Asia’s office landlords must meet structural challenges

The office sector in Asia is facing a number of structural challenges, such as flexible working, ESG, and the rise of AI. Landlords need to adapt changes to remain competitive. Read more.

Asia’s CBDs have emerged from the pandemic into a more uncertain global economy, however office landlords should be as concerned with structural trends as the economic cycle.

“The post-pandemic office market faces a number of structural challenges which will, at the least, change the way assets are used and which may reduce long-term demand,” says Simon Smith, Head of Asia Pacific Research & Consultancy at Savills.

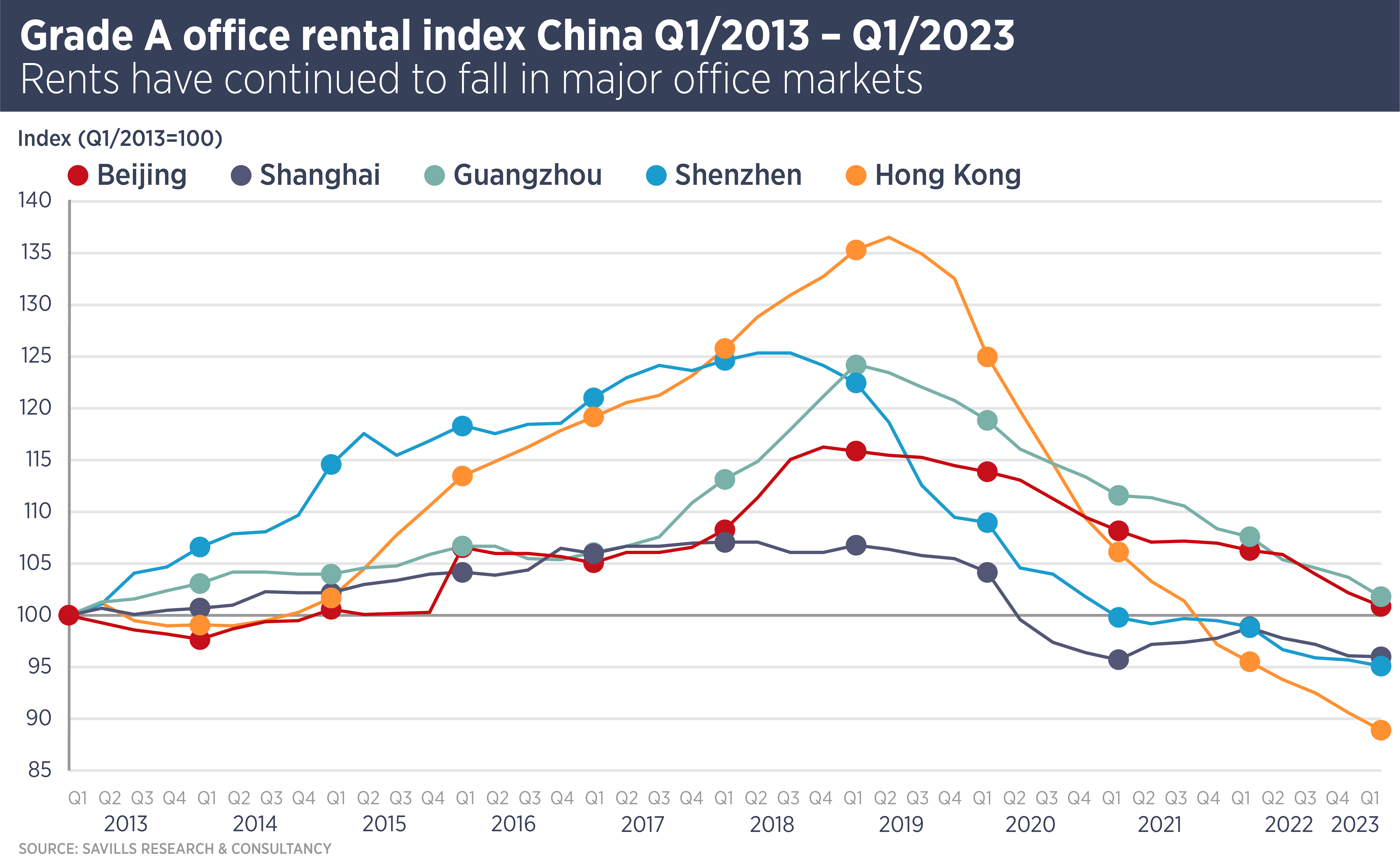

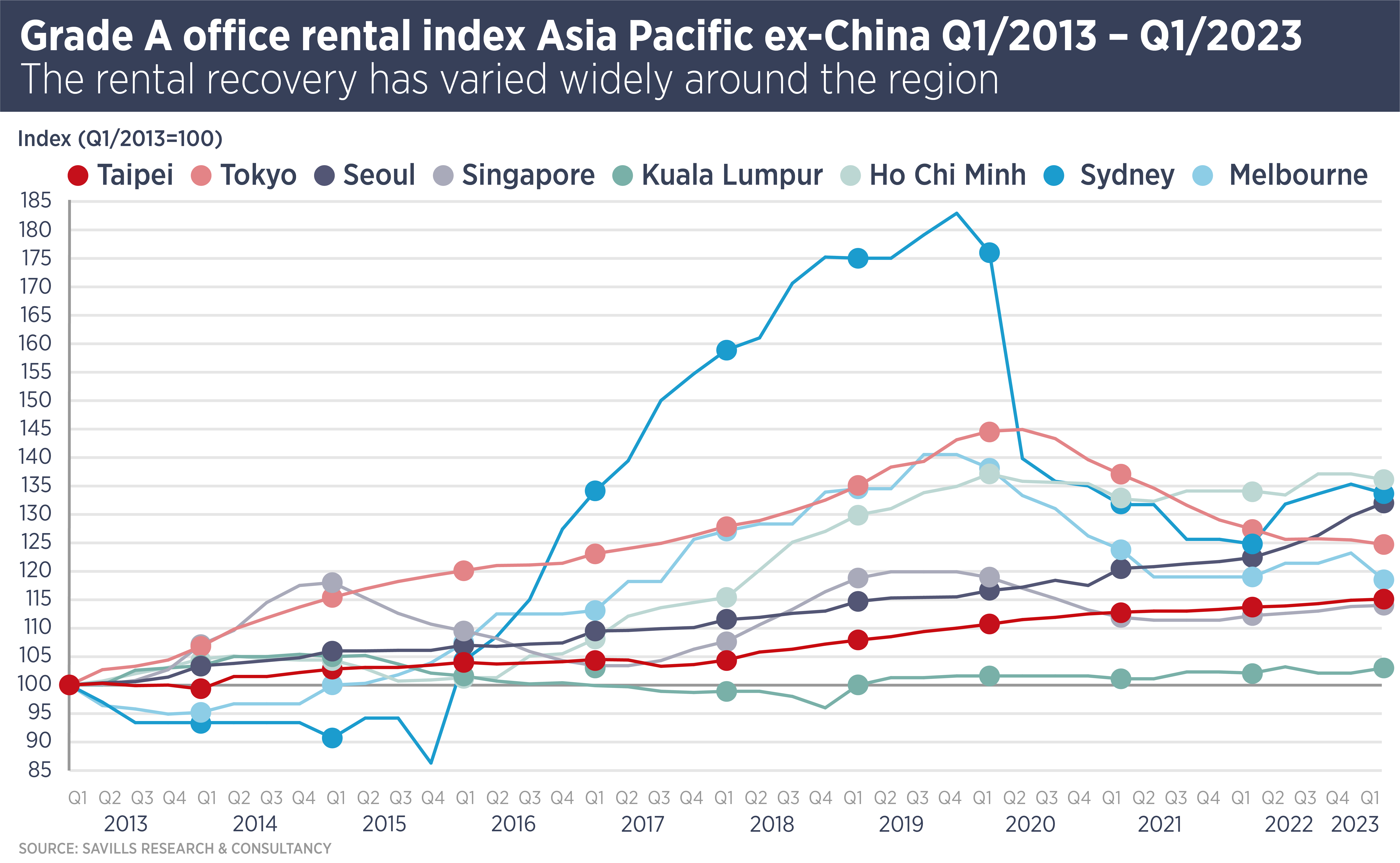

The effect of structural changes can be obscured by cyclical movements. This is very much the case in Asia Pacific today, as office markets are at different stages in the cycle and operating in different economic circumstances.

For example, vacancy in Seoul’s business districts is falling, while Singapore’s market is beginning to cool due to a weakening tech sector. Tokyo seems set to digest the new stock to be delivered this year, while in Hong Kong vacancy rates look set to continue rising as a series of mega projects – such as the High Speed Rail West Kowloon Terminus Development, with 2.75m sq ft of new office space – complete in the next few years.

The office sector worldwide is being forced to adapt to a number of trends, such as flexible and home working as well as rising occupier demand for healthy and sustainable workplaces. Looking further ahead, the rise of artificial intelligence (AI) could have a significant impact on white collar employment.

Flexible working

Working from home has become entrenched in the United States, with close to half of the office working population refusing to return. In Europe, the majority of staff are back in the office most days, while in Asia, the trend never became entrenched to the same degree. Smaller homes, safer cities and better public transport has made the Asian CBD more attractive than downtown USA.

Nonetheless, Asian office staff are working more flexibly than before the pandemic. Even in cultures where ‘face time’ is prioritised, such as Japan, some companies are promoting flexible working, especially in the tech sector. Office workers may not necessarily work from home, but they occasionally work from other locations, such as cafes, hotels or shared spaces in apartment buildings.

