City lowdown: Metro Manila

Manila’s real estate market adapts post-COVID, driven by BPO demand, logistics growth, flexible offices, and new infrastructure shaping Mega Manila.

Manila has been struggling to recover from the impacts of the covid pandemic, however improving infrastructure, consistent demand from the business process outsourcing (BPO) market and a growing modern logistics sector will support future growth.

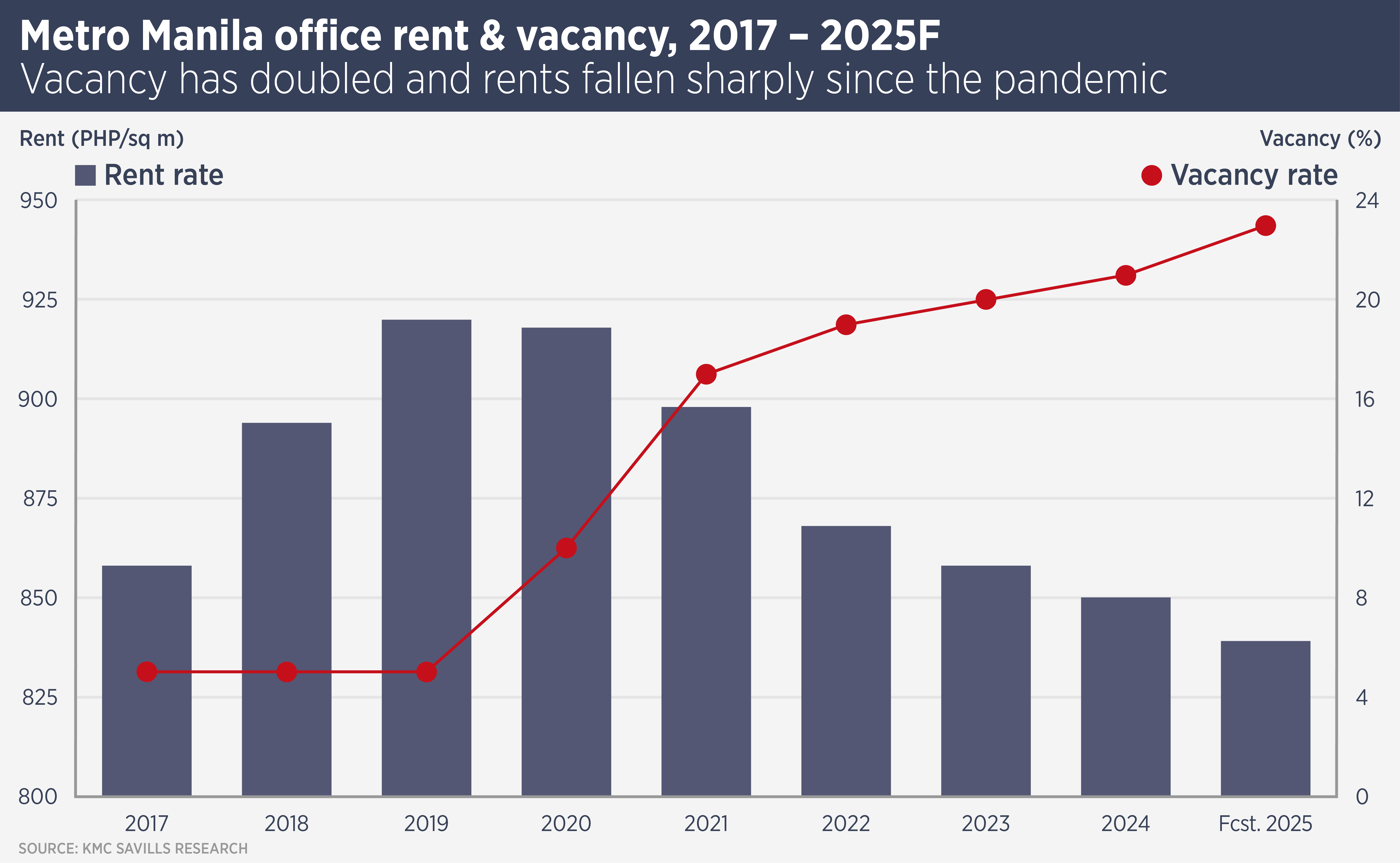

The pandemic was disruptive for Metro Manila; not only did it damage the Philippines capital’s economy, but it led to more hybrid and remote working, which has affected demand for office space.

