Wealthy Indians set to make their mark

In recent years, there has been considerable focus on the spending power of wealthy Chinese people and their ability to influence retail, hospitality and real estate markets.

However, India also has a growing wealthy population and the huge numbers involved in a nation with more than 1.3bn people mean it too will have a global influence over time.

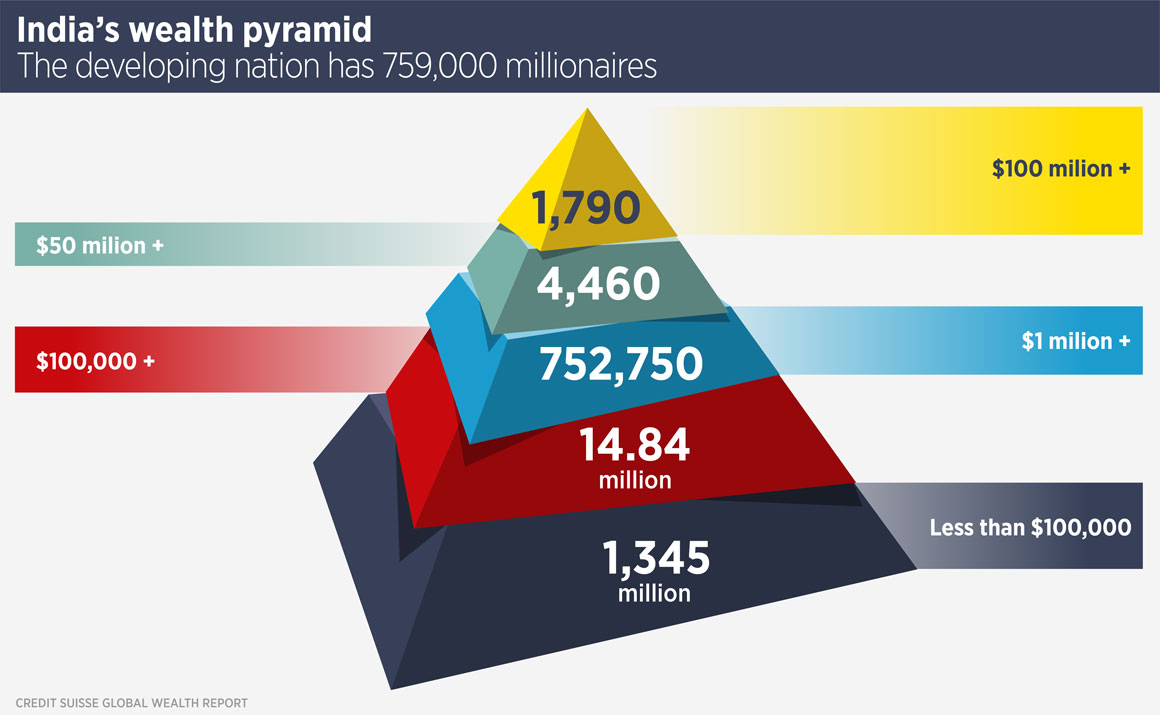

India is not a rich nation: 78% of the population has wealth (total net assets) of less than $10,000 and only 1.6% have more than $100,000, although that equates to 15.6m people – a sizeable total.

According to Credit Suisse’s wealth report, there are 759,000 Indian millionaires (in US dollar terms), which compares with 4.4m in China and 18.1m in the US. Of those millionaires, 1,790 have wealth of more than $100m.

Only people at the top of India’s wealth pyramid will be involved in cross-border real estate purchases, says Shveta Jain, managing director, residential services at Savills India. Most of these will be in residential assets.

“There are lots of opportunities in India, but people seek diversification and wealth preservation, so mature cities are preferred. The UK is popular due to language and historical links as well as the availability of direct flights,” she says.

The US, Canada and Australia are also popular while some wealthy Indians are looking at countries which offer golden visa schemes. Holiday homes are another option, with a large number of purchases in Dubai, which is the top destination for Indian tourists, according to Mastercard.

“Education is extremely important to Indian people and so increasing numbers are educating their children overseas, in the US, UK and Australia,” says Jain. “In some cases they may invest in property which their children will occupy.”

The wealthiest Indians often have businesses overseas and can use capital generated from these to acquire substantial assets, including commercial real estate investments. Others are restricted by India’s Liberalised Remittance Scheme, which allows $250,000 of overseas investment per year. Families typically pool investments, says Jain.

Overseas tourism was once limited to India’s upper classes, but more and more middle-class families are now holidaying overseas, says Jain. The three most popular destinations, according to Mastercard, are Dubai, Singapore and Mecca.

Destinations growing in popularity include South East Asia, especially Thailand and Malaysia, while growing numbers are heading to Europe, with the UK, Switzerland (a popular honeymoon destination), France and Italy favoured destinations. Indian tourists are more concerned with experiences than purchases, says Jain and are also becoming more experimental with regards to location and activity.

Just as shops and hotels have adapted to make Chinese tourists more comfortable, some are making themselves more attractive to Indians, by offering vegetarian food which caters to travellers’ religious requirements.

Further reading:

Savills India

Contact us:

Shveta Jain