City lowdown: Tokyo

The largest city in the world, with 37 million people in its wider metropolitan area, Tokyo is also the Asia Pacific region’s largest real estate market and a perennial favourite of investors.

The COVID-19 pandemic hit Japan sufficiently hard for a state of emergency to be declared, but despite this the nation proved remarkably resilient. Tokyo transaction volumes fell 23% to $19.9 billion in 2020, according to Real Capital Analytics, making it the busiest city in the region and one of the most resilient gateway cities: only Seoul, where investment volumes grew, performed better in the Asia Pacific region.

The IMF estimates Japan’s 2020 GDP fall at 5.1% and predicts recovery of 3.1% in 2021, however the economy remains stable, with only a nominal rise (0.7%) in the unemployment rate last year. The ongoing pandemic means a much-subdued Olympics effect for the city, which is going ahead with the games, possibly with no foreign visitors.

Tetsuya Kaneko, head of research and consultancy at Savills Japan, says: “Like every other city, Tokyo is fraught with uncertainties. No one really knows which of the changes brought by the pandemic will be temporary and which will be permanent.”“However, Japan’s economy remains stable and Tokyo remains one of the largest real estate markets in the world, with a deep pool of local and foreign investors. The pandemic has been handled relatively well here, which has given a boost to investor confidence. For real estate investors, low interest rates mean Tokyo remains attractive.”

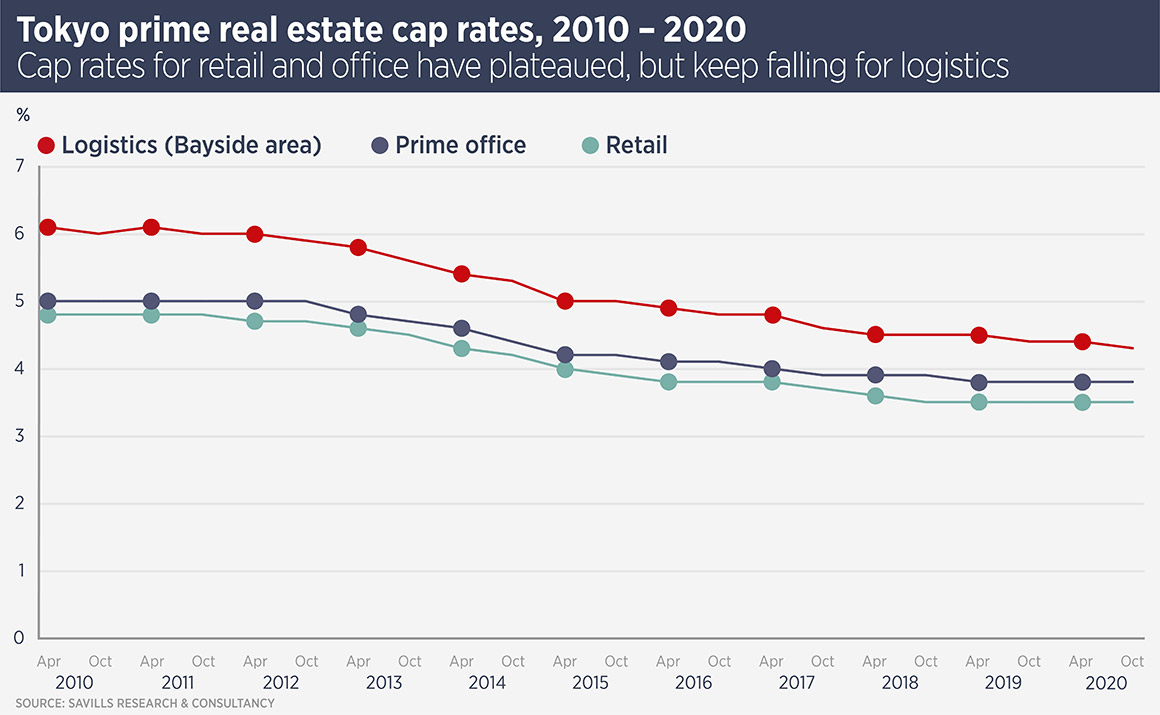

While retail and office rents have fallen, cap rates have held steady and in the logistics sector, which thrived in 2020, cap rates are now rapidly compressing and logistics operators expect to see the best assets trade at close to 3%.

The effect of the pandemic and government measures to contain it has been strongly asymmetric, boosting the logistics sector, while retail and hospitality have suffered. Tokyo’s most expensive logistics facilities are located in the bayside area, while demand is growing for last mile facilities nearer to consumers. Considerable new supply in the Greater Tokyo region was easily absorbed last year, while the vacancy rate fell to a record low of 0.4%. Nearly 3 million sq m of new supply is expected this year and the expectation is that it will be absorbed easily.

Logistics real estate investment trusts have been keen buyers of stable assets, proving tough competition for foreign players. “Investment enthusiasm remains robust and this trend looks likely to continue for a while, with multiple investors desperate to acquire logistics assets while overall fundamentals appear strong,” says Kaneko.

Tokyo retail was still reeling from the rise in consumption tax in 2019, so the pandemic caught it in a vulnerable state. However, rents did not fall and in some cases paradoxically rose in the first half of 2020, despite few people shopping in urban stores and the total absence of tourists. In the luxury retail district of Ginza, rents rose 2.5% in the first half of last year, breaching the ¥80,000 per tsubo level for the first time in a decade. In the Shinjuku shopping and entertainment district rents rose by 8.2% in the first half of 2020. The counter-intuitive rises in rents derive from some prime assets becoming available, boosting listing rents, says Kaneko. More fallout from the pandemic is expected for urban retail going forward, although the scale depends on how quickly the city returns to normal.

