An electrifying opportunity for landlords

Electric vehicle adoption is reshaping real estate. Explore EV charging, infrastructure, and investment opportunities for asset owners across Asia and beyond.

The adoption of electric vehicles (EVs) is accelerating across the world, leading to a host of potential opportunities for asset owners.

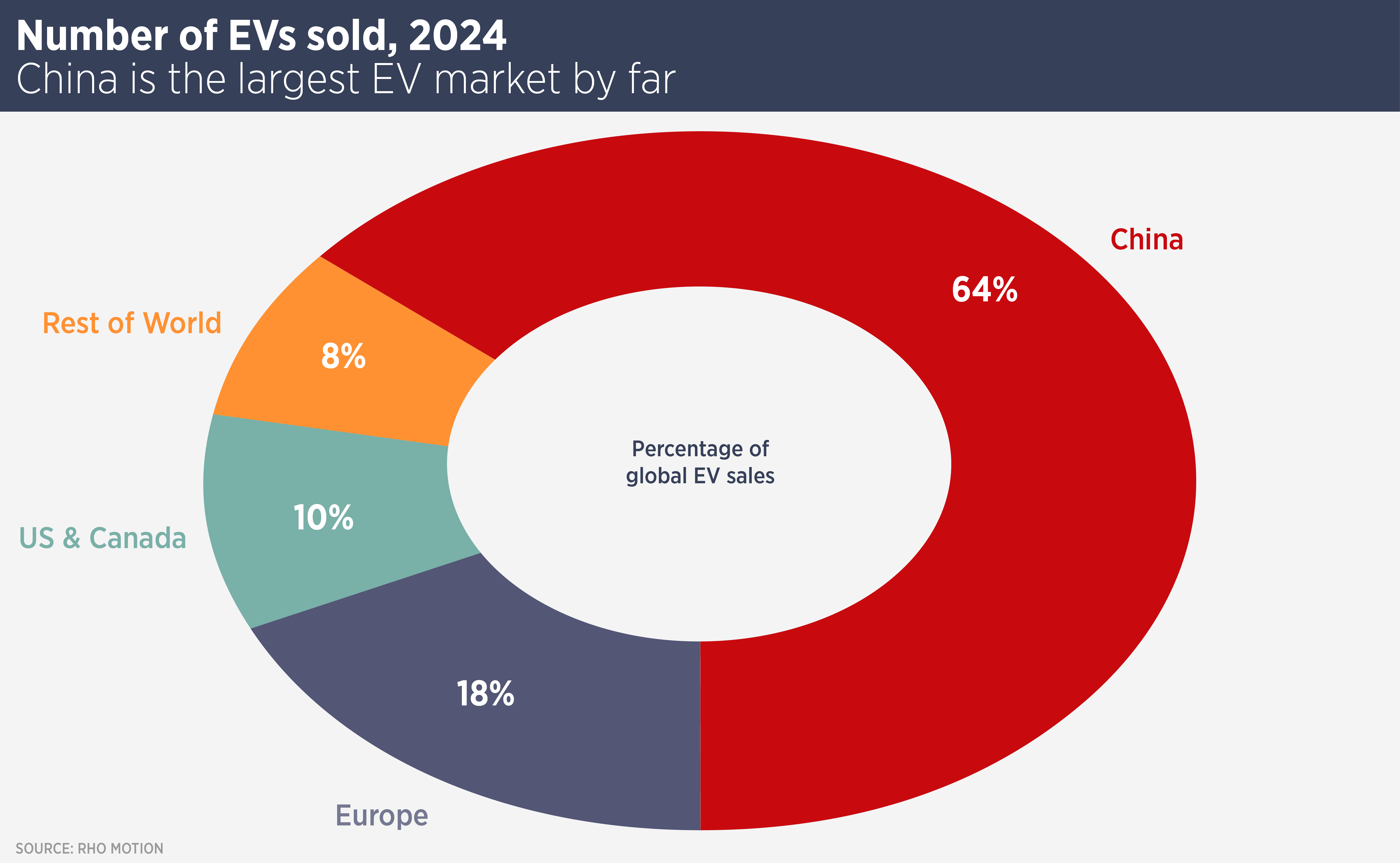

More than 17 million EVs were sold in 2024 and Sales of battery EVs (BEVs) are expected to increase by 30% in 2025, according to S&P Global Mobility. Nearly two thirds of global EV sales were in China, which is also the leading manufacturer of EVs.

“With nearly 40 million EVs on the road, around 10% of the total fleet, China is the biggest market for EVs and the biggest opportunity to date,” says Simon Smith, Regional Head, Research & Consultancy, Asia Pacific. “Chinese EV drivers need charging infrastructure and manufacturers of cars and batteries need industrial space.”

Forward-thinking real estate investors have already been investing in EV infrastructure. In 2021, Hidden Hill, the venture capital arm of logistics specialist GLP, closed a fund in partnership with YKC Clean Energy Technologies to invest in smart EV charging infrastructure in China.

Charging ahead

Even with EVs making up a small percentage of cars on the road, there is substantial demand for charging infrastructure and this is seen as a significant opportunity for owners of real estate. Owners of retail properties with car parking can install chargers to attract customers and to make extra income. Some landlords are also installing solar PV panels on the roofs of malls to supply the chargers.

EV charging is also both a selling point and a potential revenue generator for owners of office and multifamily assets. For example, Japanese EV charging service provider Ubiden has collaborated with residential asset management subsidiaries of Orix Real Estate to install EV chargers at their condominiums.

“As EV adoption grows, charging facilities will move from ‘nice to have’ to essential for asset owners,” says Smith. Many older buildings will need to enhance power capacity to support fast chargers while landlords will need to partner with charger operators to share installation costs and revenues.

New manufacturing

EV manufacturing is different from the way internal combustion engine (ICE) cars are made. Typically, batteries are made in large and hi-tech “gigafactories” while the EV assembly process is somewhat simpler than for ICE cars. Simpler cars mean fewer service centres are needed and the supply chain for EVs is more streamlined. Fewer ICE cars will also mean less demand for space from component manufacturers.

Meanwhile, a new competitive landscape is emerging. A decade ago, regional car manufacturing was dominated by Japanese brands such as Toyota, Honda and Nissan, Korean marques Hyundai and Kia, and Indian manufacturers Tata Motors and Mahindra & Mahindra. The EV market today belongs to Chinese brands such as BYD, SAIC Motor, Geely Auto Group, XPeng Motors, Li Auto and NIO Inc.

However, Hyundai, Nissan and Tata are also ramping up EV production. India is challenging China with more affordable models and Indonesia, Thailand and Vietnam are emerging markets for local manufacturing. Vietnam is making a name for itself in electric motorbikes.

Longer-term changes

“Widespread adoption of ICE vehicles swept away a host of businesses from saddlers and carriage makers to stable hands, blacksmiths and feed merchants, so EVs are set to transform real estate in a myriad of ways,” says Smith. “Cities around the world will be transformed to meet the demands of EV owners. And just wait until autonomous vehicle tech is perfected….”

Further reading:

Charged for change: how Evs are reshaping India real estate

Contact us:

Simon Smith