Australian office property market outlook 2021

Rising commodities prices signal better times ahead for office markets in Australia’s resource-driven cities.

Prices have been rising for a number of commodities in recent months, leading to speculation about the start of a new commodities “supercycle” such as that which followed the global financial crisis. Oxford Economics claims: “The recent price spikes are due to reduced supply amid severely disrupted mines and supply chains.” However others disagree and claim a wider recovery from COVID-19 will drive demand.

Paul Craig, chief executive, Savills Australia & New Zealand, says the current cycle is very different to the 2011-2015 boom. “The last boom period saw record levels of investment in exploration, development and infrastructure etc in almost the entire resources sector including iron ore, oil and gas, gold and lithium.

“Presently the expansion is more limited, to iron ore, gold, lithium and to a lesser extent oil and gas. Minerals exploration expenditure is now back up to similar levels as December 2012.”

A resources boom of any sort tends to be positive for Australian office demand, as commodities companies and those which serve that market take on staff. “Generally, exploration is a lead indicator for office demand, with the real demand coming when the projects secure development and funding approval and the planning, design and construction commences,” says Craig.

“Like previous cycles, the greatest beneficiary will be Western Australia (Perth) with both Queensland (Brisbane) and South Australia (Adelaide) enjoying a positive impact. What we aren’t really seeing at this point is the growth in the big engineers such as Worley, Calibre, Schlumberger for example, as these are more aligned to the oil and gas sector.”

