Boom time for Seoul offices

A perfect combination of investor and occupier demand, coupled with low supply, is propelling the Seoul prime office market.

The office sector remained the most popular with investors in Korean real estate In 2021, accounting for half the KRW27.6 trillion ($22.1bn) of total transactions. Total transactions rose 10% over 2020.

Domestic investors took advantage of COVID travel restrictions to secure high-quality, ‘safe haven’ assets in 2020-2021, accounting for 91% of total office deal volumes. In the five years before the pandemic, foreign capital accounted for 20% of office transaction volumes. Office prices have risen sharply and the average prime Seoul office effective cap rate now stands at 3%.

JoAnn Hong, head of research and consultancy at Savills Korea, says: “Intense domestic competition to purchase has led to higher capital values, which has resulted in the emergence of more REITs and blind funds to attract capital.”

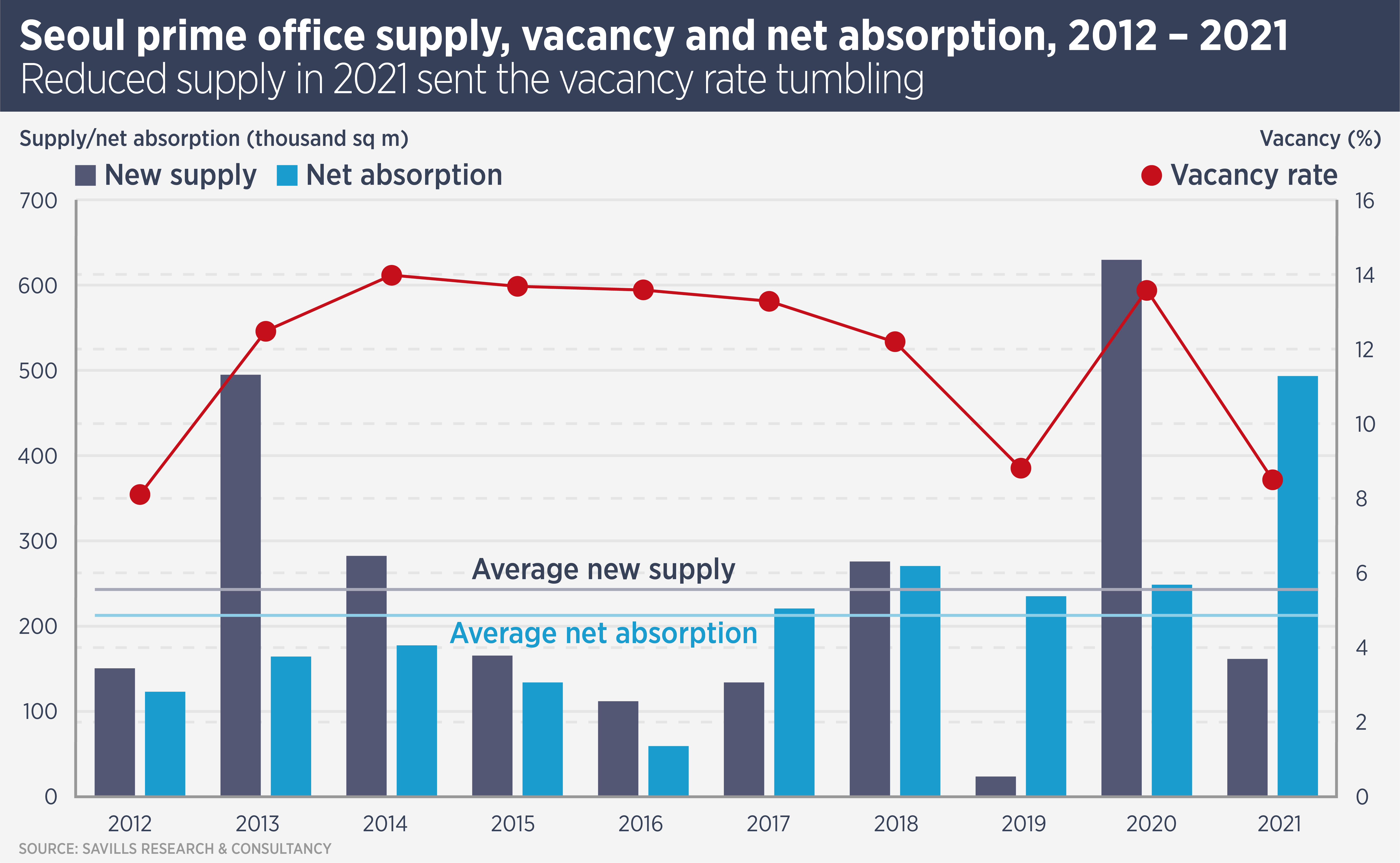

Lower supply of new office space means the Seoul office market is set to shift in favour of landlords. No new prime space will be delivered this year and over 2022-2024, prime office supply will be only one third of the 10 year average. “Net absorption hit a 10 year high in 2021 and leasing demand is expected to remain strong, reducing the vacancy rate to a 10-year low,” says Hong. Tenant demand is coming from IT, fintech and e-commerce companies.

While office investment remains focused on Seoul’s three business districts, the Pangyo district, to the south of Seoul, known as Korea’s Silicon Valley is attracting investor interest. The vacancy rate here is below 1%, which should lead to strong rental growth and Savills data show record take-up in 2021. Assets in this area have been subject to resale restrictions, however these are being gradually eased, offering more opportunities for investors.

For example, in April, M&G Real Estate bought a Grade A office building in Bundang, near Pangyo for KRW264.5bn. It is the UK investment manager’s second purchase in the Bundang/Pangyo area.

As travel restrictions between Korea and the rest of the world have begun to ease, foreign investor interest is likely to increase. Recently, foreign investment has been most prevalent in the industrial and logistics sector, where overseas capital still accounted for 17% of transaction volumes in the 2020-2021 financial year.

However, the strong office leasing market may encourage foreign investors to take a greater role. Even a return to pre-COVID levels of foreign investment would mean substantial capital entering the Korean office market.

Further reading:

Savills Korea Real Estate Outlook 2022

Contact us:

JoAnn Hong