City lowdown: Brisbane

Brisbane's office market thrives as the city prepares for the 2032 Olympics. Demand for prime space is driving rental growth and lowering vacancy rates, with infrastructure upgrades underway to support future growth.

Brisbane is beginning preparations to host the Olympics in 2032, but in the meantime, investors are focusing on its strong office market.

The state capital of Queensland straddles the Brisbane River, which flows into Moreton Bay. Located just over 900km up Australia’s east coast from Sydney, the city has a population of around 2.7 million, with 4 million in the wider metropolitan area. It is a major port, a centre for the resource economy and a hub for tourism.

Strong population growth and tight labour market conditions are driving demand for office space at the prime end of the market. Savills data show net take-up of prime office space in the Brisbane CBD increased by circa 42,000 sqm over the six months to July 2024, the strongest take-up among Australia’s major CBD markets, continuing a trend of robust demand for office space over the past couple of years.

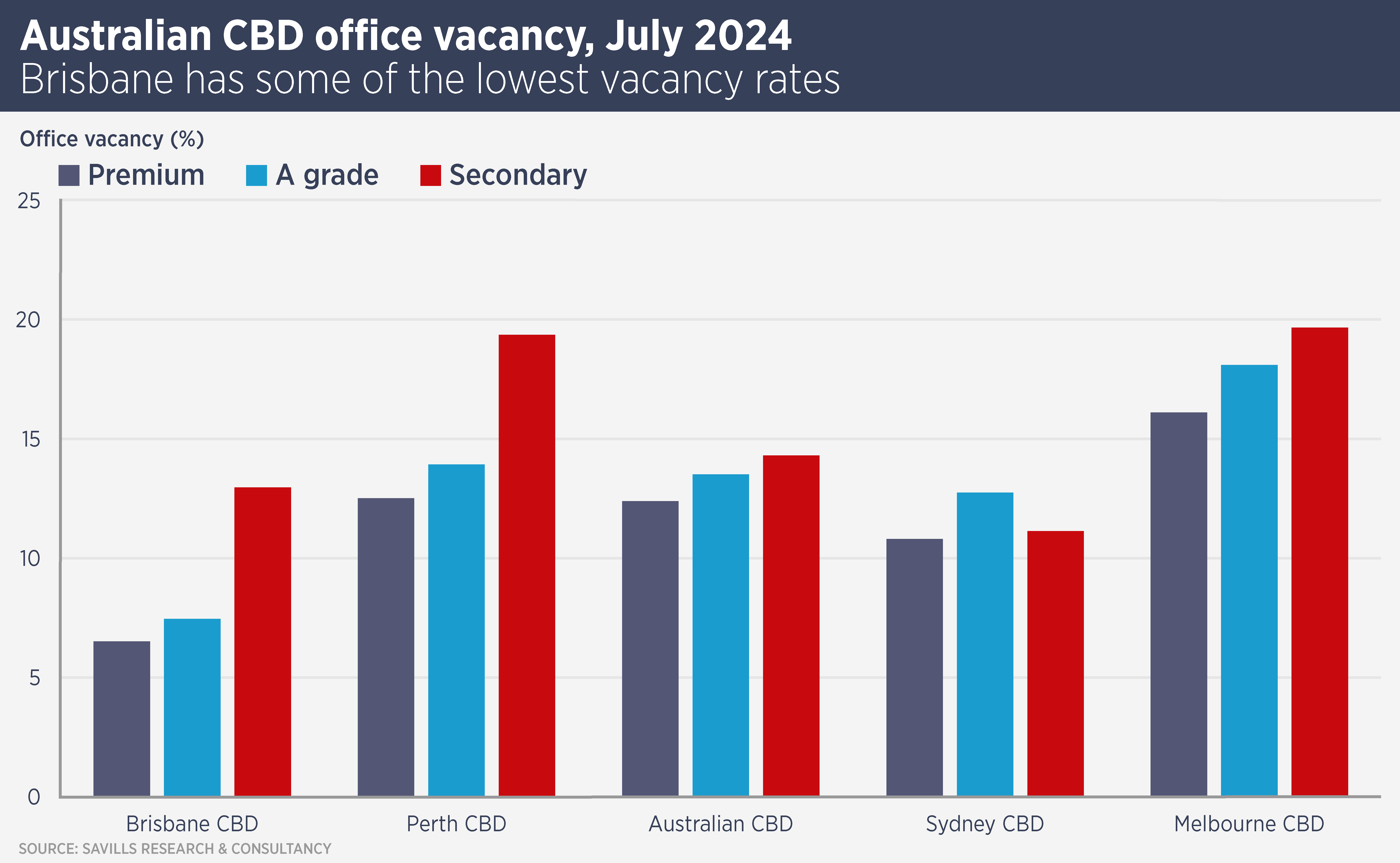

Brisbane CBD prime office vacancy rate continues to fall, declining to 7.2% in July, down from 10.2% in January, and a recent peak of 16.3% in January 2022. Brisbane has overtaken Canberra as the tightest prime office market among the major Australian capital cities.

