City lowdown: Mumbai

India’s dynamic and diverse second city has the distinction of being the nation’s financial capital and also home to Bollywood, the creative powerhouse which produces more movies than Hollywood.

Mumbai is home to more than 20m people and new migrants arrive each year in search of fame and fortune. The city is home to some of India’s richest and poorest; the slum district of Dharavi lies close to the skyscrapers of the modern Mumbai. Historically, Mumbai relied on the textiles industry and exports via its port, but it is a firmly modern city today. According to Forbes, Mumbai boasts 38 billionaires, more than San Francisco or Singapore.

“The key industries driving the Mumbai economy are banking, financial services and insurance,” says Arvind Nandan, head of India research and consultancy at Savills. “In recent years it has also become a technology hub. These industries have been the main drivers of real estate development.”

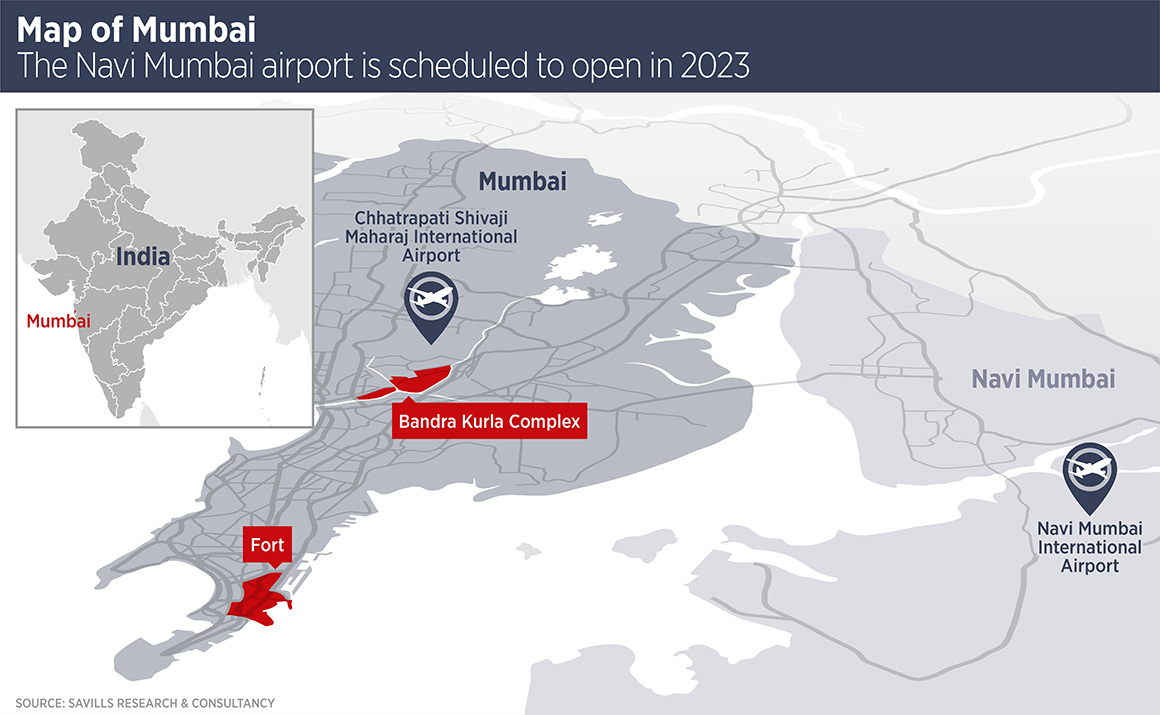

Mumbai lies on a peninsula in the western Indian state of Maharashtra and has expanded from the tip of the peninsula, home to its historic districts and the original CBD, to fill the available space. Overspill space has been created on the mainland in the Navi Mumbai area. The city’s main business district today is Bandra Kurla Complex, located close to the city’s international airport and with surrounding residential districts.

“The city’s location means it is battling a fundamental shortage of land,” says Nandan. “Navi Mumbai and other satellite cities have created overspill space, but Mumbai still has the most expensive real estate in the country and its core districts are expensive even by international standards.”

As a consequence, the city’s infrastructure has come under tremendous pressure, he says, and new infrastructure developments hope to alleviate this. The city relies on an old network of railways and traffic-clogged roads but is building a new metro system in four phases. The first phase is open, but the second phase has been delayed until late 2021.

Perhaps the most significant infrastructure development is the new airport under construction in Navi Mumbai. Set to open in 2023, it will operate alongside the existing airport and is expected to draw real estate investment to the area. Looking further ahead, plans to build bridges between the peninsula and the mainland have been mooted.

The location of the new airport is important because it re-enforces links between Mumbai and Pune, a major city to the south east. “The new airport will attract capital to Navi Mumbai and could generate a new business district in future,” says Nandan.

Mumbai has been an important destination for overseas real estate private equity; the first pre-GFC phase of investment was mainly into residential development, albeit not always successfully. Lack of regulation in the sector led to sharp practices and investment dwindled after the GFC. Since then, most foreign investment has gone into the office sector, targeting the major business districts and IT parks. Major foreign investors in Mumbai include Blackstone Group, GIC and Brookfield.

“A number of overseas investors are targeting Bandra Kurla Complex,” says Nandan. Other office locations which will attract investor interest in the future include Andheri-Jogeshwari, Malad-Goregaon, Powai-LBS Marg and Thane-Navi Mumbai.

India introduced a raft of residential market regulations in 2016, which have made the market more attractive to overseas investors, as well as protecting consumers. Now private equity investors are looking at residential development once more, says Nandan, particularly the mid-market segment. For example, Canada’s Ivanhoe Cambridge last year invested $250m in a smart city development near Mumbai. Savills expects residential areas such as Andheri, Jogeshwari, Jogeshwari–Vikhroli Link Road, Marol and Chandivali to attract more interest from investors in the future.

Further reading:

Savills Mumbai

Contact us:

Arvind Nandan