Tokenisation on the rise in Asia real estate

Discover how blockchain tokenisation is transforming real estate investment in Asia, unlocking liquidity, diversification, and new capital opportunities.

Blockchain-backed tokens have been in the news, following President Trump’s executive order allowing Americans to use retirement savings to invest in cryptocurrencies and other alternative assets. Meanwhile, with less fanfare, Asian investors are increasingly using tokenisation to access real estate.

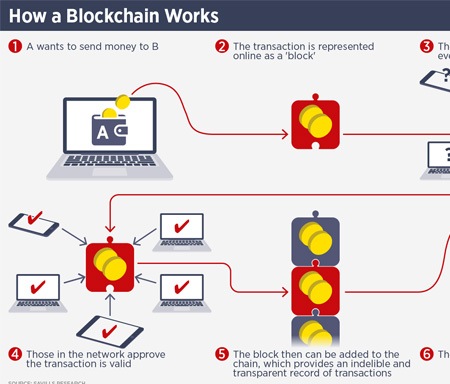

The blockchain is a decentralised digital ledger which securely stores records across a network of computers in a way which is transparent, immutable, and secure. The technology is used by various cryptocurrencies, such as Ethereum or Bitcoin, but can also be used to tokenise real estate, with each token representing a share in an asset.

“With conventional capital and loan markets tightening, owners and developers are seeking alternative sources of private debt and equity. At the same time, private investors often face high barriers to entry into private equity funds or large property assets. The real estate industry wants to broaden its capital base but is constrained by the scale and illiquidity of assets,” says Chris Marriott, CEO, Southeast Asia at Savills.

Real estate investment trusts (REITs) have been a long-standing way for retail investors to gain access. REITs have been highly successful in Asia Pacific but are still subject to market risks and, in most cases, involve investing in a portfolio of assets. Tokenisation platforms allow investors to buy a stake in individual assets, via either equity or debt.

“By breaking ownership into smaller, more accessible units, tokenisation allows a wider pool of investors to participate. For ultra-high-net-worth individuals and family offices, these structures also enable capital to be allocated across a more diversified mix of assets, asset classes, and geographies. This not only broadens access but also has the potential to unlock liquidity and channel new capital into Asian real estate markets,” Marriott adds.

Platforms have been launched across Asia Pacific, with Singapore being a significant hub, as well as Japan. However, tokenization is also being explored in markets such as Japan, Thailand and Indonesia. In Singapore, niche tokenisation platforms such as Fraxtor and InvestaX have been launched, while in Japan, mainstream investment managers are looking to tokenise assets. For example, in July, Japanese real estate investment firm Gates Inc announced a strategic partnership with Oasys to tokenise an initial $75 million worth of prime Tokyo real estate assets on the Oasys blockchain.

“The recent performance of cryptocurrencies such as Bitcoin is boosting attempts to use blockchain for real estate,” says Marriott. “Furthermore, regulators all over the world are trying to understand and utilise this technology. Singapore’s MAS (Monetary Authority of Singapore) is leading this in Asia, spearheading Project Guardian, a collaborative initiative with financial institutions to explore tokenised asset structures and digital investment ecosystems. This positions Singapore as a regulatory leader in digital finance across Asia Pacific.”

Will tokenisation offer liquidity?

While the idea of buying a tiny piece of a building and holding it via a secure, tradeable token sounds attractive, there are drawbacks, many of which are related to the nature of real estate itself. “Investing in an individual real estate asset or a portfolio requires real estate knowledge,” says Marriott. “Properties need to be managed; will investors in tokens be able to identify good investment managers? And will such tokens really be liquid? Blockchain tokens might have the ability to be traded, but this needs willing buyers and sellers.”

There is also the question of whether tokenisation needs blockchain technology. Singapore platform RealVantage offers investors the chance to buy into individual assets but does not use blockchain. Marriot says: “One might ask whether blockchain is necessary to make smaller chunks of real estate available.”

Platforms like Oasys are building infrastructure to support secondary markets, but liquidity remains theoretical without active investor participation. Tokenisation may be tradeable, but real liquidity depends on market depth and investor confidence. “The success of RealVantage suggests fractionalisation can be achieved without blockchain. This raises a broader question: is blockchain a necessary innovation or simply one of several tools to democratise access to real estate?” says Marriott.

Something both Fraxtor and RealVantage have in common is that they are only open to accredited investors, with personal assets above S$2 million ($1.55 million), financial assets above S$1 million ($800,000), or annual income not less than S$300,000 ($233,250). Both RealVantage and Fraxtor also require relatively high minimum investments, S$25,000 ($19,500) in the case of Fraxtor.

Marriot says: “Whilst some may say the minimum size is too large to be truly democratised, there will always be a cost to the management of an investor account, which creates the cost barrier rather than the tokenisation itself. In the medium term at least, I would expect such platforms – whether they use blockchain or not – to appeal primarily to wealthier investors with real estate knowledge.”

Indeed, there might be more potential for tokenised real estate as an institutional investment, says Marriott. “An investment manager could tokenise 20% of its fund, for example. These tokens would be sold to institutional investors who could use them to boost liquidity in their portfolio. This could become a powerful tool for flexibility in capital management and diversification over time.”

Further reading:

Asia Pacific Real Estate Investment Q2 2025

Contact us:

Chris Marriott