City lowdown: Bengaluru

Attracting skilled migrants from all over India, booming Bengaluru is one of Asia’s prime IT and office hubs and a favoured destination for global real estate capital.

Bengaluru, formerly known as Bangalore, was known for a years as a garden city, with a benign climate due to its elevated location. Public investment in infrastructure and education led to migration from the rest of India and in the early 1990s a combination of new national economic liberalisation policies and the emergence of a strong education system encouraged the development of the IT and telecoms sector.

Today, the city population is more than 13m and includes 35% of India’s 2.5m IT professionals. Bengaluru is home to 400 of the Fortune 500 companies: tech companies such as Microsoft, Oracle, Google, Facebook and IBM are substantial business space occupiers. It is also a hub for start-ups, with more than 7,000 in the city; eight of India’s 21 tech unicorns were founded there.

“Bengaluru is home to a diverse, highly talented and skilled diverse workforce, which means companies looking at India always consider Bengaluru very seriously. The combination of its talent pool, high quality higher education institutions, a benevolent climate, excellent cosmopolitan culture, sound government, infrastructure and good transport links, makes it the first choice location for global IT companies,” says Sarita Hunt, managing director at Savills, Bengaluru.

“It is the city which attracts the most migrants in India, meaning we have a strong supply of talent; 200,000 software engineers join the market each year.”

As well as being the largest contributor to IT exports for India, Bengaluru accounts for 65% of India’s aerospace business, has a strong manufacturing base as well as hosting financial services groups such as Visa, Goldman Sachs, RBS and Deutsche Bank.

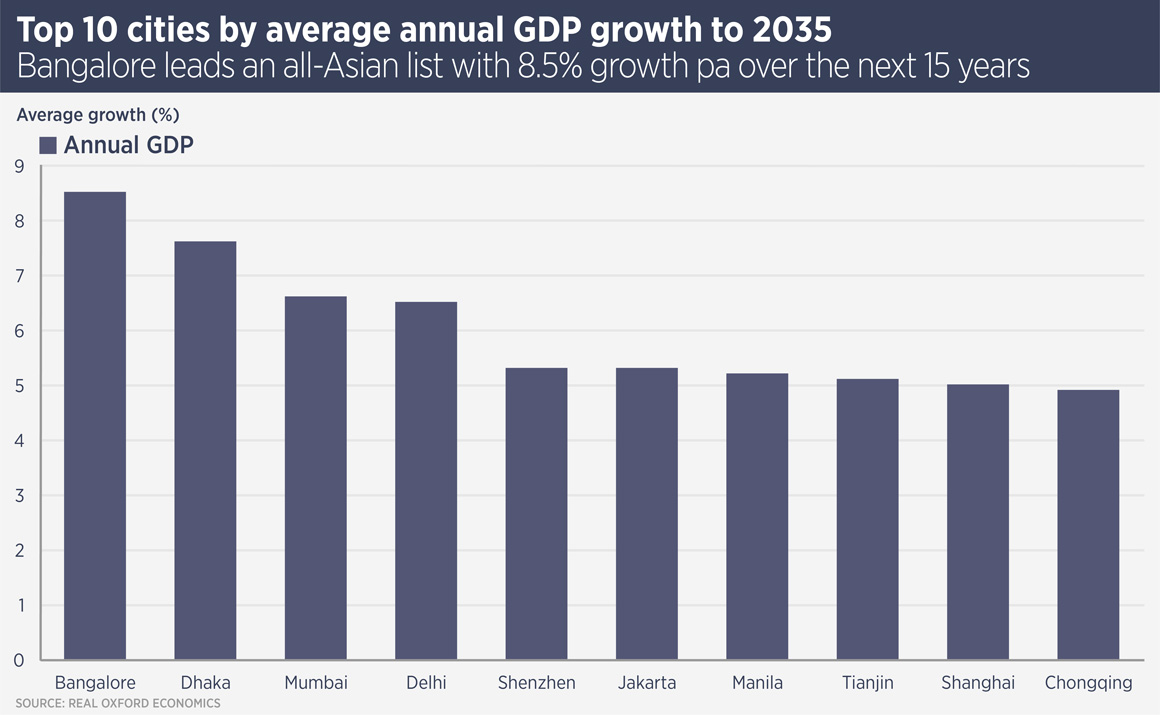

These factors combine to give Bengaluru the best growth prospects in the world, according to Oxford Economics, which forecasts GDP to rise 8.5% a year on average through to 2035.

