Big bounceback for India offices

Savills data show a 130% year-on-year increase in gross office space absorption across the six largest office markets in the country in the first half of 2022, with demand coming from a variety of business sectors.

The office sector in India has shaken off the covid pandemic and surged ahead, with accelerating take-up as workers head back to their desks.

Savills data show a 130% year-on-year increase in gross office space absorption across the six largest office markets in the country in the first half of 2022, with demand coming from a variety of business sectors.

Megha Maan, Director, Research & Consulting, India says: “India’s 3rd covid wave receded fairly swiftly and with far few deaths than earlier waves, which has boosted business confidence. Staff are returning to the office and occupiers are pressing forward with decision-making once more.”

The recovery has so far been concentrated in Bengaluru (India’s largest office market), Delhi-NCR and Pune, which together accounted for two-third of the 30.4m sq ft of leasing activity in the first half.

Some cities showed a remarkable rebound from 2021. Pune’s 2022 first half gross absorption figure was four times that for the same period in 2021, while leasing activity in Delhi-NCR and Mumbai doubled. Hyderabad was relatively subdued in comparison but still saw a 38% rise in leasing from H1 2021.

Bengaluru, home to 30% of India’s prime commercial real estate space, is set to overtake its pre-pandemic record of 15.6 million sq ft of office take-up, set in 2019.

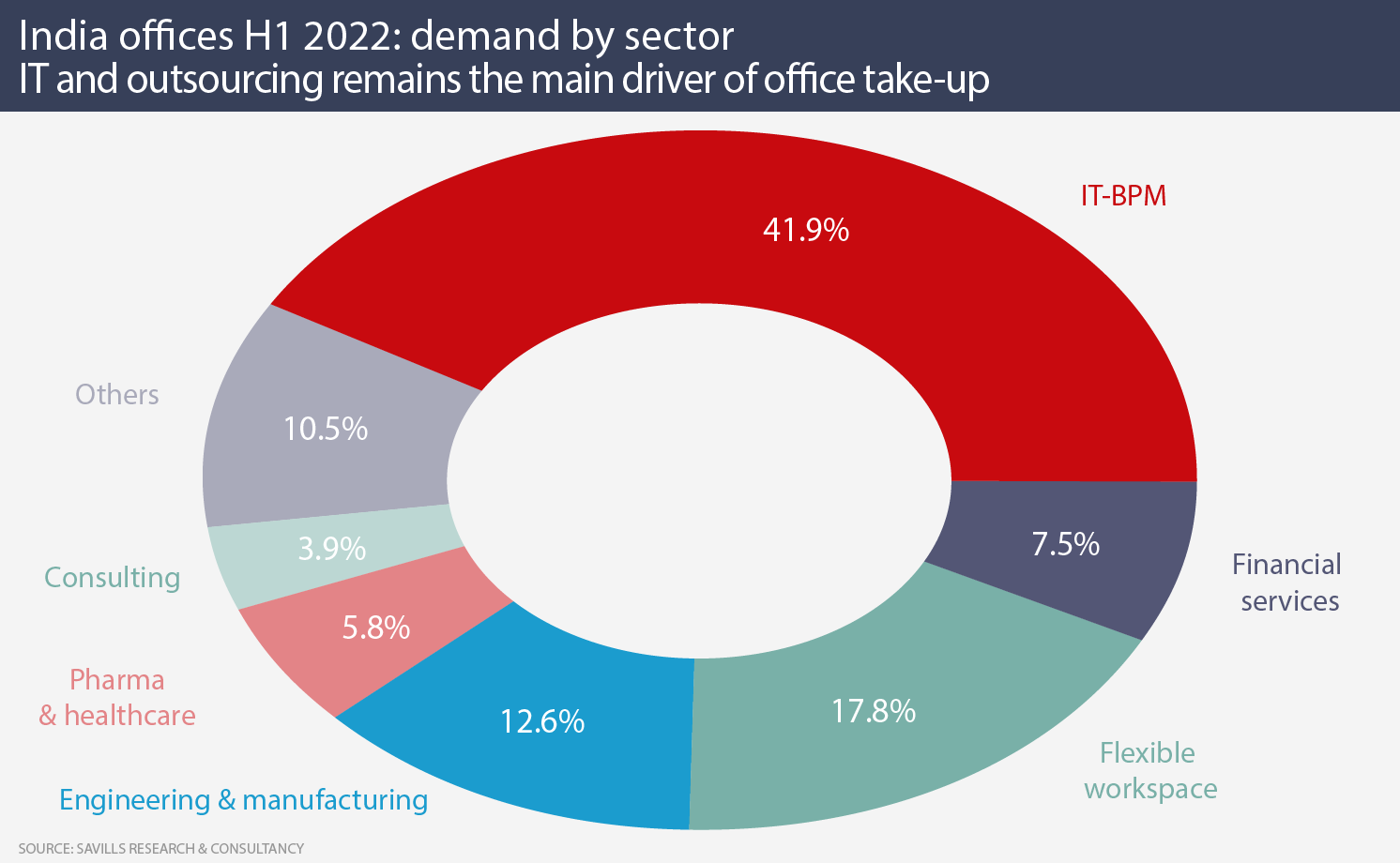

The earliest recovery in demand for Indian office space came from the IT/outsourcing business, which accounted for 42% of take-up in H1 2022. However the recovery is now broader, with the flexible workspace, engineering and manufacturing, healthcare and financial services sectors all contributing.

The flexible workspace sector accounted for 17.8% of overall take-up. The sector accounted for a remarkable 47% of take-up in Pune in the first half, with take-up attributed to flexible workspace occupiers up elevenfold on the same period last year.

Megha Maan said: “With most coworking spaces offering a fully managed business eco-system and the option to recalibrate to accommodate occupier needs, the share of flex spaces in office leasing activity is likely to reach an all-time high of 20% by 2022 year-end.”

Rents rose by an average of 7% from last year across all the major cities, with the exception of Pune where landlords kept rents down, which likely encouraged the city’s strong take-up. There were pockets of much higher rental growth in undersupplied sub-sectors such as Gurugram and Noida in Delhi-NCR, which saw rents shoot up 20% and 11% respectively.

Delhi-NCR was the only one of the six major markets not to see an increase in supply in the first half of this year, while Chennai and Pune saw the most dramatic hikes in supply.

Despite rising interest rates and inflation, the return of office workers and increased business confidence, due to the much improved covid situation is driving the market forward.

Megha Maan said: “Given the exceptional performance of office markets across the country, India is likely to witness 55-60 million sq ft of leasing activity in 2022. Notwithstanding any unforeseen event or a fresh wave of infections, this leasing activity appears to signal a change of trajectory, from a strong recovery phase to a growth phase.”

Further reading:

Savills India Research

Contact Us:

Simon Smith