Australia still top of the list

Australia remains extremely popular with Asian real estate investors, even as prices continue to rise.

Real Capital Analytics data shows Australia to be the only major Asia Pacific market to increase deal volumes in the first half of this year, compared with the same period in 2018. Overall H1 volumes fell 19% but Australia’s rose 3%.

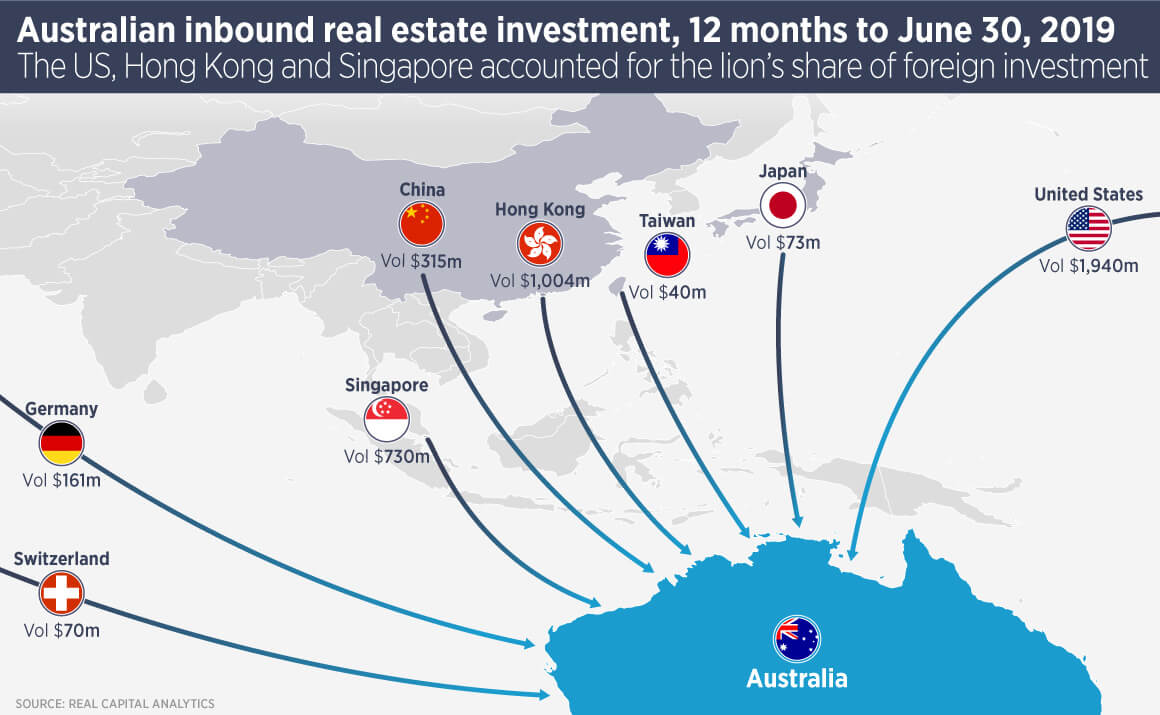

The biggest spenders in the year to June were investors from North America, Hong Kong and Singapore. Ben Azar, national head of cross border investments at Savills Australia, says: “The strong fundamentals for Australia, particularly Sydney and Melbourne, continue to be attractive to overseas investors, especially those looking for stability.

“Demand from Hong Kong remains strong for the right assets and we have seen the emergence of a lot of new entrants considering the Australian market as a result of the current political situation in the SAR.

“There is still interest from Singapore too, however many Singaporean investors are finding it hard – especially in Sydney and Melbourne – to meet their yield targets due to the competitiveness of the market in those cities.”

Not that long ago, Mainland China was the major source of foreign capital for Australian real estate. However capital restrictions have almost entirely turned the tap off, although Chinese groups with arms in Hong Kong and those with capital to recycle in Australia are still active, Azar says.

Average prime office yields in both Sydney and Melbourne are below 5% and with the prospect of more rental growth in both markets, as well as the prospect of interest rates being “lower for longer” means downwards pressure on yields will continue.

In recent years, Japanese investors have become more outward looking but so far have invested only minimally in Australian real estate, at least as far as direct property is concerned.

Azar says: “Japanese money is pouring into Australian funds, however so far investment in direct assets has been limited, although we have had discussions with a number of Japanese investors about direct property. For now it seems that indirect gives them sufficient exposure to Australian property, although that might change in the future as they become more familiar with the market here.”

The local residential sector also appears to have bottomed out and Asian interest – restrictions on foreign buying notwithstanding – is understood to be strong for homes in Sydney and Melbourne. Brokers have reported an uptick of interest from buyers in Greater China in particular.

Further reading:

Savills Australia

Contact us:

Ben Azar