City lowdown: Taipei

Taipei is one of Asia’s smaller capital cities, but offers a mature and sophisticated real estate investment market.

A centre for financial services, particularly insurance, Taipei is also a manufacturing hub and a popular tourist destination for travellers from Hong Kong, Mainland China and Japan. Taipei City is also a technology hub; the Neihu and Nankang technology parks are home to 6,000 tech companies.

While the real estate market is transparent, it is notable for the almost complete dominance of local players. “The property market in Taipei City is very localised with 95% of buyers being domestic,” says Erin Ting, head of research at Savills Taiwan. Prime assets tend to be snapped up by Taiwan’s powerful insurers as well as domestic property companies and private investors.

The power of local capital in a relatively small market is reflected in tight yields for all sectors; Savills estimates Taipei offices yield 2.4-2.6% for example while industrial properties yield 2.6-2.9%. Interest rates, cut to a 20-year low in February, add further support to the low yield environment.

Benefitting from preparations begun in the wake of SARS, Taiwan has been one of the most successful nations in terms of dealing with the COVID-19 pandemic and its economy, while damaged, has been relatively unscathed. GDP growth is predicted to be positive at 1.92% this year, one of the best performances from a developed economy. Retail and hospitality real estate have suffered the most, while the office and industrial sectors have so far proved resilient, says Ting.

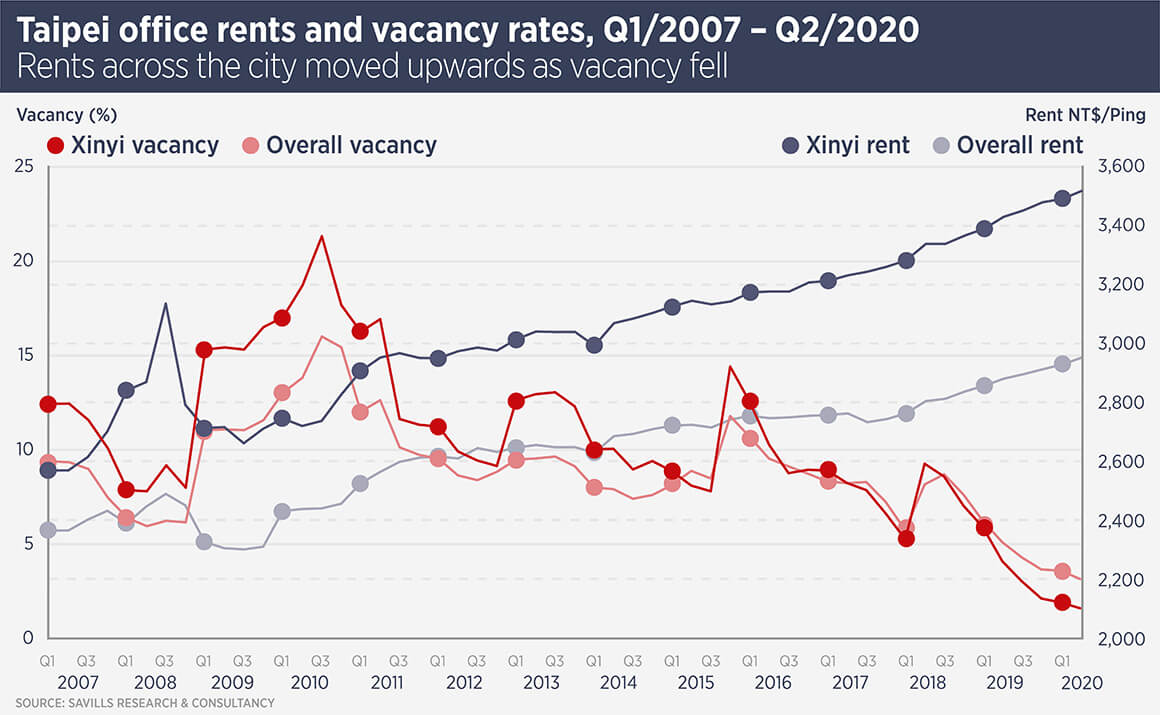

In the office sector, rents have continued to rise this year and the prime Xinyi district saw rents rise 3% in the first half. Limited supply over the next three years and pre-leasing of space is expected to keep vacancy tight.

Xinyi, in the South East of the city, was developed in the 1970s and has grown to become Taipei’s premier luxury residential, grade A office and retail location. It has 20 Grade A office buildings offering more than 1m sq m of space and rents are 20% higher than the citywide average. The district is also home to Taipei 101, once the world’s tallest building and today the ninth, and 14 major department stores, making this area an important part of the retail landscape in Taipei.

Buyers of commercial real estate have been focusing on the office and industrial sectors, while in the first quarter of this year land sales rose 28% (16% in the first half), suggesting developers are confident Taipei will recover swiftly from the effects of the pandemic.

“The office sector has a lot of potential over the next few years,” says Ting. “There is a lack of new supply and the city’s stock is old: 30% of grade A office buildings in Taipei City will be at least 30 years old iby 2024. There is also a shortage of grade B office buildings.”

While overall investment volumes have slowed slightly this year, the industrial market has boomed with owner-occupiers, particularly tech and manufacturing firms among the major buyers. Prices have risen too; the sale of an old pharmaceutical factory in the first quarter showed a 31% price increase over five years. The trade war between China and the US means a number of Taiwanese manufacturers are considering relocating operations back to Taiwan.

Supermarkets and convenience stores saw sales increase sharply in the first half of 2020 but department stores were hit, with sales down by more than 10%. However, “the relatively low holding costs and low interest rate environment mean that very few owners are willing to sell at deep discounts to the market, even for hotel and retail property,” says Ting.

Further reading:

Savills Taiwan research

Contact us:

Erin Ting