Easing inflation set to boost Asia real estate

Higher interest rates could have limited impact on Asia Pacific real estate investment, as US inflation expectations moderate and vendors adjust price expectations. Learn more.

The impact of higher interest rates on Asia Pacific real estate investment could be limited, as US inflation expectations moderate and vendors adjust their price expectations.

“Asia Pacific has not been immune to inflationary pressures, principally in the form of higher food and fuel costs, however price rises have been more subdued than in the US or Europe. Interest rates nevertheless have had to rise, except in China and Japan, and higher borrowing costs have impacted real estate,” says Simon Smith, Head of Asia Pacific Research & Consultancy at Savills.

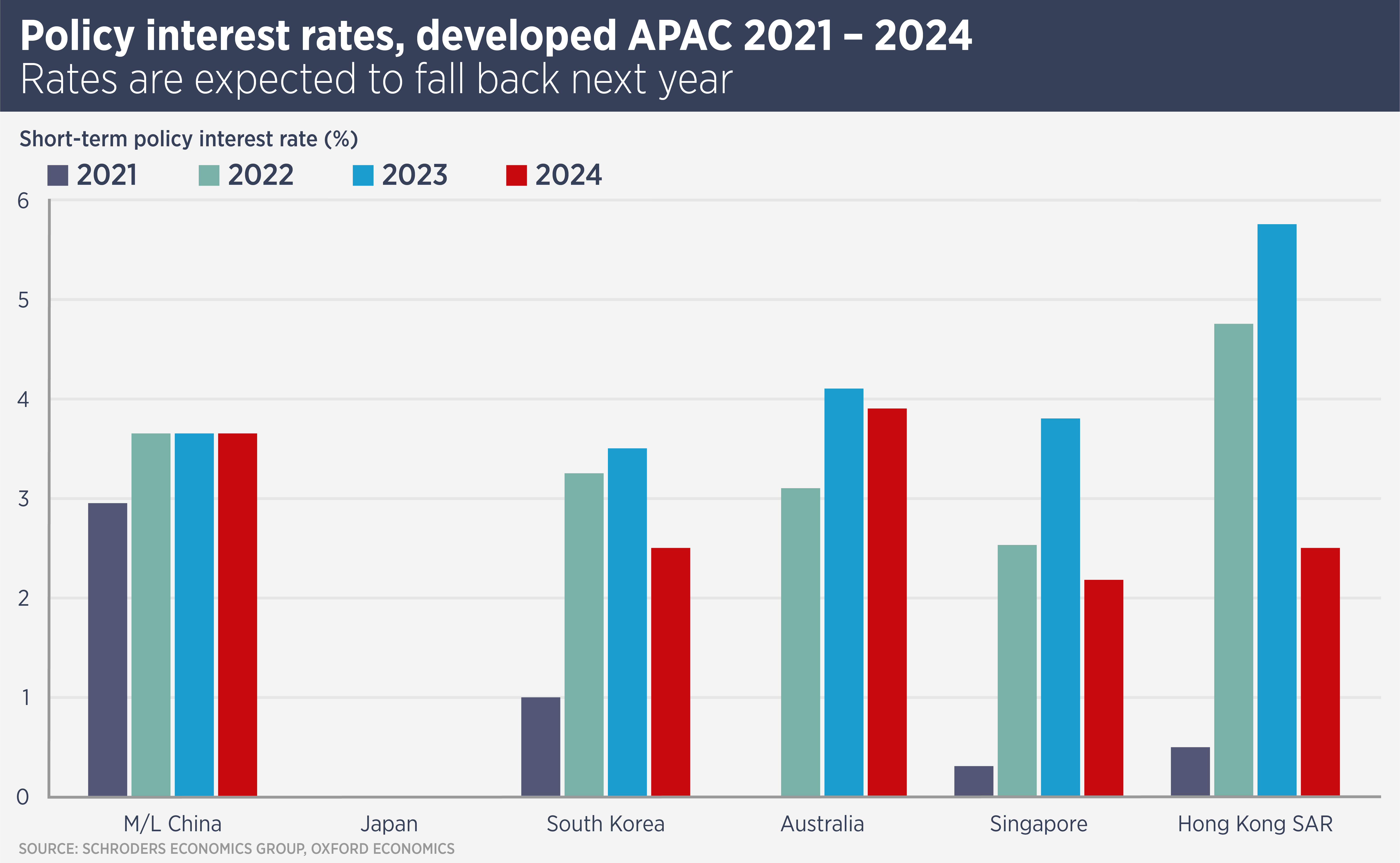

Mainland China and Japan continue to operate in a different inflation environment to the rest of the world, with static policy rates in both nations.

The spike in borrowing costs in late 2022 contributed to a poor first quarter for Asia Pacific real estate transactions. MSCI Real Assets data show the trading volume of income-producing assets fell by 50% from a year earlier to $27.2 billion.

Additionally, yields have risen by 25-100 basis points (depending on sector and market) across the region. Markets where interest rate rises have been sharpest and yields low, such as South Korea and Australia, have seen the most dramatic movements.

However, there a growing sense that interest rates rises, in the US in particular, have begun to take effect. In June, the US Federal Reserve held interest rates steady after a run of 10 increases.

In Schroders’ latest Asia Pacific real estate market update, Andrew Haskins, Head of Strategy and Investor Advisory, Real Estate, Asia Pacific at Schroders Capital, says: “There is growing evidence that global inflationary pressures are moderating. Further, there is now a perception – which Schroders shares – that US interest rates are nearing their peak as recession risks increase. In combination, these factors should ease the pressure on APAC central banks to hold interest rates high.”

Schroders and Oxford Economics predict policy rates in South Korea, Australia, Singapore and Hong Kong will fall back next year. Meanwhile, China’s low inflation and surprisingly muted post-pandemic recovery means policy rates are likely to remain unchanged.

Despite rising inflation (hitting 3.4% in May) and a weak currency, Japan has held off changes in policy rates. In June, The Bank of Japan expressed caution over raising interest rates too quickly. However a number of commentators believe new governor Kazuo Ueda may raise rates or further loosen its yield curve control, which would put upwards pressure on property yields.

For the time being, however, Japan remains one of the few markets with a positive gap between finance costs and real estate yields. However, as real estate yields adjust around the region, positive gaps will reappear. For example, Singapore saw a number of shopping centre transactions in the first quarter at yields of 4.5% and buyers were able to secure finance at around 4.2%.

“A combination of realistic vendors and moderating inflation expectations mean would could see a recovery in real estate activity later this year,” says Smith.

Further reading:

Asian Cities Report 1H 2023

Contact Us:

Simon Smith | Andrew Haskins