No WFH means Seoul offices are thriving

Seoul's thriving office market gains momentum as Korean professionals prioritize city workplaces over remote setups. With limited supply and rising rental performance, overseas real estate investors are drawn to prime office assets.

Seoul’s office market is booming thanks to Korean white-collar workers preferring a desk in the business district to one at home.

Prime office assets are also boosted by a lack of competing supply and their rental performance has attracted the interest of overseas real estate investors.

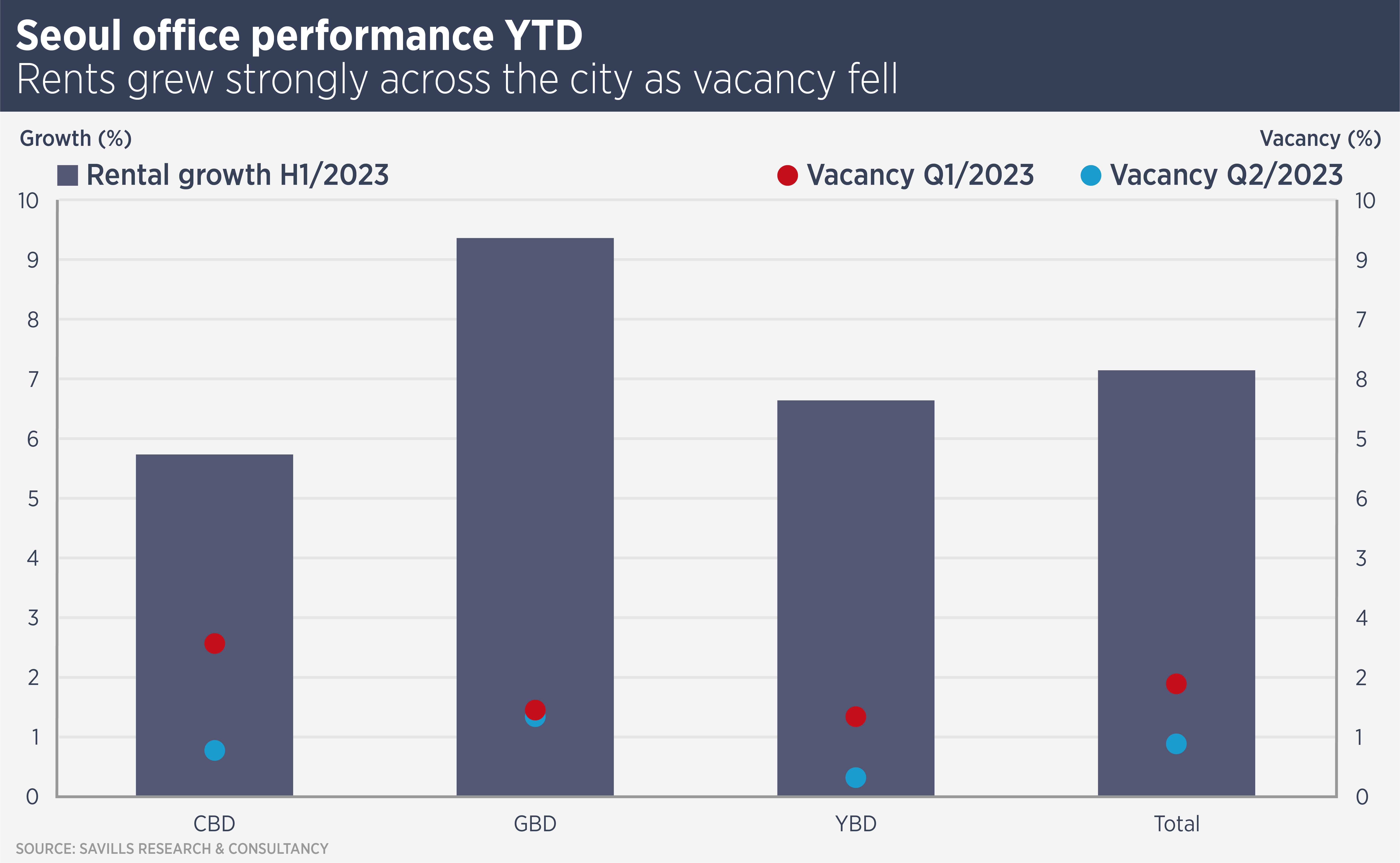

Savills data show the city’s prime office vacancy rate was down to 1.8% in the second quarter of this year, while rents rose 7.1% in the year to June 30. Seoul’s Central Business District and the Yeoido and Gangnam business districts all showed strong rental growth.

A recent Economist article reported that Korean was ranked lowest out of 34 countries for actual and desired days spent working from home. Korean workers spend an average of only half a day working from home each week, compared with one day in Germany and 1.5 days in the UK.

The desire for more time at home is limited too: Korean workers would like to work around a day a week from home on average, while US and Canadian workers would like to spend half the week at home.

JoAnn Hong, Head of Research and Consultancy at Savills Korea, says: “Korea has a strong corporate culture with an emphasis on the office and the preference for office work is combined with restricted supply. No new prime office buildings were delivered in the past two years, leading to a supply-demand imbalance for Seoul’s office market.

“With vacancy rates below 3% for all main business districts, the only negative for prime office take-up is the lack of any large vacant spaces. The gap between face and effective rents has also narrowed, with most recently negotiated leases reported to be settled without any tenant incentives.”

The performance of the prime office market has attracted a number of overseas buyers into the sector, says Hong. For example, private equity group KKR bought the 57,574 sq m Namsan Green building in the CBD from local group IGIS for a reported $186.7 billion in March. A number of overseas investors, including GIC Private, Hines and M&G Real Estate bought office assets in Seoul last year.

Looking ahead, Hong says: “The current tight supply environment is expected to persist until late 2026, at which point there will be a large wave of new offices especially in the CBD. While that surge in total available space may result in a pause in rental growth, the adverse impact is likely to be greater for secondary offices, while core prime offices will benefit from demand for upgrade space.”

Further reading:

Savills Korea research

Contact us:

JoAnn Hong