Asia’s retail recovery begins

Discover the impact of the end of COVID restrictions and the resumption of tourism on prime retail in Asia, Retail property owners are experiencing a boost in confidence and rising rents.

The end of covid restrictions and the resumption of tourism around the region have boosted the performance of prime retail in Asia.

However, the sector still faces challenges from inflation and e-commerce, while Chinese tourists – a mainstay for many markets prior to the pandemic – have yet to return in numbers.

“The return to some sort of normality around the region has been a boost for retail property owners in Asia’s gateway cities,” says Simon Smith, Head of Asia Pacific Research & Consultancy at Savills. “The end of pandemic restrictions has led to a recovery in confidence and rises in retail rents, albeit small ones. Retail sales have improved in most markets.”

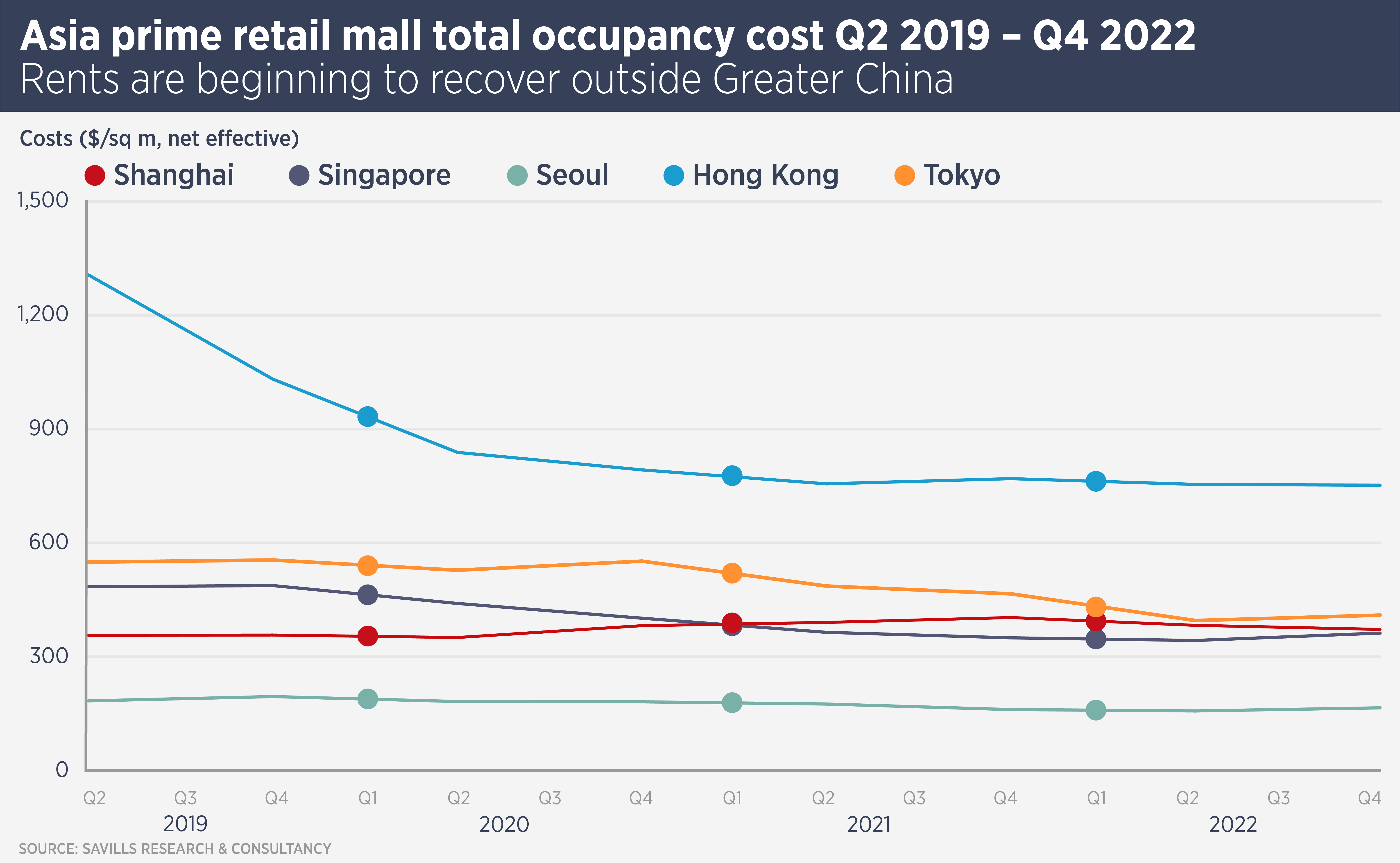

Savills data show retail rents rose in the final quarter of last year outside China and Hong Kong, where covid restrictions were not loosened until earlier this year. However, the latest data for Hong Kong shows a sharp rise in retail rents in the first quarter of this year, up 3.9% quarter-on-quarter overall for prime high street shops and 5% for shopping centres.

