City lowdown: Bangkok

Bangkok’s retail and tourism sectors thrive amid new infrastructure, while the office market faces oversupply challenges.

The Thai capital is one of Asia’s key destinations for retail and tourism and is benefitting from new infrastructure, however its office market is still negotiating historic oversupply.

Bangkok’s growth is underpinned by Thailand’s solid GDP growth outlook – slated for 3-4% pa for the next few years – and continued urbanisation adding approximately 1.5% to the 12 million population each year.

Although visitor numbers have not recovered to pre-covid levels, Bangkok and Thailand remain amongst the world’s most popular tourist destinations and tourism boosts the city’s retail and hospitality industries. Thailand is also seeing more remote workers and expats.

The city has received a substantial boost from ongoing and planned infrastructure projects which are improving connectivity, reducing Bangkok’s n notorious traffic congestion and promoting sustainable urban development. The expansion of the mass transit system, which has added two new lines in recent years, with two more on the way, alongside improvements in rail, river transport, and high-speed rail networks, is making Bangkok a more accessible and liveable city. These developments are also stimulating real estate growth, revitalizing older neighbourhoods, and encouraging transit-oriented development.

Kunvara Boonsuk, Senior Analyst, Research & Consultancy, at Savills Thailand, says: “These infrastructure developments will not only ease traffic congestion and boost public transport usage but also stimulate real estate investment, enhance tourism, and drive economic growth. With better interconnectivity between different modes of transport, Bangkok is transitioning into a more efficient, modern, and globally competitive city.”

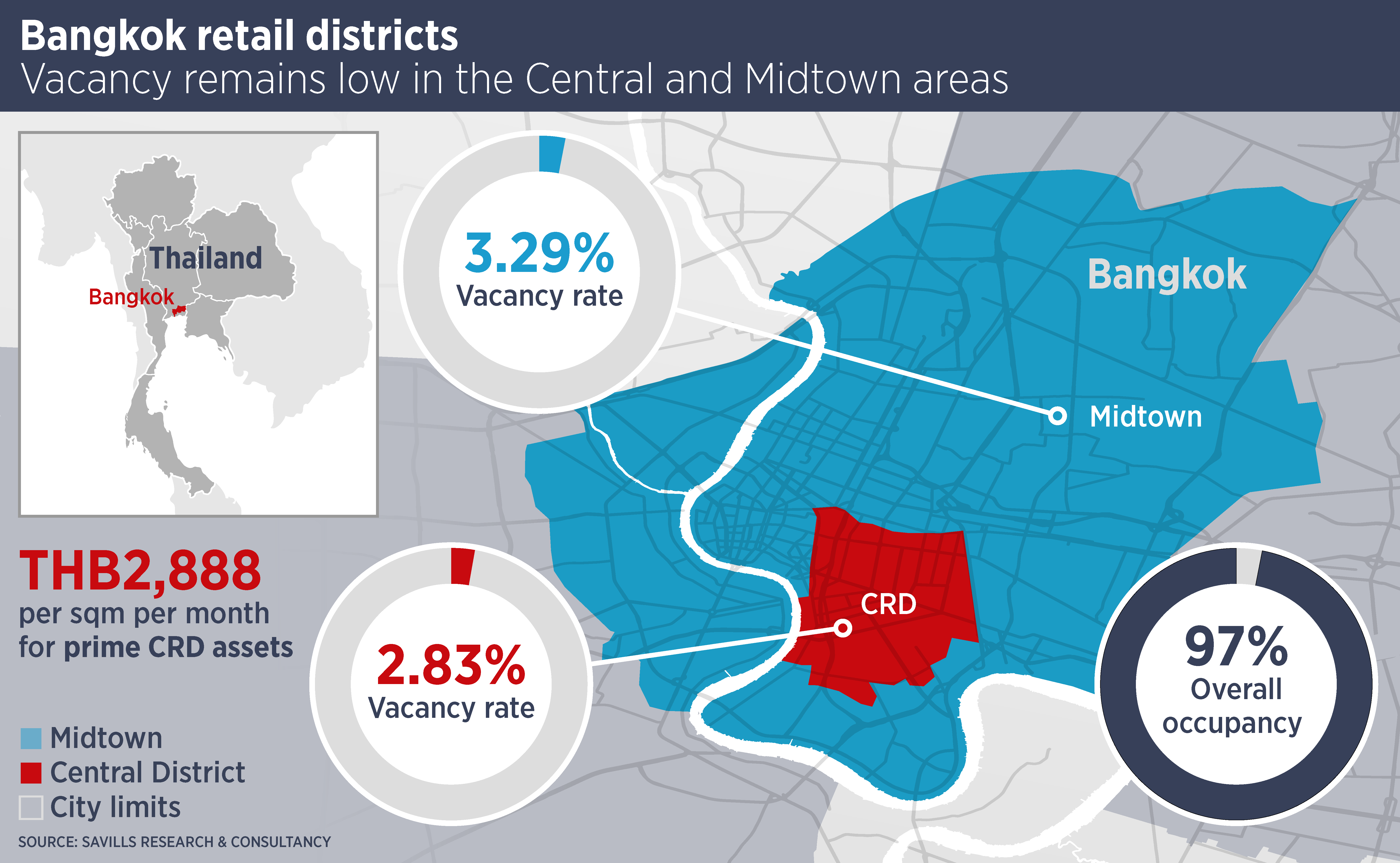

Bangkok is a popular retail destination and boasts some of the region’s biggest and most glamorous shopping centres. The prime retail area is located in the Pathumwan district, particularly around Siam and Ratchaprasong, known as the city’s shopping and entertainment heart. Retail vacancy in the central retail district (CRD) is under 3% and similarly low in the midtown district. Low vacancy has driven a wave of new retail developments in the CRD and Midtown areas, including some very large shopping centres which form part of mixed-use developments such as One Bangkok, Bangkok Mall and Dusit Central Park.