The pandemic has been disastrous for the hospitality sector, which had been expecting 2020 to be a record year due to the Olympics. However, the long-term prospects for Japanese tourism still look strong and the nation’s reputation for order and cleanliness ought to be a boon in the post-COVID era. Furthermore, regardless of the recent boom in visitor numbers, domestic travellers accounted for 84% of nights stayed in 2019. Hospitality owners who can ride out another difficult year should bounce back, while there should be some capital available to take advantage of those who cannot hold on.

Overseas investors have been keen to buy in Tokyo’s multifamily residential sector, which has proven resilient to downturns, as has the sector worldwide. Investors including PGIM, Blackstone Group, Nuveen Real Estate and Allianz Real Estate, have spent several billion dollars in recent years. Meanwhile, Tokyo is emerging as an ultra-luxury residential location, with stock – predominantly located in the central Minato district – set to double in the next few years.

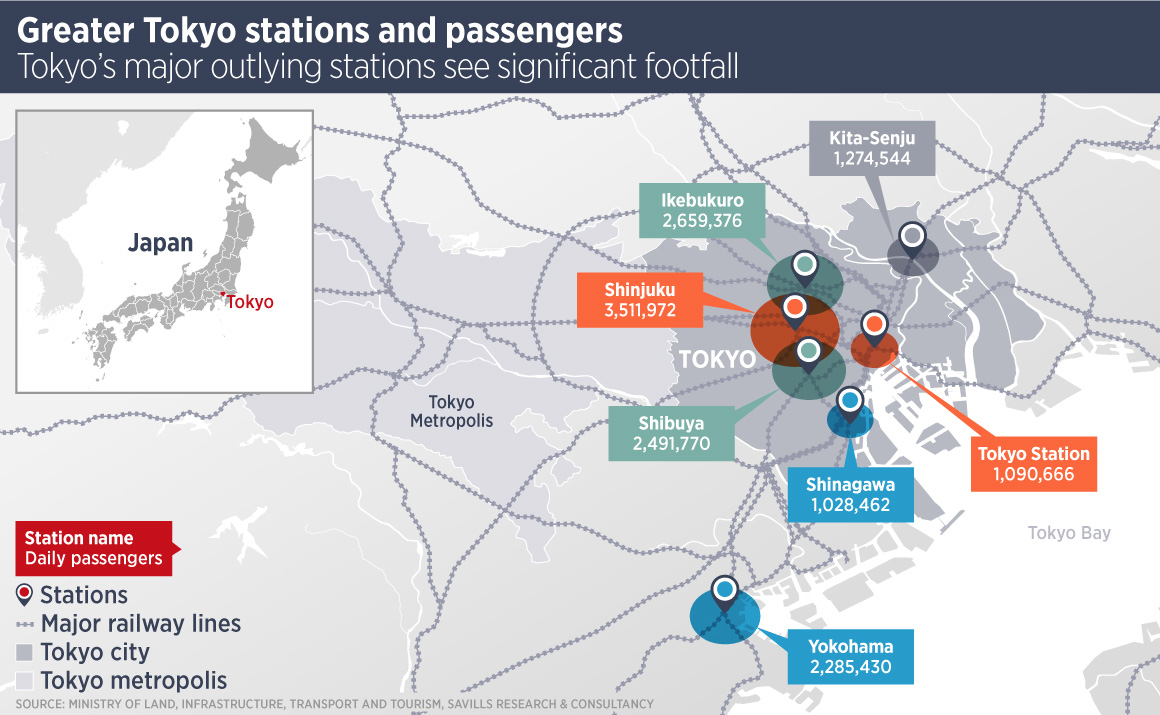

Tokyo’s office sector has suffered as companies turned to homeworking and put expansion plans on hold. Grade A rents in the central five wards (C5W) saw their first yearly decline since 2011, falling 2.4% year-on-year to ¥36,460 per tsubo. Vacancy rates have risen only marginally, to 1.0%, although that is their highest level in five years. Nonetheless, footfall at Tokyo stations has risen to about 60-70% of pre-pandemic levels, indicating a gradual return to work. Tokyo’s most valuable office assets are located in the city’s C5W, however these assets are tightly held and rarely accessible to investors, unless via a REIT.

A lack of stock in core locations is being relieved by Tokyo’s rail network which is creating new zones of value in the city’s periphery. COVID-19 may encourage more individuals and firms to decentralise in future, nonetheless areas such as Yokohama, Ikebukuro, Shinagawa and Omiya may be on the cusp of growth. Office and residential investment volumes in the Kanto reion, excluding Tokyo prefecture, amounted to ¥193 billion in 2020, growing 37% year on year.

Despite Japan’s overall ageing and shrinking demographics, Tokyo has been attracting migrants and cheaper peripheral locations, centred on rail hubs, are attractive to new residents. “If working from home is now ingrained in Tokyo, then some workers may start to seek districts where they can find more space, while some companies may prefer to have more dispersion of office sites, which bodes well for these peripheral districts,” says Kaneko.

Further reading:

Savills Japan Research

Contact us:

Tetsuya Kaneko