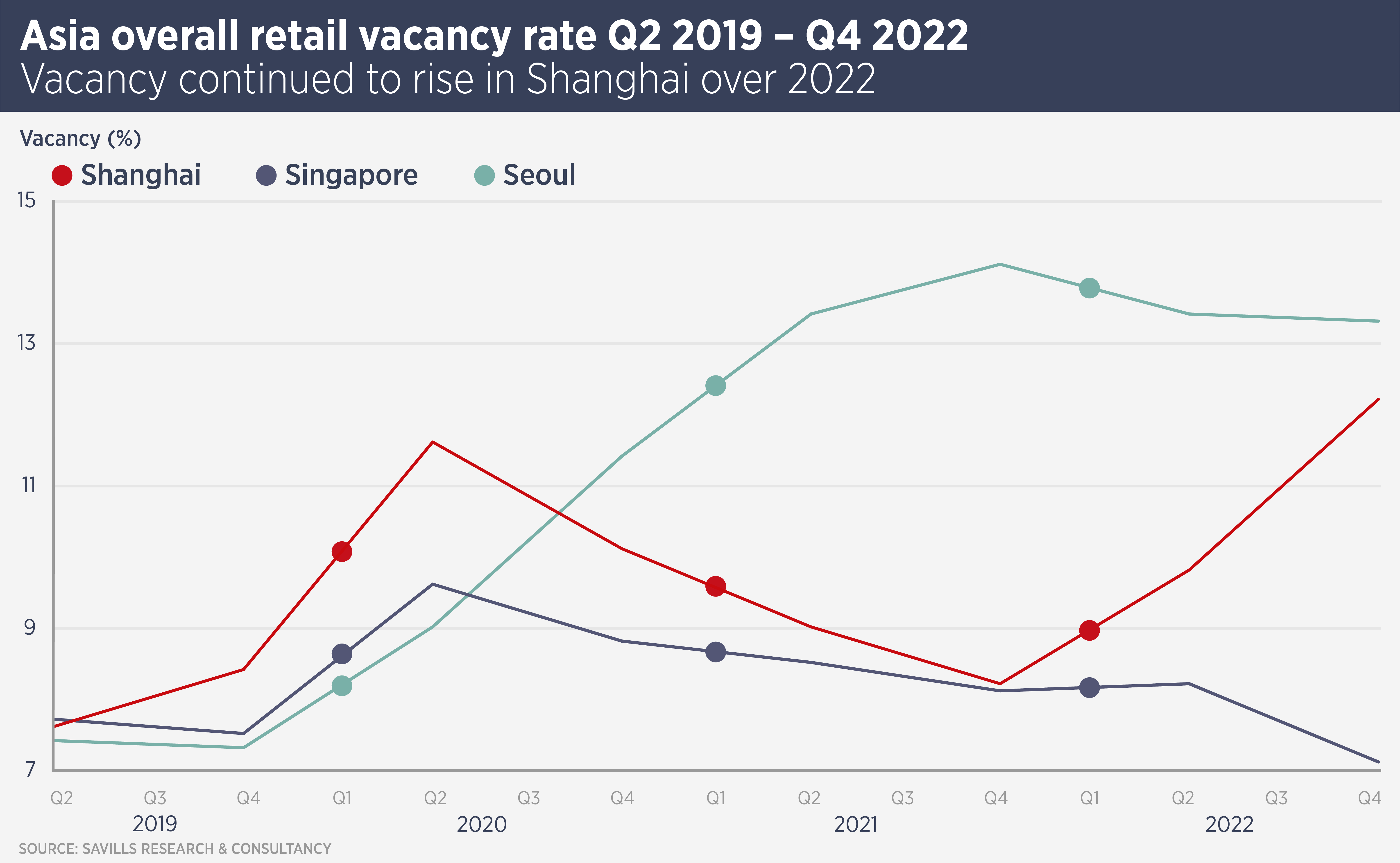

Shanghai however saw rents slide further in the first two months of this year and retail sales were still down on the same period last year. However, footfall has increased dramatically and Savills suggests a recovery in take-up and occupancy rates is possible in the second half of the year.

Tokyo prime retail rents have begun to recover, with luxury retail leading. The luxury sector did well during the pandemic, as wealthy Japanese were unable to travel overseas. “In the present post-pandemic era, the momentum of luxury brands has not slowed, and vacant spots are virtually non-existent in prime locations,” says Tetsuya Kaneko, Head of Research & Consultancy at Savills Japan.

Prime retail vacancy rates around the region have not fallen substantially, although Singapore saw a 1.1 percentage point drop in vacancy in the final quarter of last year. Seoul rents have crept up despite an only marginal improvement in vacancy. Vacancy has continued to rise in Shanghai and remains high across China’s large cities.

Hong Kong managed to record sharp rises in rents in the first quarter of 2023, despite vacancy remaining high, suggesting a focus on the best prime retail space. Some streets in the Tsim Sha Tsui and Causeway Bay shopping districts have more than 20% of street shops vacant.

Although tourism numbers have started to recover, Hong Kong has not seen the return of high-spending Chinese tourists. Most visitors from the Mainland have arrived in large tour groups. Hong Kong retail owners are not alone in hoping for the return of wealthy Mainland tourists, they will provide a boost to Tokyo and Seoul as well.

Despite some good news in recent months, retail property owners are still under pressure, says Smith. “Retailers face economic challenges in the short to medium term and the threat of e-commerce to asset owners has not gone away. Online shopping habits became more entrenched around the region during the pandemic. This means shops and shopping centres need to provide more experiences to attract and retain shoppers.

“Inflation is pushing up construction and labour costs, so asset owners must hope that retailer confidence will continue to grow and support rental growth.”

Further reading:

Japan retail report

Contact Us:

Simon Smith | Tetsuya Kaneko