City lowdown: Perth

Perth has suffered since the end of the resources boom in Western Australia, but the economy and the real estate market are showing signs of recovery.

With a population of jut over 2m, Perth is Australia’s fourth most populous city. The state capital of Western Australia, it rode high on the resources boom in the early part of the 21st century. Developers broke ground on a host of new schemes to support the resources industry, but the party came to an abrupt end due to falling prices for iron ore and other resources. Perth was in recession in 2016 and 2017 and had record unemployment in 2018.

However, lower interest rates and a weaker Australian dollar have boosted the economy: unemployment has fallen sharply this year and is now under 6%. Professional job advertisements, a forward looking indicator for office demand, in Western Australia saw significant growth over the 12 months to August 2019, up 9.4%.

Resources is still the major driver of the Western Australia economy, but agriculture, wine and tourism are also important, with growing visitor numbers from China.

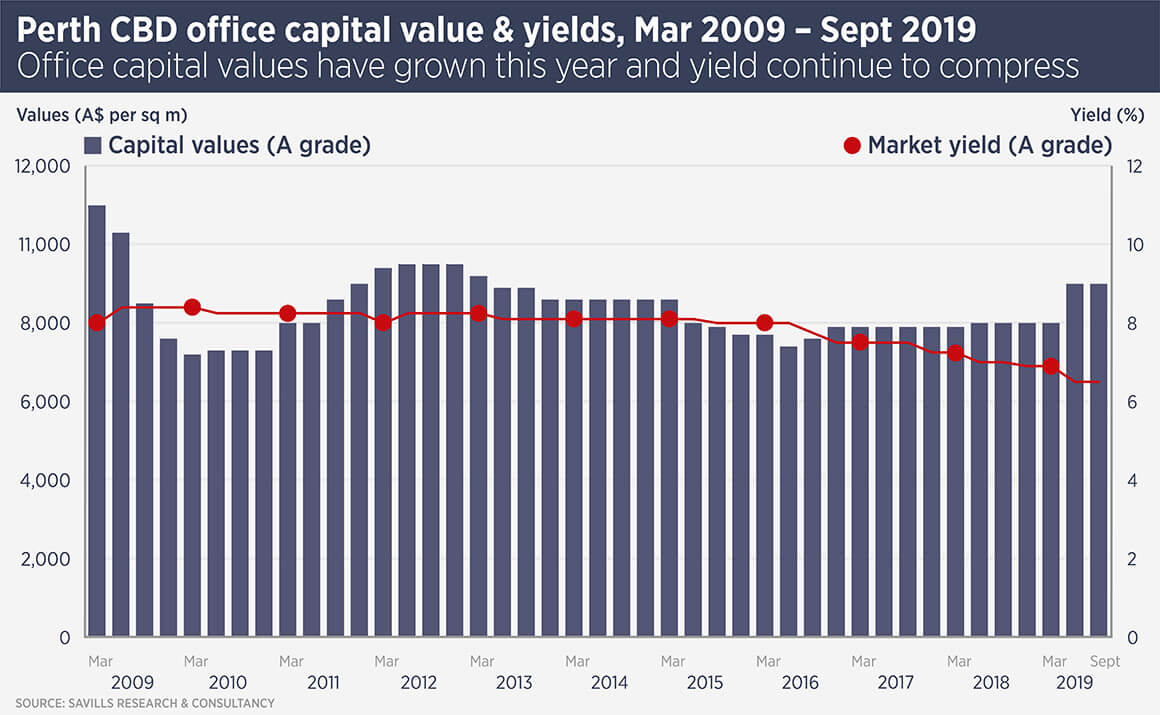

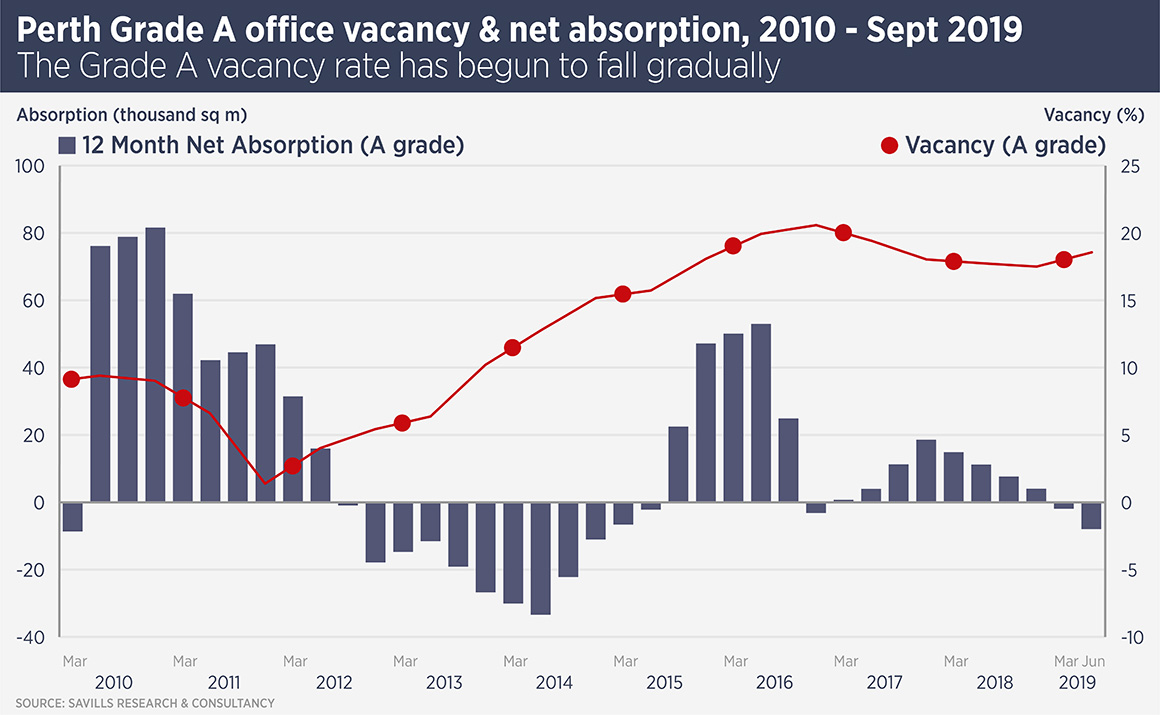

The main sectors of interest to overseas investors have tended to be the office market and the industrial market. “Perth office is problematic as a result of a slowed economy, oversupply and low levels of confidence, however there are green shoots beginning to emerge. Enquiry levels are increasing and net effective rents are showing signs of growth,” says Phil Montgomerie, head of research for Savills Australia.

CBD vacancy is down to 18.4% from above 20% and Savills predicts a steady decline over the next decade. Average lease terms for premium buildings have risen to 8.5 years from 7.5 years, suggesting improving business confidence.

A number of foreign investors have acquired assets in Perth in recent years, focusing on prime buildings best placed to succeed in the leasing market, or those let to the public sector. Last year, GIC bought Exchange Tower from AMP Capital and Primewest, for A$320m ($228m). In 2017, GIC awarded an A$800m mandate to Charter Hall and Primewest to acquire buildings in Perth and Brisbane, which also suffered after the end of the resources boom.

The industrial real estate market has also shown signs of recovery, with sharp capital value growth over the past 18 months. “Perth is coming from a very tough economic environment over the last five years after the resources slump. However, with a rebounding local economy and business confidence, the Perth industrial market has begun to improve in the last 12 months, with leasing and sales levels beginning to pick up,” says Montgomerie.

Further reading:

Savills Australia

Contact us:

Simon Smith