Cold storage market blows hot

Cold storage real estate is a hot investment opportunity in Asia Pacific, backed by rising demand and higher returns than conventional industrial. Learn more about the factors driving demand and how investors can capitalize on this trend.

Backed by rising demand across Asia Pacific and offering higher returns than conventional industrial, cold storage real estate is becoming the region’s hottest investment opportunity.

Cold chain logistics is essential to ensure the freshness of food as it is transported around the region and is also used to store and transport medicines. Cold storage warehouses provide chilled and frozen rooms to keep goods fresh. Modern facilities are using automaton to increase efficiency and lower running costs.

“As Asia Pacific’s economic growth elevates more people to the middle class, consumers will demand higher quality products requiring proper preservation in a controlled environment, which means rising demand for modern, efficient cold storage facilities,” says Simon Smith, Head of Asia Pacific Research & Consultancy, at Savills.

Demand for cold storage spiked during the pandemic as more people turned to online grocery shopping but the important long-term drivers are increasing household income, the rise of urban middle-class populations and steadily growing e-commerce. Asian consumers’ changing lifestyles mean more are turning away from traditional wet markets towards supermarkets and buying more frozen and pre-prepared products.

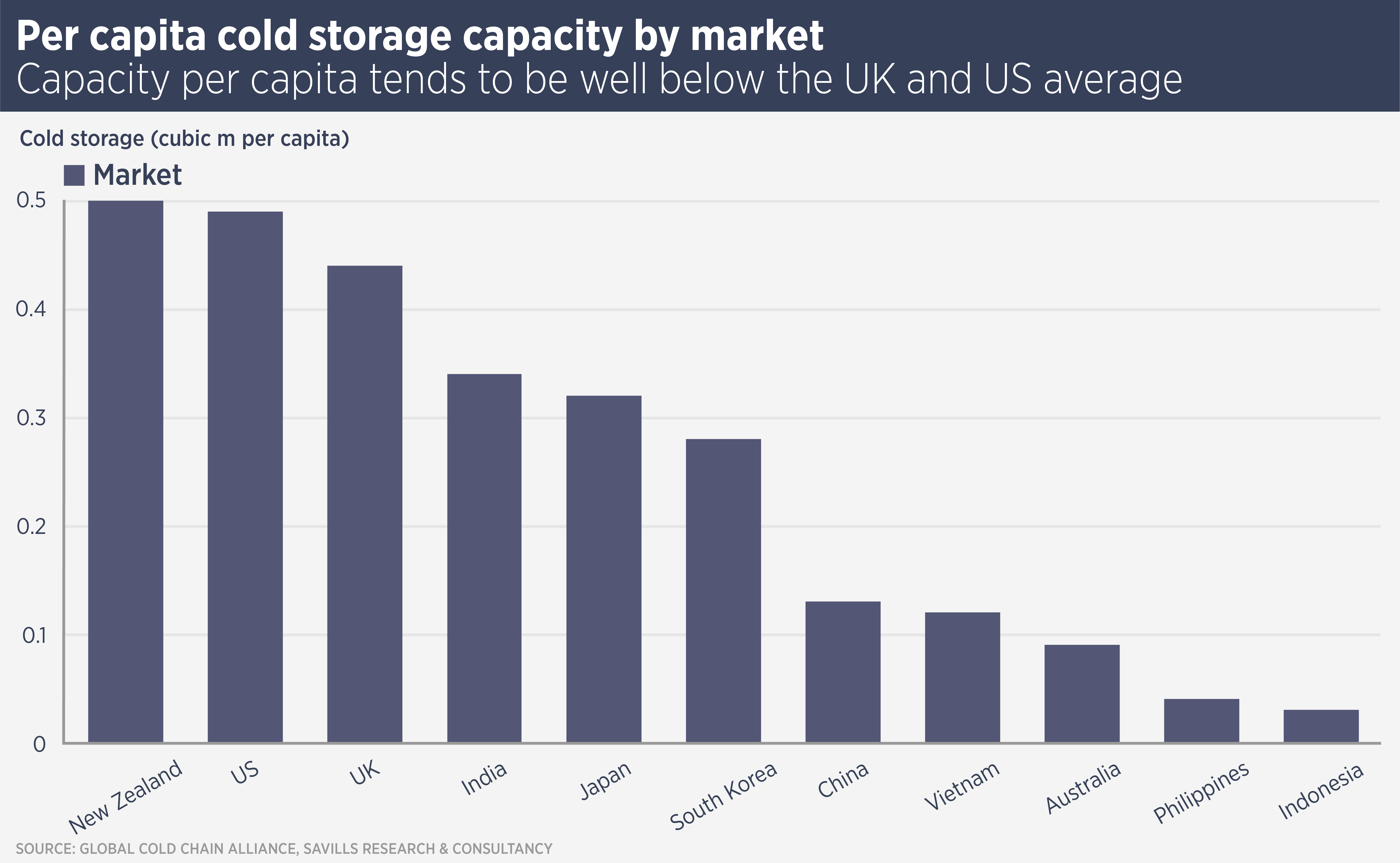

India, China and Japan are in the top five global markets for cold storage capacity; however they are relatively underserved on a per capita basis, compared with developed markets such as the US and UK.

Cold storage facilities are often small and inefficient: the average Japanese cold storage facility is one tenth the size of those in the US. These circumstances mirror those of the early stages of the Asia logistics real estate market.

Owning and managing cold storage facilities is more complex than dry warehousing, due to the specialised and costly fit outs and the health and safety requirements regarding food and medicines. However, these complicating factors also mean that tenants invest more and therefore take on longer leases – often twice as long as for dry warehousing.

The added complexity also means a yield premium for cold storage facilities. “On average, we see that prime cold storage warehouses offer 4% to 5.5% yields across major Asia Pacific markets, representing a 30 to 150 basis point spread over dry warehouse margins,” says Smith.

China and India are the largest markets for cold storage in Asia and in both countries the market is highly fragmented, with more than 3,000 players in India. Meanwhile, Vietnam is very underdeveloped with fewer than 50 facilities nationwide but is growing rapidly.

To date, real estate investors have focused on China, which offers scale, good infrastructure and a consolidating tenant market. Logistics real estate players such as ESR, DNE and GLP as well as investors such as CapitaLand and Blackstone Group are currently active in the market.

ESR recently completed a 113,000 sq m cold storage facility (pictured above) at the ESR Chengdu Qingbaijiang Cold Chain Industrial Park in Sichuan, China. Meanwhile, GLP has announced plans to build 100 cold storage facilities across China by the end of 2025.

“Real estate investors are coming to realise the potential for modern cold storage facilities around the region, an opportunity underpinned by rising consumer prosperity and the region’s growth prospects,” says Smith.

Further reading:

Asia Pacific Cold Storage Markets Spotlight June 2023

Contact Us:

Simon Smith