It is not clear what the ideal mix of office, home and “third” space will be for the Asian office worker in the longer term, but building in flexibility and amenity to office spaces will be a priority for landlords regardless.

ESG

The pandemic naturally made people concerned for their health and also appreciative of quality of life, which has made them demand more from their office space. Health, safety and wellness are now far more important for tenants and offices which fail to deliver clean air and comfortable space will suffer.

At the same time, corporations are taking environmental sustainability and decarbonisation far more seriously. Asia is somewhat behind the rest of the world in this regard, but larger companies (ie the largest and most prestigious tenants) increasingly demand energy efficient space. Savills research estimates a rental premium of 5-10% for green buildings but in the future, inefficient and unhealthy buildings may simply become impossible to lease.

Smith says: “The “green premium” will shrink as sustainability becomes part of the fabric for Grade A office assets. The threat is to lower grade assets, which tenants and their staff may simply reject at any price.”

AI

The opportunities and risks of AI are being hotly debated by businesses and governments all over the world. However the market ends up being regulated, AI and machine learning is developing fast and can no more be ‘uninvented’ than the wheel. One of the major risks presented by AI is that it will make huge numbers of white collar jobs redundant.

Earlier this year, a Goldman Sachs report suggested 300m jobs worldwide could be threatened by AI, particularly legal workers and administrative staff. Audit has also been highlighted as a function to which AI is well suited.

“Many mid-level desk jobs are threatened by AI,” says Smith. “This could be a far more significant threat to the office sector than flexible working. However, as with previous technology advances, new roles will emerge to replace those lost and landlords should look out for new sectors generating employment.”

Further reading:

Asian Cities Report 1H 2023

Contact Us:

Simon Smith