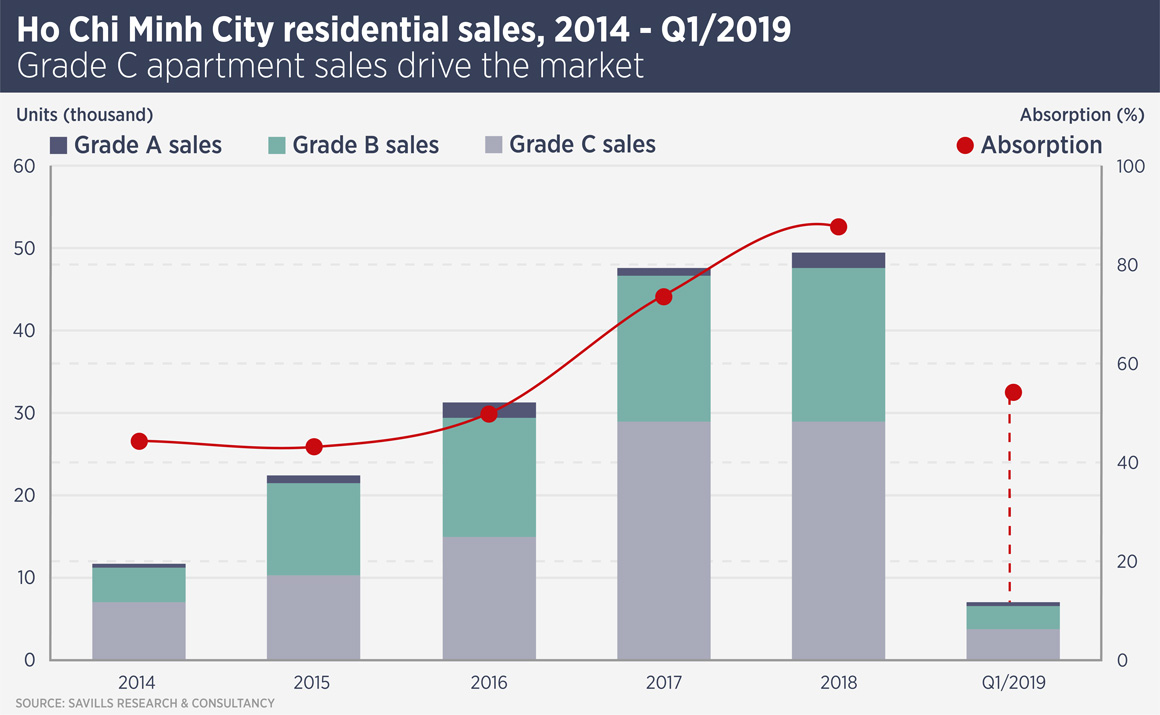

The residential sector is at the apex of HCMC’s growth, driven by a need for better housing, a growing middle class and an increasing number of overseas buyers. New developments can sell up to 30% to foreigners and this allocation tends to sell quickly.

Griffiths says: “HCMC is the nation’s gateway city and hub of commerce, capturing this growth in its dynamic residential market. With strong immigration and a low urbanization ratio, relatively high household occupancy and a large qualitative deficit then conditions are ripe for residential development. This is also the first generation of high-density apartment living, which now allows affordable homes for the mass market.

“Historical supply in the city has been predominantly C grade dwellings and future supply, handovers and launches will also be mostly C grade. This is driven by owner-occupiers, who in Vietnam are not overly exposed to debt, so the chance of a housing bubble is low.

“While C grade has been the market driver, there are now many more launches of upper B and A grade apartments – in a few cases at eye watering prices. New A grade apartments tend to be located near the city centre and built to international standards.”

