Tokyo offers opportunities across multiple sectors

Explore why Tokyo remains Asia’s top real estate hub, with strong growth in office, retail, logistics, and hospitality sectors attracting global investors.

There are few cities across the world which offer opportunities across all real estate sectors, but Tokyo seems to be one.

The city has benefited from Japan’s spectacular tourism recovery, a strong office market and resilient fundamentals underpinning the logistics sector. As well as the sectors discussed here, it is also a target for regional data centre players.

“The Japanese economy is set for modest growth for the time being, while rising wages and company profits support real estate,” says Tetsuya Kaneko, Managing Director and Head of Research and Consultancy, Japan at Savills. “Tokyo is naturally the focus for much of Japan’s economic activity. It is the largest real estate market in the region and thus continues to attract capital looking for depth and liquidity.”

Tokyo is not the only thriving real estate market in Japan, but it is the largest and most liquid real estate market in the region, making it perennially attractive to both domestic and overseas investors.

Office

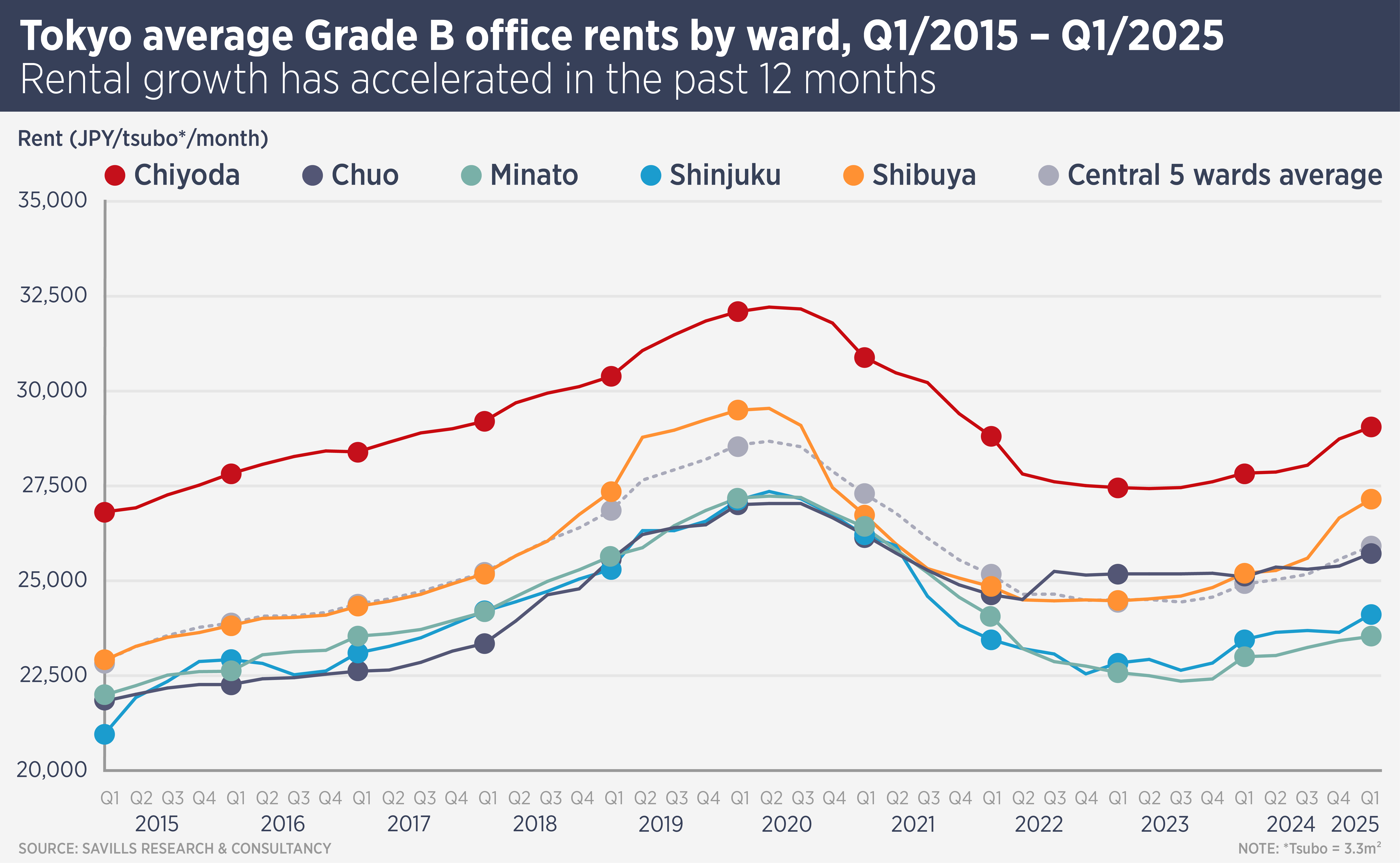

In many CBDs across the world, only the top end of the office market is thriving, as multinationals migrate to “best in class” space with sustainability and wellness certifications. In Tokyo, however, Grade B offices grew consistently in 2024 and a “further recovery is underway” in the larger scale Grade B office market, says Kaneko.

Average Grade B office rents in Tokyo’s Central 5 Wards rose 4% in the 12 months to Q1 2025, Savills data show and vacancy is down to 2%. Japanese companies are reporting strong profits and homeworking is in decline which, along with tight supply, supports occupancy and rents.

Investor interest in the sector remains strong, with more acquisitions from overseas capital in recent months. Often, these investors are looking for opportunities to add value with capex.

Retail

Tokyo’s prime retail submarkets have been performing well, on the back of strong and sustained growth in inbound tourism. Last year, visitors to Japan spent a total of ¥8.1 trillion (US$55 billion), up 53% on 2023. Average first floor rents in Tokyo rose 3% in the second half of 2024. Prime retail streets have been performing well, and vacancies are few and far between in such areas.

There is broad interest in retail assets from overseas and domestic private equity as well as Japanese real estate investment trusts (J-REITs). Retail cap rates in Tokyo compressed slightly last year, despite higher interest rates.

Logistics

The Tokyo logistics market is heading towards equilibrium, after a period of elevated supply, which suggests room for growth in the future. Vacancy rose from below 2% in 2020 to 9% last year, due to increased supply, however rising construction costs have constrained new building and the supply pipeline has started to fall.

Despite rents falling 2.5% in the second half of last year, both overseas and domestic investors have been picking up the pace of acquisitions. “Overall, the logistics sector is nearing a turning point, as consistent demand is coupled with declining new supply,” says Kaneko.

Hospitality

A record 37 million people visited Japan in 2024, 5 million more than in 2019, the last year before the pandemic. Japan’s attractiveness to tourists has caused some problems in the most popular areas and sparked investment from hotels in staff and technology to help them cope. Supply is constrained in Tokyo and other major markets, however a new generation of repeat visitors to Japan has begun to explore other areas.

MSCI data show investors spent ¥1.1 trillion (US$7.5 billion) on hospitality real estate in Japan in 2024, a record 20% of the total for the year. “Hotel assets should remain highly desirable assets among investors in 2025,” says Kaneko.

Further reading:

Savills Japan Research

Contact us:

Tetsuya Kaneko