Foreign investors begin to step up in Seoul

Korean investors utterly dominated the investment market in Seoul during the pandemic, however there are signs that foreign funds are becoming more active.

Korean investors utterly dominated the investment market in Seoul during the pandemic, however there are signs that foreign funds are becoming more active.

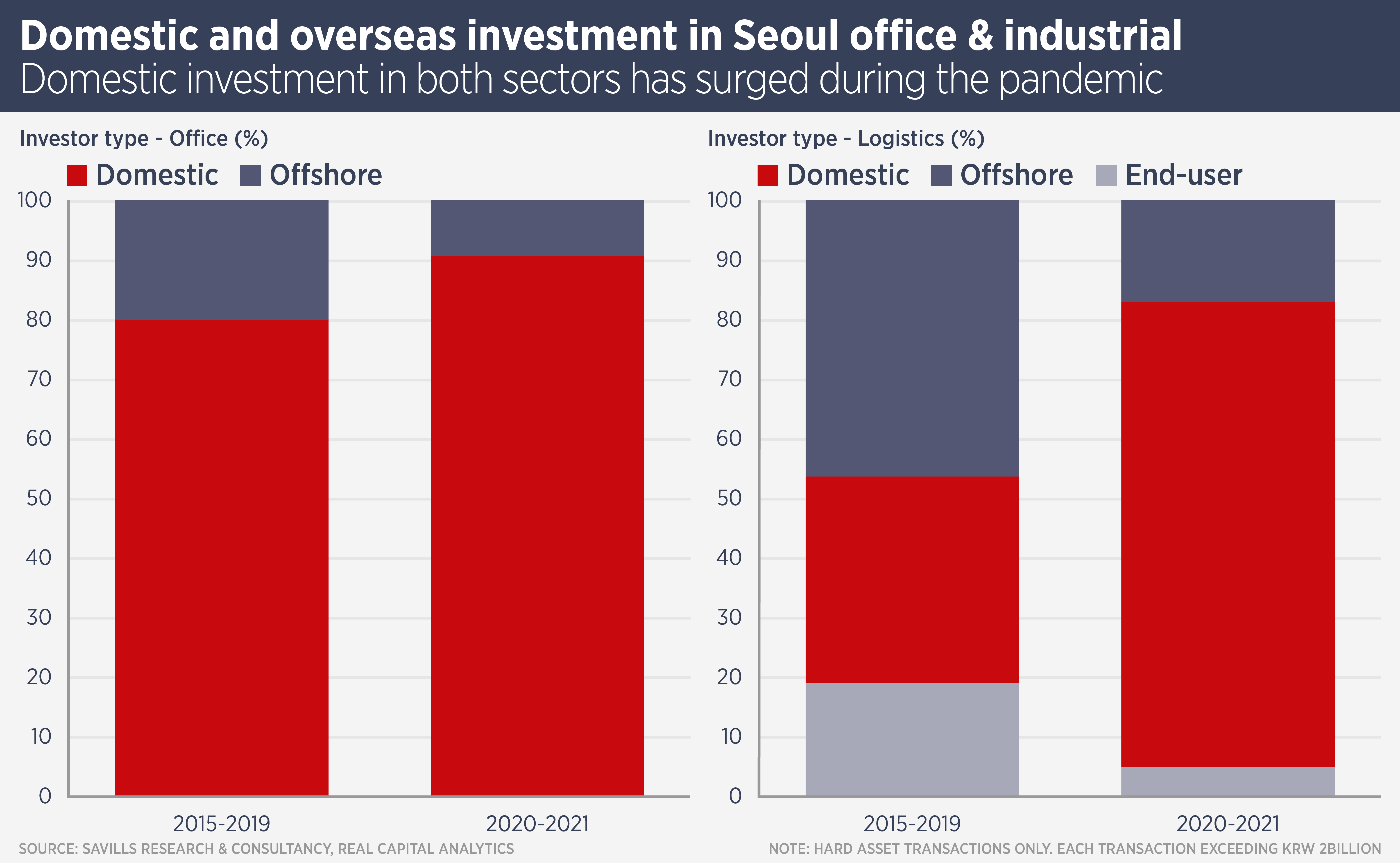

During the pandemic, Korean investors were unable to travel to inspect investment opportunities overseas, so focused their efforts and capital on their home market, leading to the proportion of foreign investment in the office and logistics markets more than halving in 2020 and 2021, compared with the previous five years.

Foreign investors had a 20% share in office deals from 2015-2019, down to 9% in 2020-21, while logistics market share fell from 46% in 2015-2019 to 17% in 2020-21.

JoAnn Hong, Director, Research, Consultancy & Valuation at Savills Korea, says: “The competition for Korean assets was intense during the pandemic and this kept many foreign investors out of the market, as Korean institutions and other buyers were forced to invest at home.”

With the pandemic easing and Koreans able to travel and receive visitors once more, the situation for overseas investors is easing somewhat. Domestic investors looking overseas will provide less competition and ease of travel also benefits overseas investors looking at Seoul.

Some of the world’s biggest private equity real estate investors look set to increase their investment in Korean real estate. Blackstone Group recently re-established an office in Korea and hired Chris Kim from Angelo, Gordon as its new head of Korean real estate. Meanwhile Goldman Sachs plans to invest $1.7 billion in Korean real estate, focusing mainly on the logistics and data centre sectors.

Allianz Real Estate appointed former National Pension Service of Korea head of real estate Scott Kim as chief executive for Asia Pacific, which may lead the insurer towards more investment in Seoul.

Hong says: “Although domestic capital remains dominant in Seoul, there are new overseas players emerging and a couple of first time investors are reviewing deals in the market. This suggests the proportion of foreign investment will start to move upwards again.”

And, although investment numbers have been lower, established foreign real estate investors such as M&G Real Estate, Hines and Actis have continued to buy assets and develop in Korea.

Overseas investors are also beginning to look at a wider range of projects, says Hong. “As well as interest in the office and logistics market, we see queries from foreign funds about the data centre and residential markets too.”

The outlook for the Seoul office market remains positive, with vacancy rates falling 1.4 percentage points to 7.1% and rents rising 1.8% in the first quarter of this year, according to Savills research. Demand is also strong for modern logistics and data centre space.

Further reading:

Savills Korea Research

Contact us:

JoAnn Hong