Betting on Brisbane’s office market

Discover Brisbane's Thriving Office Sector: High Occupancy, Soaring Rents, and Investment Opportunities. Explore the factors driving Brisbane's office market success, from rising rents to robust occupier fundamentals.

A strong occupier market is sparking interest in the Brisbane office sector.

Despite troubles reported worldwide in the office sector, the capital of the Australian state of Queensland has high occupancy and has seen growing prime office rents.

Katy Dean, Head of Research & Consultancy at Savills Australia, says: “The strength in Brisbane relates to its strong occupier fundamentals. This is feeding through to rental growth, particularly for Premium and Grade A space in the CBD.”

Office vacancy in the Brisbane CBD has been falling since mid-2021 and absorption in the six months to July was more than twice the historical average, Savills analysis of the Property Council of Australia’s data shows. At 11.6%, Brisbane’s vacancy rate is only a whisker higher than Sydney’s 11.5%.

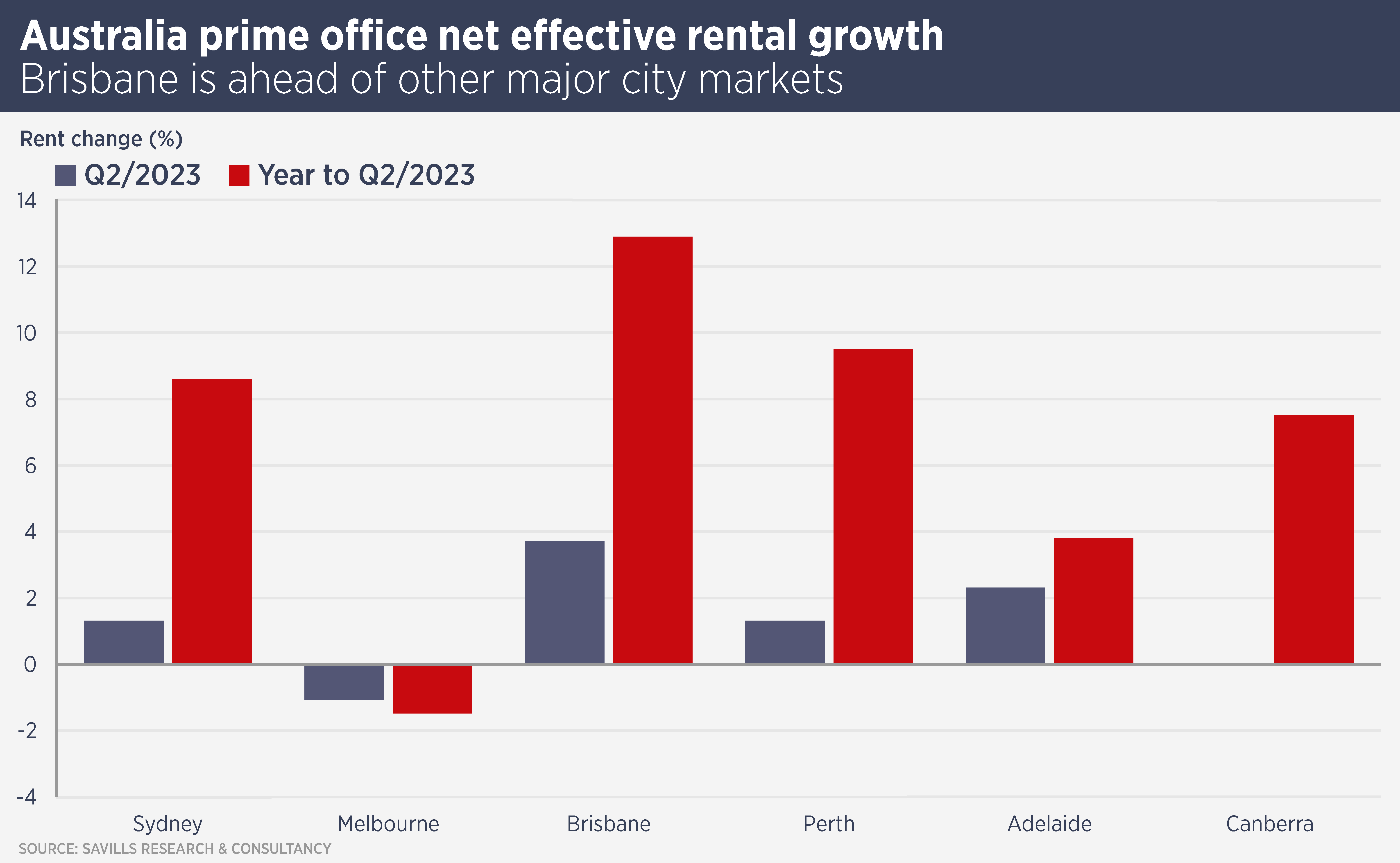

Savills research reports Brisbane Prime office (net effective) rents rose 5.7% in the first half of this year, the highest for any of Australia’s major cities. Over the 12 months to end-June 2023, rents rose 12.9%. Sydney was the next-best performer with an 8.6% rise over the same period.

Lack of new office supply is a key factor, with little new space set to come online before late 2024 and most of that pre-leased. However, Dean points to a number of underlying trends which support continued success.

Queensland has historically recorded GDP growth above the Australian average and has also seen the highest employment growth, something crucial to the office sector, of all Australia’s major cities in the past five years.

Its population has been growing too and inward migration is supported by job creation and by house prices which are below Sydney, Melbourne and Adelaide.

The city is also home to several infrastructure projects, including new rail and road lines and preparations for 2032, when Brisbane hosts the summer Olympics.

These drivers present significant gains for existing owners and new capital looking at Brisbane office, says Anthony Ott, Managing Director for Savills Queensland.

“We’ve seen very little structural change to office demand from this post-Covid shift to hybrid working, except there are more occupiers looking to future-proof their businesses by being in better quality space, which is leading to this sustained run of historically high take-up and rental growth,” says Ott.

“Brisbane office is particularly in favour at present because of its income growth story and macro fundamentals,” Ott says. There is still liquidity in the market for the right asset.”

“Private investors, offshore capital and select unlisted funds are looking at both prime and secondary Brisbane office assets. Overseas investment managers including NPP Corporation and Savills Investment Management have invested in the Brisbane office market in the past 12 months.”

Despite interest rate hikes weighing heavily on transactional activity, Brisbane has been shielded somewhat, with office occupancy rates well ahead of its eastern seaboard counterparts.

The city also offers office yields averaging 6.15% for A grade, higher than 5.65% in Sydney and Melbourne. However, average A grade yields have only expanded 65bps since Q3-22, compared to the east coast average of 90bps.

Ott says the contraction of office vacancy, limited new supply over the next 2 years, a highly diversified industry base, and the volume of infrastructure development being undertaken or proposed, are significant factors that are sustaining investor demand despite higher debt costs.

Further reading:

Savills Brisbane

Contact us:

Katy Dean