Korean and foreign investors plump for Seoul offices

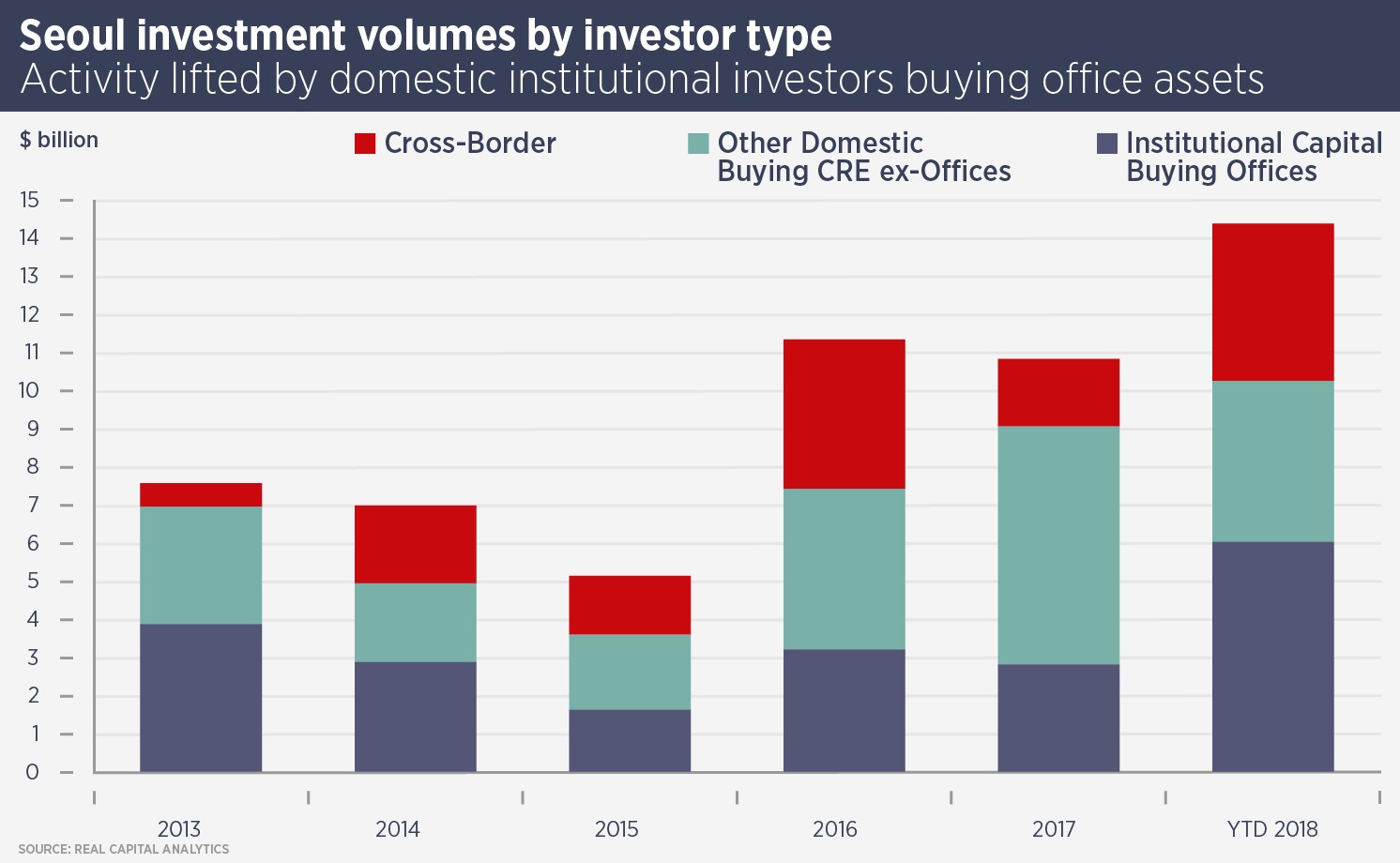

Commercial real estate transaction volumes in Seoul rose 79% to more than $14bn in the 12 months to the end of September, Real Capital Analytics data show, driven largely by domestic investors buying offices.

Foreign investors were also active in the office market: the sale of Centropolis Towers to British investment manager M&G Real Estate for $1.06bn was the biggest single asset deal in the region in the third quarter. The office building is being sold with vacant possession but M&G said it was confident of being able to let the space.

Meanwhile the largest portfolio deal in the quarter, according to RCA, also took place in Seoul, with a JV between Korea’s IGIS Asset Management, US private equity firm KKR and the National Pension Service of Korea forward buying a $1.9bn office and hotel project in the Gangnam district.

JoAnn Hong, head of research and consultancy at Savills Korea, says: “There are not many cities in Asia which provide so many opportunities to buy prime freehold assets. The economy has been growing steadily at close to 3% per annum with a stable exchange rate.”

Further reading:

Savills Korea Office Research

Contact us:

JoAnn Hong