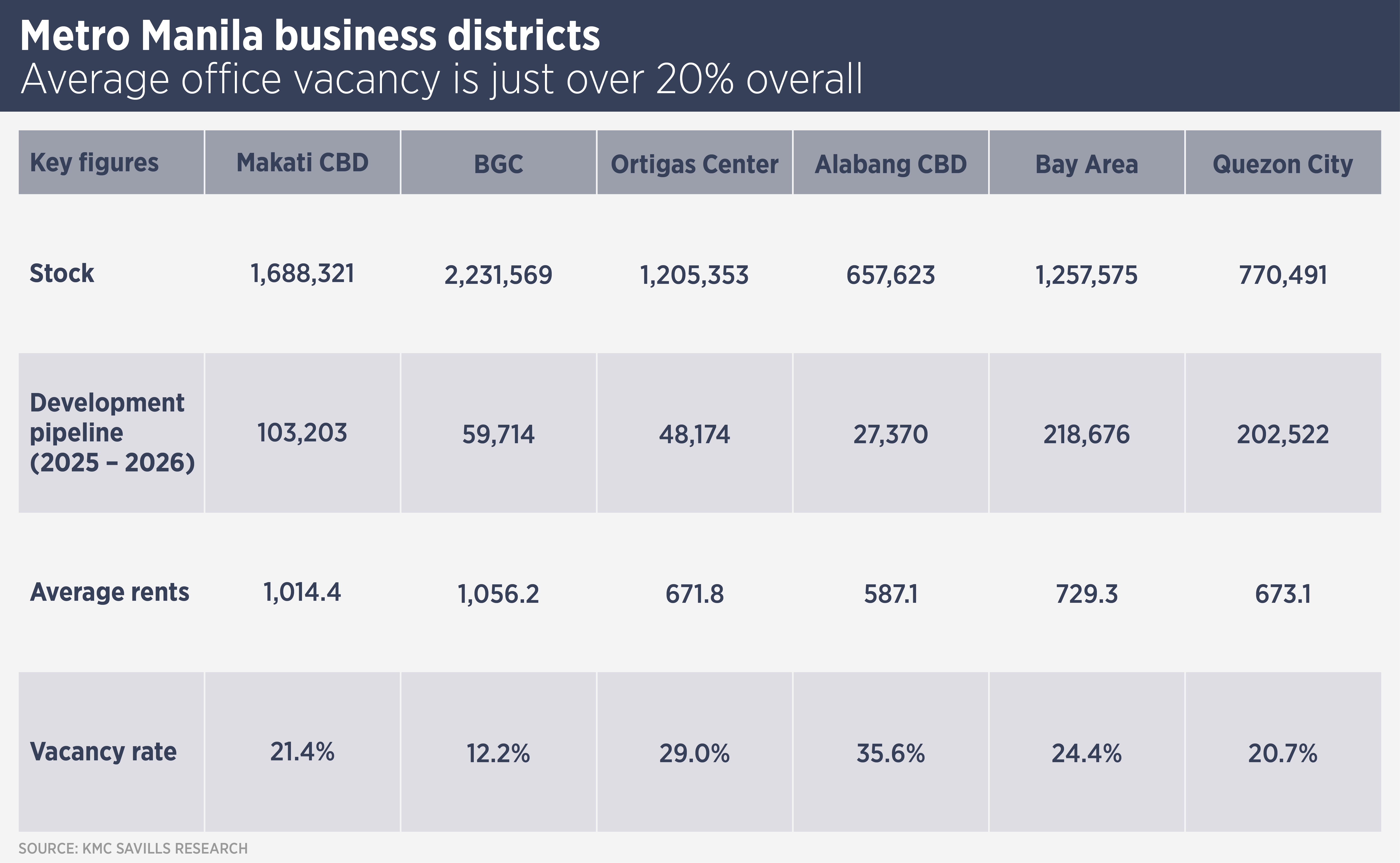

Manila is a city with multiple business districts, with Makati CBD and Bonifacio Global City (BGC) being the most significant markets, attracting the highest rents. However, office supply last year was significant and vacancy rates remain elevated across all the main sub-markets.

Last year, 495,000 sq m of new office space entered the market, only 27% of which is currently occupied. There is also the prospect of existing space re-entering the market due to a government ban on Philippines Offshore Gaming Operators (POGO). These are online gaming operations catering to foreign customers but based in the Philippines and have operated since 2003 and were regulated in 2016. Many were Chinese owned, catering to Chinese customers and employing expat Chinese staff.

POGO generated revenues for the Philippines government, but also problems. Gaming operations catering to Chinese citizens displeased China and the Philippines government felt POGO caused domestic problems too. Thus a complete ban was announced last year and foreign workers were required to leave the country.

Demand for new office space is likely to come mainly from the BPO sector, which remains strong, says Joshua De las Alas, Associate Director at KMC Savills in Manila. “We also see continued demand from government departments which are seeking to upgrade from lower grade office space,” he adds.

“Meanwhile, the flex office space is also growing, with international brands like WeWork and The Executive Center, as well as homegrown operators catering to start-ups and overseas companies.”

The growth of e-commerce and third party logistics (3PL) companies has driven a booming logistics market in Manila, with a number of areas on the fringe of the city becoming hubs. A lack of modern logistics space, specified to suit 3PLs, means there has been plenty of demand and developers are adjusting their product to meet this.

De las Alas says: “A majority of the newer facilities here are build-to-suit but we have noticed that developers have begun to realise their product was not up to scratch and have begun to develop space suited to modern requirements.”

The Manila residential market has been a glut of condominiums due to a development pipeline catering to pre-pandemic demand. KMC Savills Research data showed 37,700 unsold units at the beginning of the year, many within the supply is particularly pronounced in the lower-mid segment, where units are priced between PHP3 million and PHP7 million.

“At first glance, this price range seems accessible, but a closer look reveals why these units are struggling to find buyers,” says De las Alas.” For a studio or one-bedroom unit in this bracket, monthly mortgage payments can range from PHP 20,000 to PHP 40,000—a significant financial burden for the average Filipino family earning an average income of PHP 50,000 to PHP 60,000 per month.”

For these sums, a family could buy a three or four bedroom house outside Manila, which suits recent changes in working patterns. Furthermore, there are a number of infrastructure projects, including new metro lines and the city’s first subway– designed to cut travel times from outside Manila into the city centre. These improvements will be positive for the city overall, improving access and reducing road traffic. This linking of the city to the nearby provinces is charting the development of “Mega Manila”.

However, they will make selling city apartments more difficult. De las Alas suggests this may lead to innovative solutions, such as investors buying units in bulk for rental purposes, which could support the development of an institutional multifamily market.

Due to restrictions on the foreign ownership of land, most inward investment in real estate tends to take the form of joint ventures for development projects, with Japanese, Korean and Chinese companies the most active. Large local developers and conglomerates such as Ayala Land and Megaworld continue to dominate.

Further reading:

KMC Savills

Contact us:

Joshua De Las Alas