Asia funds less burdened with capital

Despite substantial capital raising by Asian real estate funds, the continent looks less exposed to the risk of excess dry powder than other regions.

Investors and asset managers have expressed concern that, with global real estate considered to be late in the cycle, some funds may struggle to invest capital.

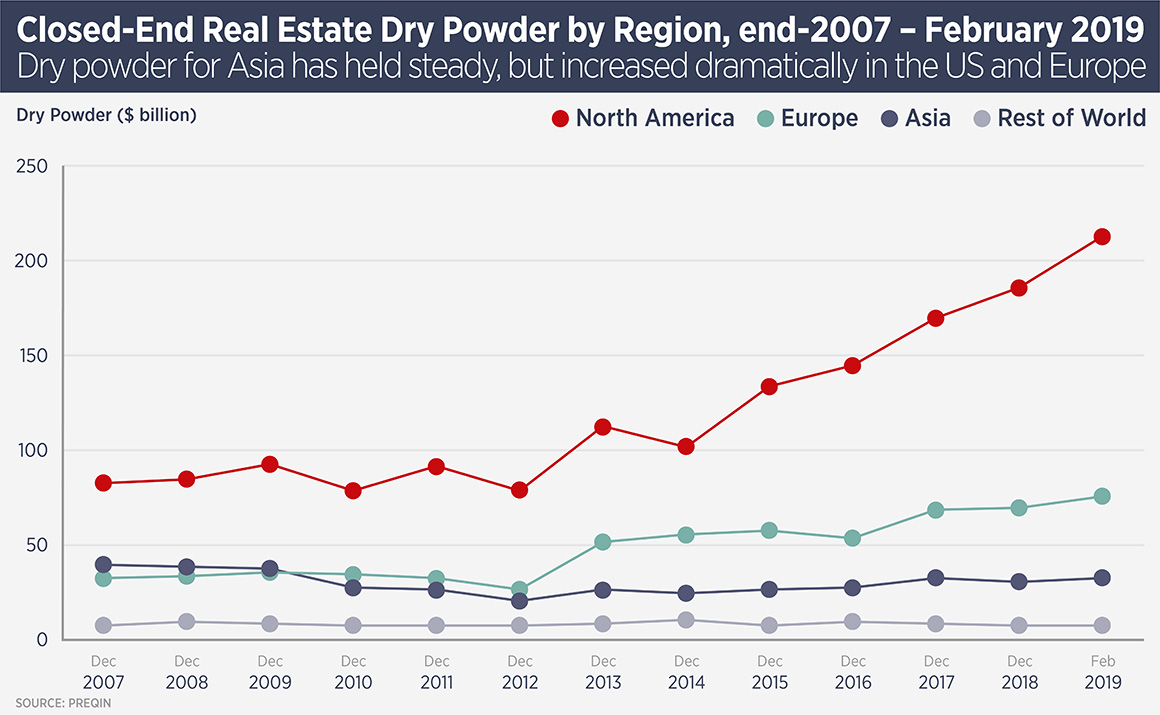

However, data from Preqin suggest Asia is better off in this regard than either Europe or North America. At the end of 2018, there was $33bn of dry powder (uninvested equity) in real estate funds investing in Asia, an increase of $6bn since 2014. However, over the same period dry powder in North American- focused funds more than doubled to $213bn, from $102bn. Europe saw a rise of 35% to $76bn.

Benedict Lai, head of Asia Pacific research at Savills Investment Management, says: “Given where we are in the current property cycle and with yields in most markets at historic lows, some funds face challenges deploying their capital.

“Nevertheless, we have seen evidence of increased inter-regional capital flows into Asia in recent quarters as part of a global diversification strategy amid a storm of uncertainties. Fund managers, in particular those who understand local market nuances, have access to off-market opportunities and are able to tap re- pricing opportunities, are well-placed to navigate through the current headwinds.”

Last year, Blackstone raised the largest Asia Pacific-focused fund in history, netting more than $7.1bn of capital. Notably, the investment period for its latest fund is longer than for its first Asia Pacific vehicle.

Lai says: “In terms of raising capital for Asia, it has definitely become much more competitive and challenging, especially for smaller managers, although investors are still keen on the region’s strong growth story.”

Further reading:

Preqin

Savills Investment Management

Contact us:

Simon Smith