City lowdown: Pune

Discover why Pune has become a hub for IT services and institutional investment. Its status as a higher education hub, liveability, and growing office and industrial sectors. Read on to learn more.

The Indian city of Pune has transformed from a manufacturing hub into a preferred IT services location and is attracting significant institutional investment.

The city’s move into higher value industries has been driven by its status as a higher education hub with a strong supply of graduates, attracted by the city’s liveability as well as its universities. It has been dubbed “the Oxford of India” and its universities are popular with overseas students as well as Indians. With a 6.2 million population and linked by expressway to nearby Mumbai, it is well-positioned for growth.

Diksha Gulati, Assistant General Manager at Savills Pune, says: “Pune’s educational excellence and its proximity to Mumbai have made it attractive to IT services companies. There is also increasing demand from flexible office operators serving start-ups and companies looking for flexibility. There is also demand for office space from the manufacturing sector.”

The city’s office market has grown rapidly to 65 million sq ft in 2022, from 50 million in 2018 and Savills predicts a further 7 million sq ft will be added this year. At the same time, Pune’s industrial and logistics market, driven by the automotive and third-party logistics sectors, has kept growing too, adding 4.7 million sq ft of supply last year to grow to 35.3 million sq ft in total.

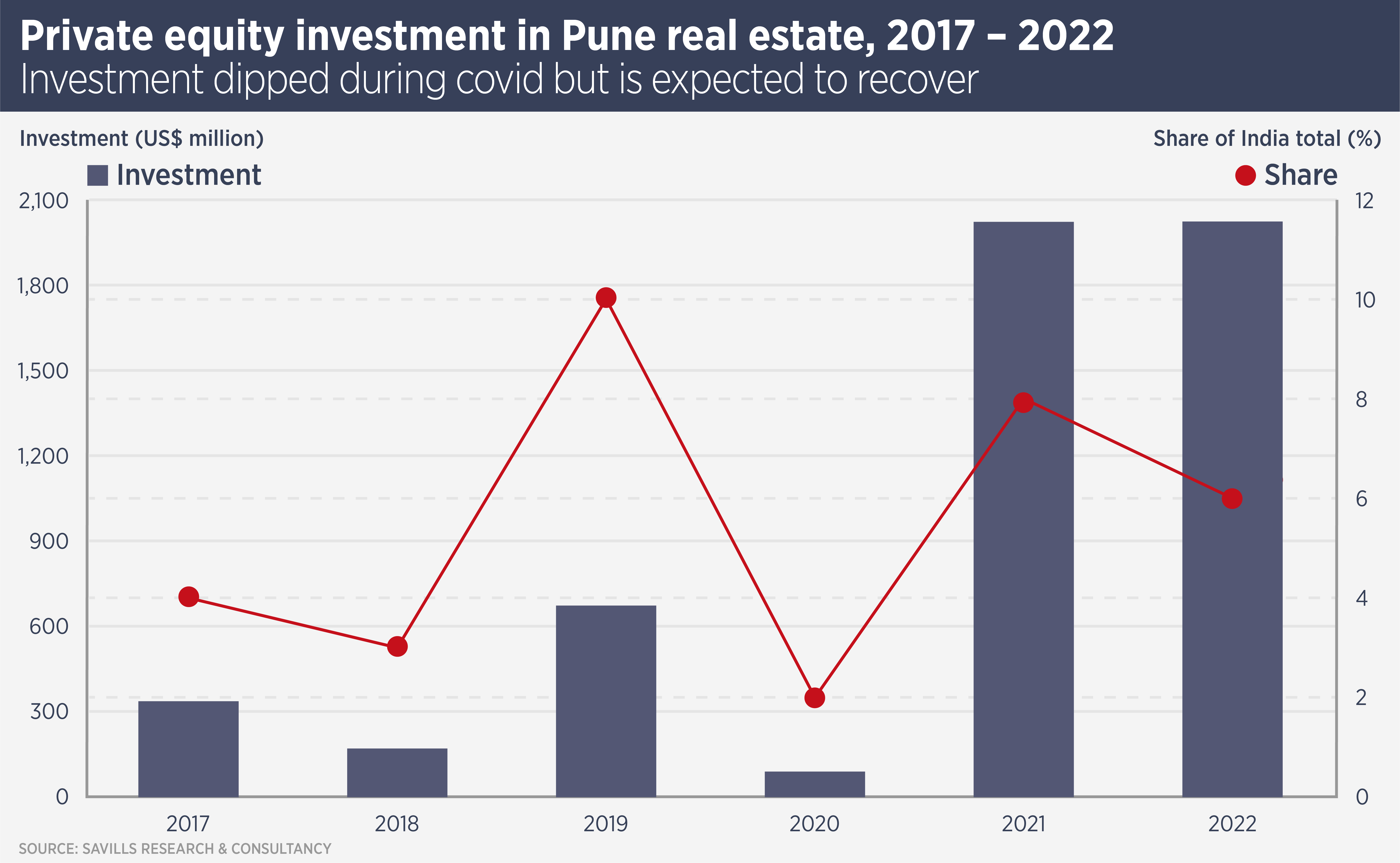

Gulati says: “The growing office and industrial sectors have attracted significant interest from institutional investors, including a number of overseas private equity groups and we expect more investment in future.”

The city has a number of business districts, however the eastern district of Kharadi and the western district of Hinjewadi have proved the most popular micromarkets for institutional investors, accounting for three-quarters of the total space acquired so far. Infrastructure improvements, including a new airport, a ring road and several metro lines, will improve the city’s connectivity and developers have new office space in the pipeline in those districts expected to benefit most.

The main institutional investors in Pune have been large global players with a commitment to India, including Blackstone Group, CapitaLand, PIMCO Prime Real Estate (previously Allianz Real Estate), GIC Private and Xander Group. Additionally, two Indian real estate investment trusts, Embassy Office Parks REIT and Mindspace Business Parks REIT have significant holdings. There are also overseas investors such as Hines, Mapletree and CPPIB with significant development portfolios underway, often in partnership with local groups.

Institutional investors have mainly targeted the office and industrial sectors, however there have also been acquisitions in the retail and hospitality space. Around 30 million sq ft of Pune real estate is owned by institutions and Savills predicts this will almost double to 57 million sq ft by 2027.

“While most of the overseas investment has come from large global players, we do see more activity from smaller institutions, particularly in the residential sector,” says Gulati.

“The growth of institutional portfolios has been muted in the past three years due to the pandemic restrictions on construction, but we expect considerable demand in the coming years from existing and new investors as the city’s stock of quality assets increases.”

Further reading:

Savills Pune institutional investment report

Contact us:

Diksha Gulati