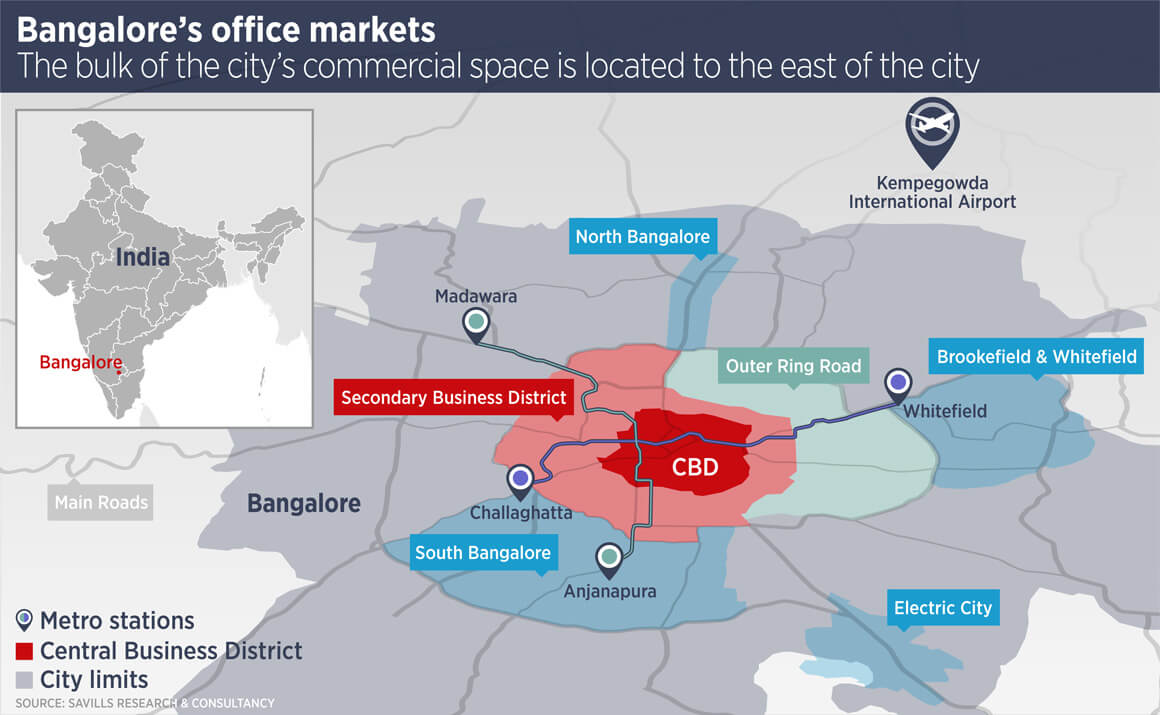

Bengaluru has the largest office market in Asia Pacific, with 164m sq ft of stock and net absorption of 15.6m sq ft last year. Despite disruption from the COVID-19 pandemic, the city recorded 3.3m sq ft of net absorption in the first half of this year. The city has expanded in concentric circles, with the CBD at the centre. However a number of other business districts have grown up and today almost 75% of the city’s office space is located in the eastern districts of the Outer Ring Road and Whitefield & Brookefield. A further 10-13m sq ft of new office stock is expected to be delivered in 2020.

At present, two metro lines are in operation, with a further four set to open in 2023, although these are likely to be delayed by 12-18 months. The new lines will link the city to its airport and also provide better links in the east, benefitting the main office districts. The Blue Line to the airport runs alongside a newer business district – North Bengaluru. Today, this is a relatively small district, however 20.8m sq ft of new space is set to be delivered by 2023, second only to the much larger Outer Ring Road district, and it is expected to benefit from its proximity to the airport.

For US tech firms, the most important tenants in Bengaluru occupying 43% of its business space, real estate remains remarkably reasonable, with rents around $1-2 per sq ft per month. Even though rents have risen significantly over the past decade, a weaker rupee means foreign firms have not seen the dollar cost of occupation rise. However it is not just cost, but the quality of staff and their productivity which attracts Silicon Valley firms to Bengaluru. “Companies came to Bengaluru for cost efficiency, but stayed for quality,” says Hunt. This is borne out by the city’s performance during the pandemic – rents have so far held steady.

Foreign investors have also been attracted to Bengaluru, following the international IT occupiers and a number of large investment groups remain active, including Blackstone Group, GIC Private, Brookfield and KKR. They have tended to team up with local developers, with perhaps the best known cooperation between Blackstone and Embassy Group, which led to the launch of India’s first real estate investment trust, Embassy Office Parks REIT, which has 15% of its assets in Bengaluru.

The logistics sector – the investor’s favourite across Asia Pacific – is also proving popular. As well as established logistics real estate specialists, overseas investors are seeking partnerships with smaller local developers. And in the future, affordable housing – a sector with great potential across India – is expected to attract wider interest.

Further reading:

Savills India

Contact us:

Sarita Hunt