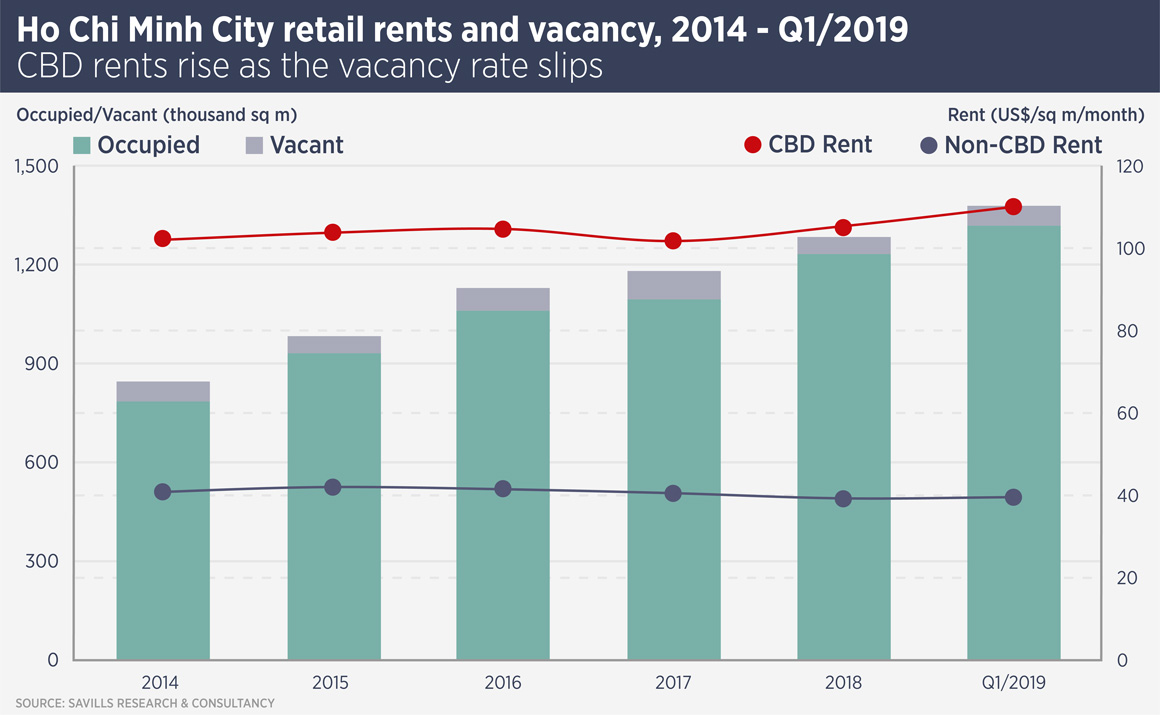

HCMC retail has performed steadily in recent years; supply has risen, but so has take-up and rents. Savills estimates total retail stock to be around 1.4m sq m and this is predicted to increase by one-third by 2021.

HCMC consumers prefer large-scale shopping centres as a destination for shopping and leisure, so malls outside the CBD have restructured their tenant mix by adding more service tenants such as F&B, healthcare, education, and gyms. These types of tenants typically seek longer leases at lower rents and also boost footfall. New malls tend have a large proportion of service tenants.

So far, e-commerce is a minor part of the Vietnam retail market, but this will inevitably change: one-third of Vietnamese are Millennials and e-commerce revenues are slated to rise 40% by 2025.

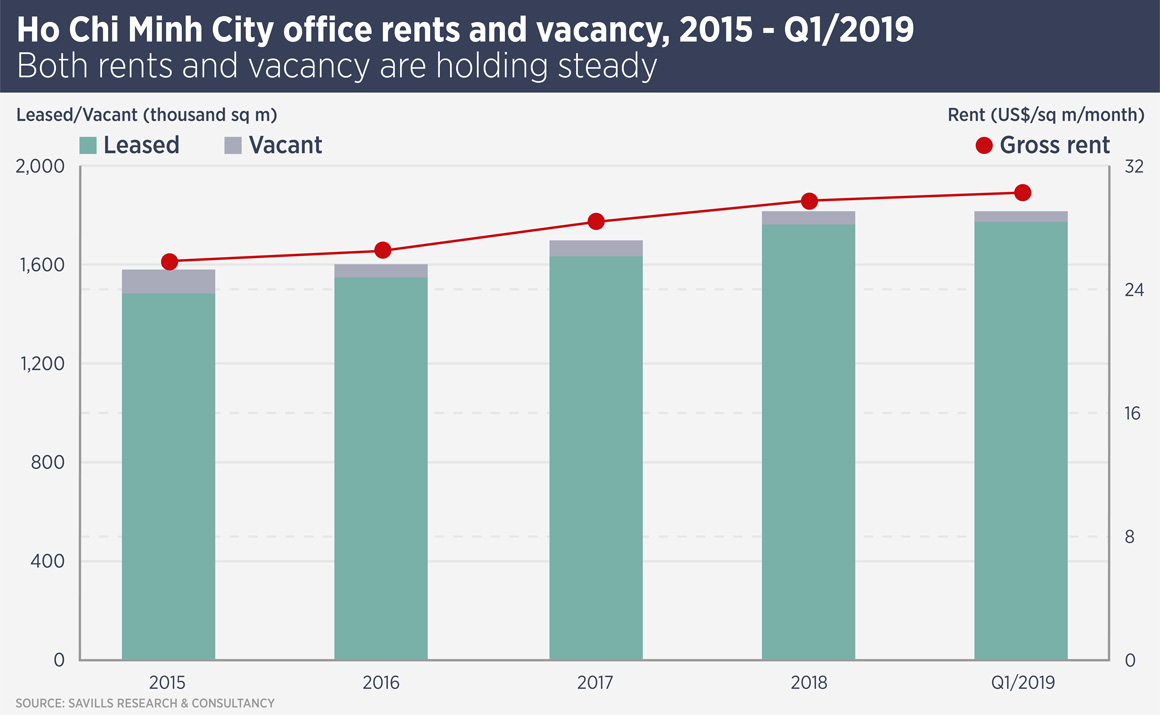

The HCMC office market has held steady for the past five years, with rising rents and take-up, even with rising supply. Rents for Grade A offices continued to lead the market, increasing 2% in the first quarter of this year and 13% since the start of 2018.HCMC has seen rapid expansion of co-working over the last two years, more than 90% per annum and there is now more than 37,000 sq m of co-working space, the majority of which (56%) is in the CBD. Notable players include WeWork, Up, Dreamplex, Regus, Compass and Kloud. These companies are anchor tenants in many buildings.

Further reading:

Savills Vietnam

Contact us:

Troy Griffiths