The city is home to several international luxury brands, boasting a two-storey Louis Vuitton retail concept which has a restaurant and exhibition space, as well as a large standalone boutique for skincare brand Aesop. The retail sector is slated for continued growth but new supply will make an already-competitive market even more so.

The residential market in Bangkok has benefitted from infrastructure improvements, a rising number of expats and second home buyers as well as continued urbanisation and migration to the city. However, homebuyers struggle with high financial costs and lending constraints, as domestic interest rates remain elevated, affecting affordability and access to credit. Thai consumers are also saddled with persistently high household debt, making buyers more cautious about taking on long-term commitments.

Prime residential districts include areas around Sukhumvit Road which are very popular. Boonsuk says the area is: “A top choice for high-end condos, offering a mix of luxury residences, vibrant nightlife, and international dining, which is popular with expatriates and local professionals.” Apartments by the Chao Praya River are perennially popular with luxury buyers, as are those near the green spaces of Lumpini Park. Branded residences are popular with luxury apartment purchasers.

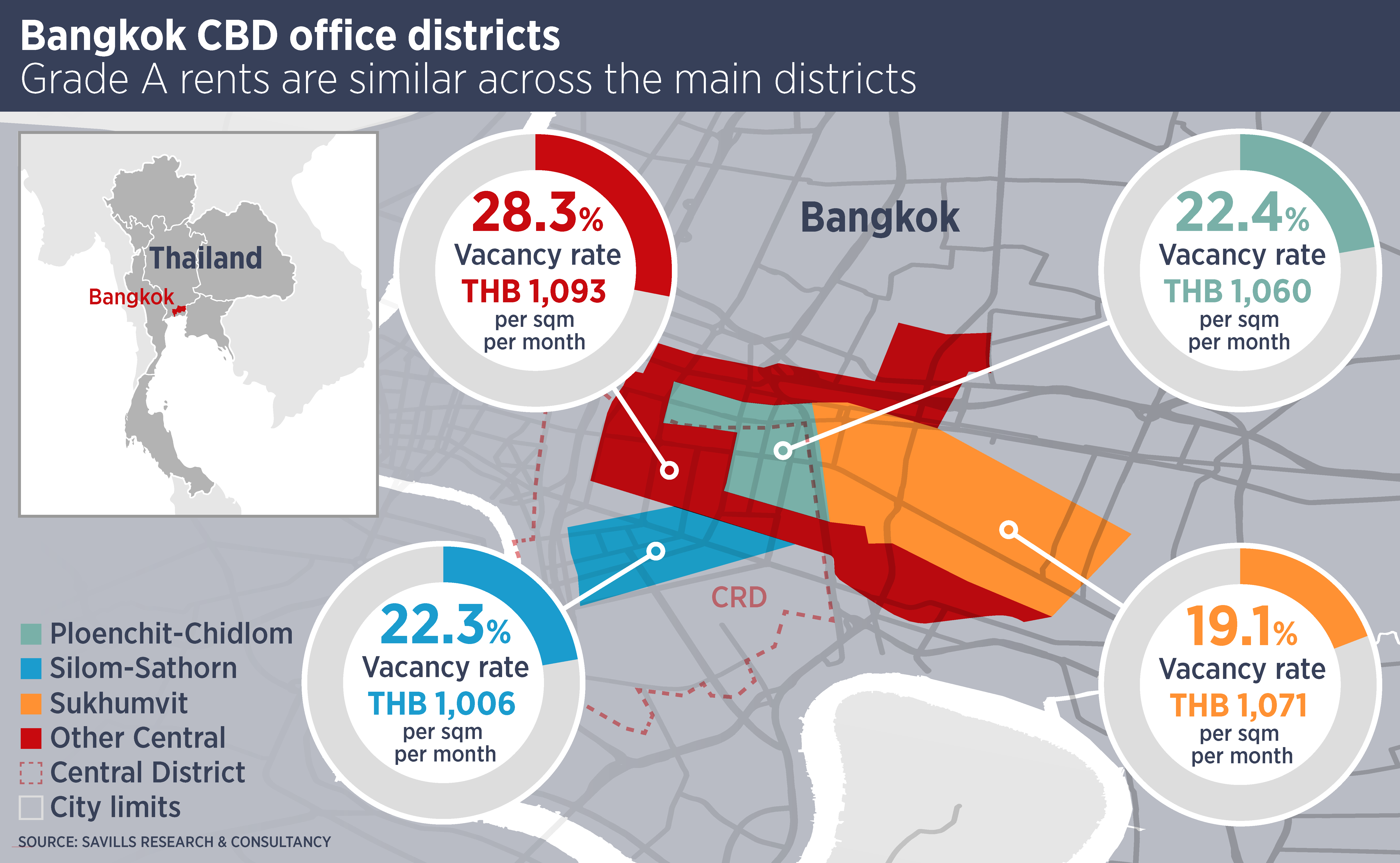

The Bangkok office market has been challenged by high vacancy rates but is poised for gradual recovery in 2025-2026, driven by broader economic growth and a burgeoning service sector. Notable developments in recent years have included the rise of hybrid working and flexible office space operators and a move towards sustainable office buildings, especially from multinational corporations and large enterprises. There are also a number of government incentives and foreign investment policies which aim to encourage international firms to establish regional offices in Bangkok.

Nonetheless, the threat of oversupply remains, especially for older buildings, as newer and more sustainable office developments enter the market.

Further reading:

Savills Thailand

Contact us:

Robert Collins