City lowdown: Shanghai

China’s second city and its financial capital, Shanghai is the destination of choice for cross-border real estate capital.

Savills data show $6.8bn of foreign capital invested in the city’s real estate market in 2019, prior to China and global markets being hit by the COVID-19 pandemic. Transactions fell sharply in the first quarter of this year but are expected to begin their recovery in the second half. The municipal government has made significant efforts to attract foreign direct investment and improve the business environment in recent months.

James Macdonald, head of China research at Savills, says: “While there may be some decoupling or a strained relationship with some overseas markets, China continues to forge strong relations with new trading and business partners and actively courts new foreign direct investment to spur growth and innovation.

Overall transaction volumes fell 65% to RMB18.1bn in the first quarter of 2020, admittedly off a large base of comparison. Macdonald says: “Many investors remained focused on smaller deal sizes or expected vendors to offer sizeable concessions. Nevertheless, strategic dispositions of larger development portfolios may become more common as companies look to reposition themselves amid changing market conditions. Long-term institutional investors are likely to witness a once-in-a- cycle opportunity to secure high-quality assets in first-tier cities”.

“Shanghai is one of China’s leading cities and most cosmopolitan, having attracted a large stable of international firms and a large expatriate workforce. Also, not only is it a key hub for financial and consumer services but also advanced manufacturing, pharmaceutical R&D, AI, Big Data and 5G.

The city is one of China’s four municipalities – large urban areas which rank level with provinces and where the only higher level of government is national – and also has a number of special economic zones, including the Pudong New Area, home to glittering skyscrapers and also the Shanghai Free Trade Zone, which was expanded last year to include the Lingang New Area of Pudong. Free trade zones are areas where China experiments with free market economics.

“Shanghai’s FTZ is often at the vanguard of new policy reforms as well as often being a testbed for the application of new technologies and business practices,” says Macdonald

As in most Chinese cities, infrastructure developments are important for real estate investors. Shanghai will play a leading role in the integration of the Yangtze River Delta (YRD) area (linking Shanghai with parts of Zhejiang, Jiangsu and Anhui). Real estate around transport hubs – such as Hongqiao, which is a hub for the metro, high-speed rail and air travel – is a subject of investor interest. While building quality and master planning leaves something to be desired and current fundamentals remain weak, the area should still benefit from long term integration with the YRD,” says Macdonald

Meanwhile, business park locations such as Zhangjiang in Pudong, an area focused on research and development, will attract significant investment and government support, Macdonald says.

Investors may also consider locations along the Huangpu River where there are significant urban rejuvenation opportunities for large mixed-use developments, with long-term potential.

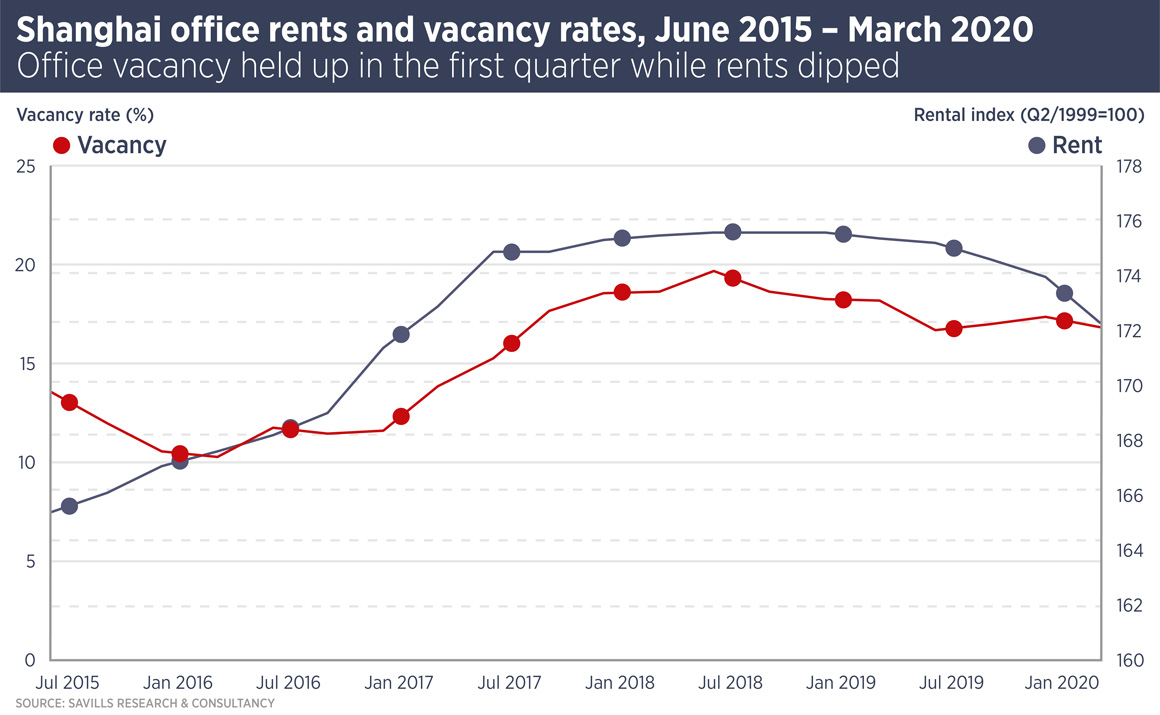

The office market has been rocked by the COVID-19 outbreak, nonetheless rents and occupancy held relatively steady in the first quarter, Savills data shows. The municipal government rolled out a number of measures to support the office market in February and in April issued plans to boost the city’s online economy, which include measures to support remote working and online exhibitions. However, by late April, working life was returning to normal for most of the city’s office workers.

One of the effects of the pandemic has been delays in the delivery of new office space, which will offset some of the shortfall in demand and reduce downward pressure on rents. Savills estimates up to half of the office space scheduled for delivery this year will be delayed until 2021.

Retail was dramatically hit by COVID-19 but has returned to some semblance of normality as social distancing rules have been relaxed and people return to work. There were some casualties of the pandemic, but Macdonald notes, “Community malls and projects which adopted digital enhancements and online platforms seem to have been less affected by COVID-19. Shanghai remains a consumer bright spot. Effective virus controls, work resumption and increasing consumer confidence have buoyed retailers’ optimism.”

Meanwhile, although Shanghai residential sales fell dramatically in the first quarter of this year, eight residential land plots with a total buildable area of 588,000 sq m were sold and home buyers soon returned to the market once social distancing rules were relaxed. “Volumes are recovering with stable end-user demand and high levels of confidence in the market,” says Macdonald.

Further reading:

Latest Savills Shanghai research

Contact us:

James Macdonald