Is there a green premium, or a brown discount?

It has been a challenge for real estate investors to quantify the benefits of making their assets more sustainable.

Despite more market data being available it can be tough to identify exactly how sustainability measures work and particularly if they make a real difference to the bottom line.

Every nation in Asia Pacific has its own green certification programme, under which a building might achieve certification if it demonstrates lower energy or water use, or if it produces less waste. In Hong Kong, for example, BEAM plus is the local certification standard.

The US LEED and UK BREEAM standards are also used across Asia; for example Henderson Land’s forthcoming Hong Kong office tower, The Henderson (pictured above), has achieved LEED Platinum pre-certification.

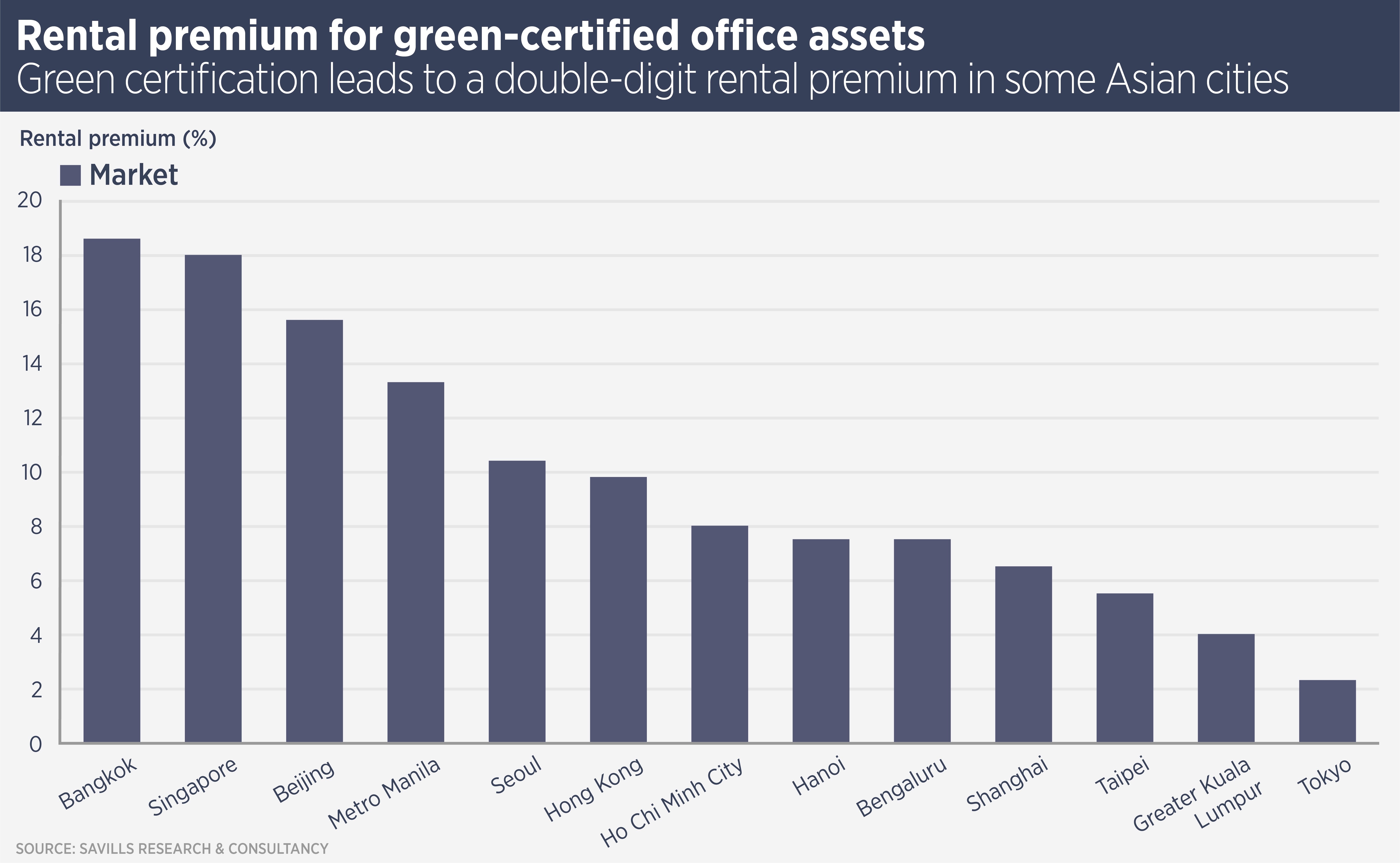

Data from Savills Research & Consultancy seem to show that tenants are prepared to pay higher rents for office properties which have achieved some sort of green certification. The rental premium varies from more than 15% in Singapore and Bangkok to less than 4% in Tokyo.

Nonetheless, the business case for ESG in real estate remains difficult to quantify, says Sam Crispin, Regional Head of Sustainability & ESG, Asia Pacific at Savills. “Although we do see an apparent rental premium between certified green stock and non-certified averages, it is still hard to pinpoint exactly how much more occupiers are willing to pay for green buildings.”

The line is blurred because ESG measures, particularly those related to energy efficiency, are now standard for new properties. For example, in China between 2016 and 2020, about 77% of all new buildings in urban areas were certified green buildings and the current 14th Five-Year Plan even pledges to raise that standard to 100% by 2025.

Crispin says: “Certified projects tend to be newer and better designed, thus naturally commanding a rental premium over older stock. Given the growing scrutiny of corporate ESG compliance, it is safe to assume prospective tenants and investors favour facilities which can help them reduce their carbon footprint and overall energy consumption.”

As ESG measures become standard practice for the best assets, investors are becoming more inclined to think of the “brown discount” non-ESG compliant assets suffer, rather than the ‘green premium’ for better assets.

Crispin says: “Looking ahead, as ESG becomes an increasingly mandated part of commercial behaviour, the performance gap between green and non-green buildings is likely to widen, transforming the real estate landscape.

“Owners of older, “browner” buildings may have to work hard to keep up.”

Further reading:

Asia Pacific ESG report

Contact us:

Simon Smith