Chris Naughtin, National Director, Capital Markets Research at Savills Australia, says: “A limited supply pipeline over the next couple of years is expected to keep downward pressure on the prime vacancy rate. The combination of strong demand and limited supply is fuelling relatively high rental growth, with prime net face rents increasing by 7% over the year to September 2024.”

Australian investors have been active in the market this year, with managers such as Quintessential Equity and Clarence Property buying major office buildings this year.

Naughtin says: “Investors continue to target Brisbane, attracted to the city’s strong office market fundamentals, which are fuelling sustained rental growth and helping to cushion the impact of higher interest rates on capital values.”

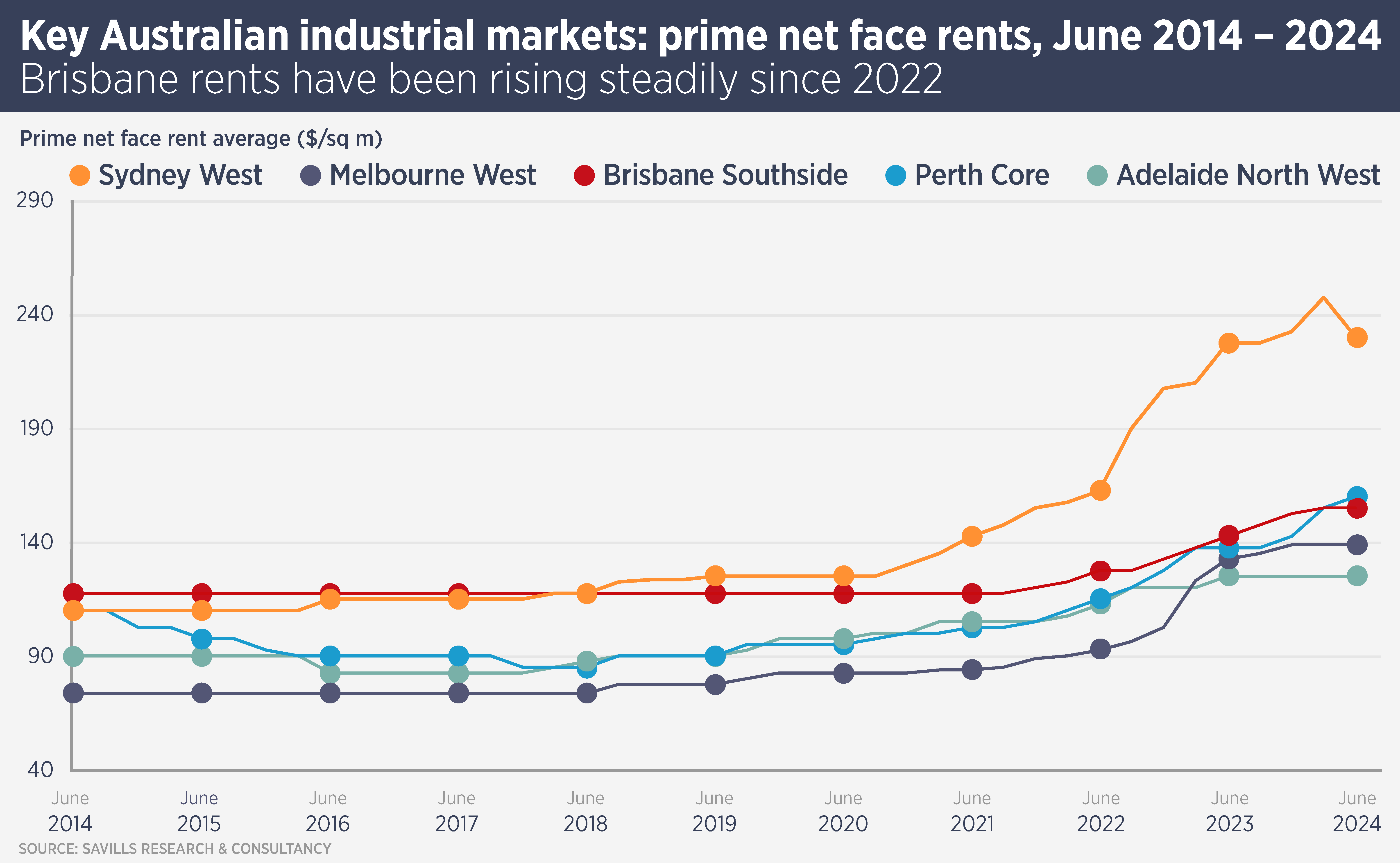

Meanwhile, industrial rents were up 11.3% in the 12 months to the end of June 2024, with prime industrial capital values up 3.9% over the same period. The industrial investment market is stable but characterised by a smaller deals and private investors.

The city has been upgrading its infrastructure; over the next 12-24 months a new cross river rail line will open as well as a new metro station at the central King George Square. More infrastructure projects are expected to launch in advance of the Olympics.

Further reading:

Savills Australia Research

Contact us:

Chris Naughtin