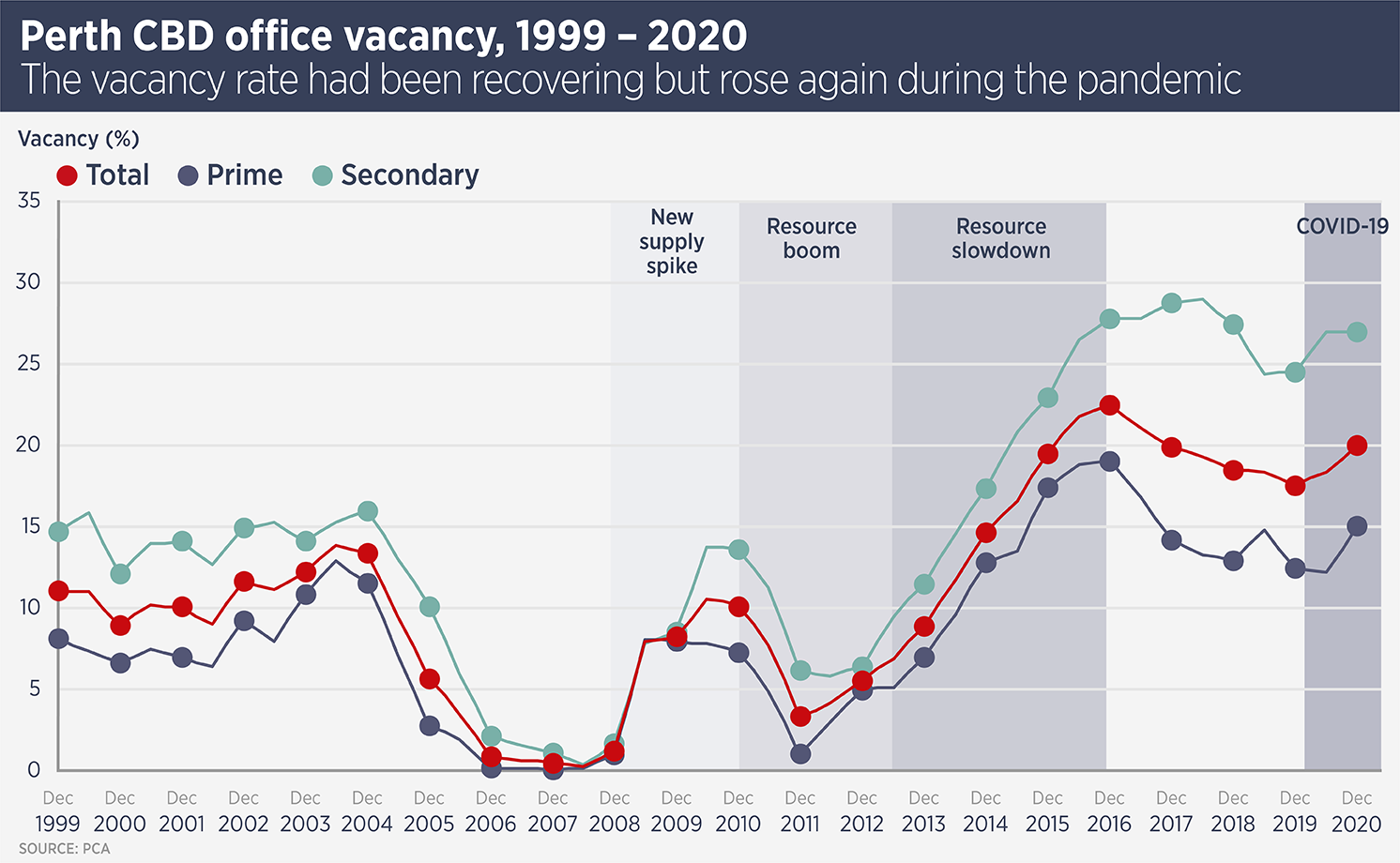

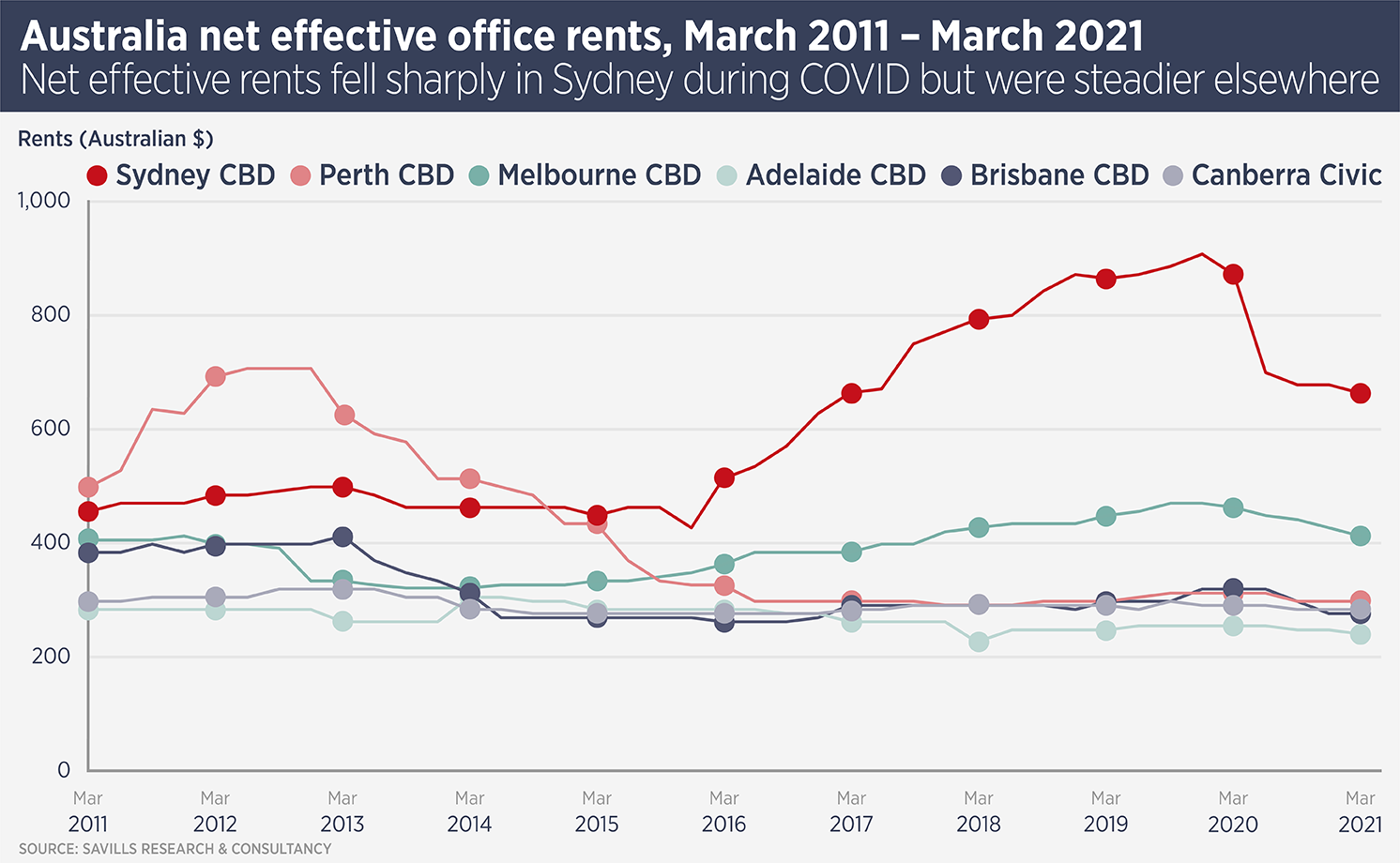

Net effective office rents in Perth, Brisbane and Adelaide have been subdued for some years, while Sydney and Melbourne saw strong growth before COVID hit. Previous performance suggests any uptick in commodities demand will benefit Perth the most, as its economy is more closely linked to resources than Adelaide and Brisbane.

Perth office pricing currently reflects the highest yields in Australia, at 6.5%, 180 basis points above Sydney, which suggests potential for substantial compression if resource activity and rental growth returns to the city.

Craig says demand for iron ore will be the key to this current upswing, due to its importance to Perth and the nation overall. “With iron ore being Australia’s largest export and responsible for 10% of Australian GDP, growth in the price of iron ore is inherently linked to improved business and consumer sentiment, higher investment levels and commitment to numerous large-scale projects, particularly the case for the Perth office market.

“With iron ore earnings on track for an all-time high in 2021, strong demand from China is expected to continue over the next several years. With half the world yet to urbanise, continued growth in iron ore pricing will continue to fuel growth in the Perth economy.”

One of the most dramatic price spikes in the past year has occurred in copper, the price of which has more than doubled in 12 months. While this is partially due to supply shortages and speculation, copper is also a key component in electric vehicles, which use three times as much as petrol or diesel powered cars.

“Copper, lithium and nickel are experiencing a resurgence with the growing shift greener energy, battery storage and electric cars,” says Craig. Australia’s largest copper mines are located with Western Australia, South Australia and Queensland, so the Perth, Adelaide and Brisbane markets should benefit from copper exploration and mining. South Australia has 68% of Australia’s copper and the state is a major national destination for copper exploration.”

Further reading:

Savills Australia Research

Contact us:

Paul Craig