City lowdown: Singapore

Safety, security and low taxation continue to attract real estate investors and occupiers to Singapore.

Safety, security and low taxation continue to attract real estate investors and occupiers to Singapore.

The city-state is the wealthiest Southeast Asian nation, with GDP per capita of more than US$105,000, according to the International Monetary Fund, and is an important centre for financial services, particularly investment and wealth management, tourism and manufacturing. GDP fell 5.8% in 2020, however most of this is expected to be recovered in 2021. It has a highly-educated population of 5.7m, of which 1.6m are expats.

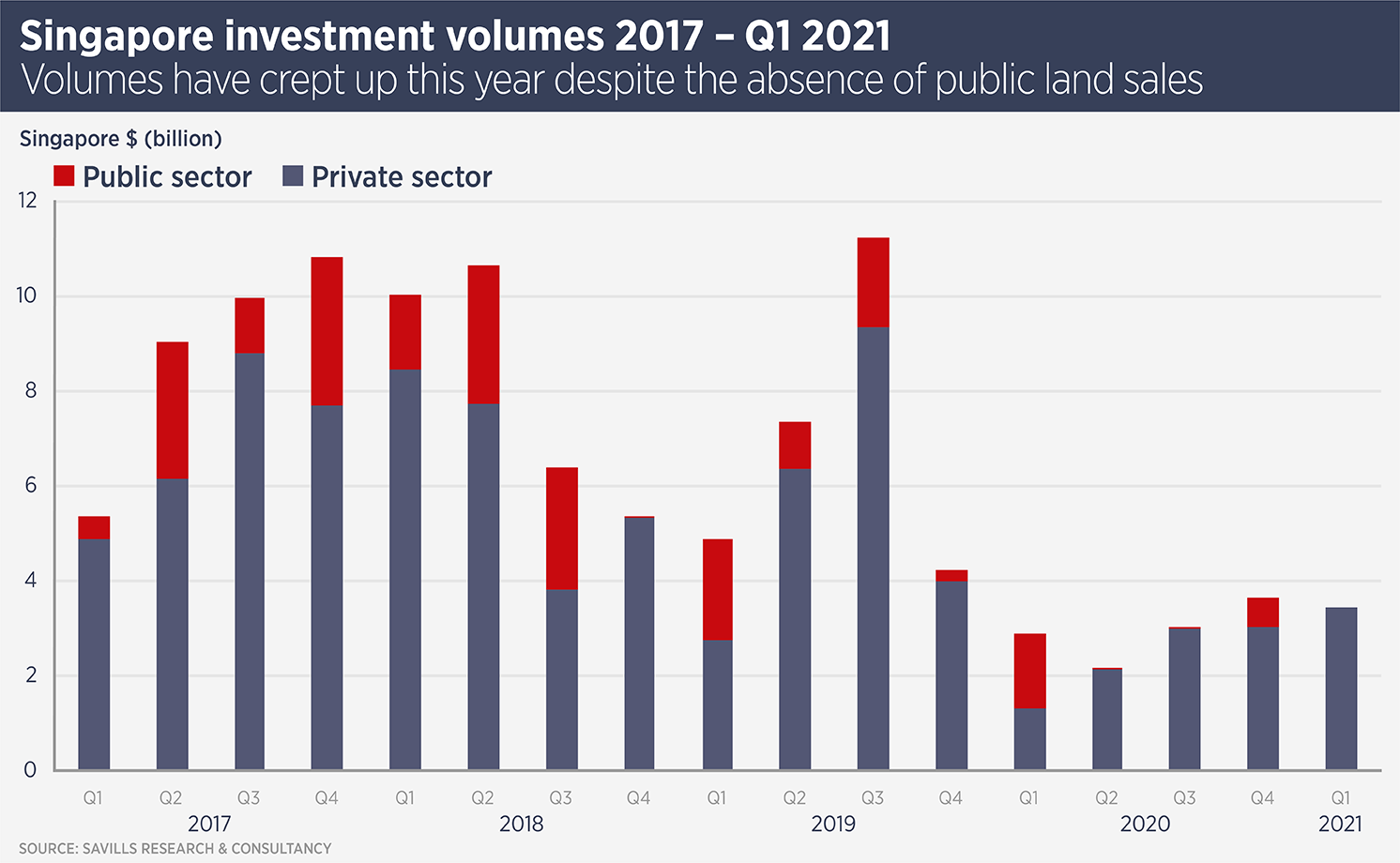

Overseas investors have been active in all real estate sectors, although activity in the residential sector has been limited in recent years, due to punitive stamp duty of up to 25%.

Jeremy Lake, managing director, investment sales and capital market at Savills Singapore, says: “Singapore’s very good response to the pandemic and the relatively low impact of COVID-19 has re-affirmed its reputation as the ‘Switzerland of Asia’. This is driving interest in real estate from institutional investors as well as high net worth and family office capital based in the region. The main barrier to increasing transaction volumes is a lack of stock for sale and a price gap between buyers and sellers.”

Singapore is also a growing hub for technology companies, attracting a record S$17.2 billion of foreign direct investment in 2020, and 80 of the worlds 100 largest tech firms maintain a presence there. Lake says: “In recent months a number of Chinese tech companies have set up shop in Singapore and they will become an ever more important factor in the office market in the future, as they are expanding rapidly. Southeast Asia, with a population of 650m, is clearly a market they wish to exploit and Singapore is their chosen hub.”

For example, ByteDance, creator of the TikTok app, this year opted to move from coworking space to 60,000 sq ft of offices, while in 2020, online retailer Alibaba bought a 50% stake in AXA Tower, a S$1.68bn 50-storey office building.

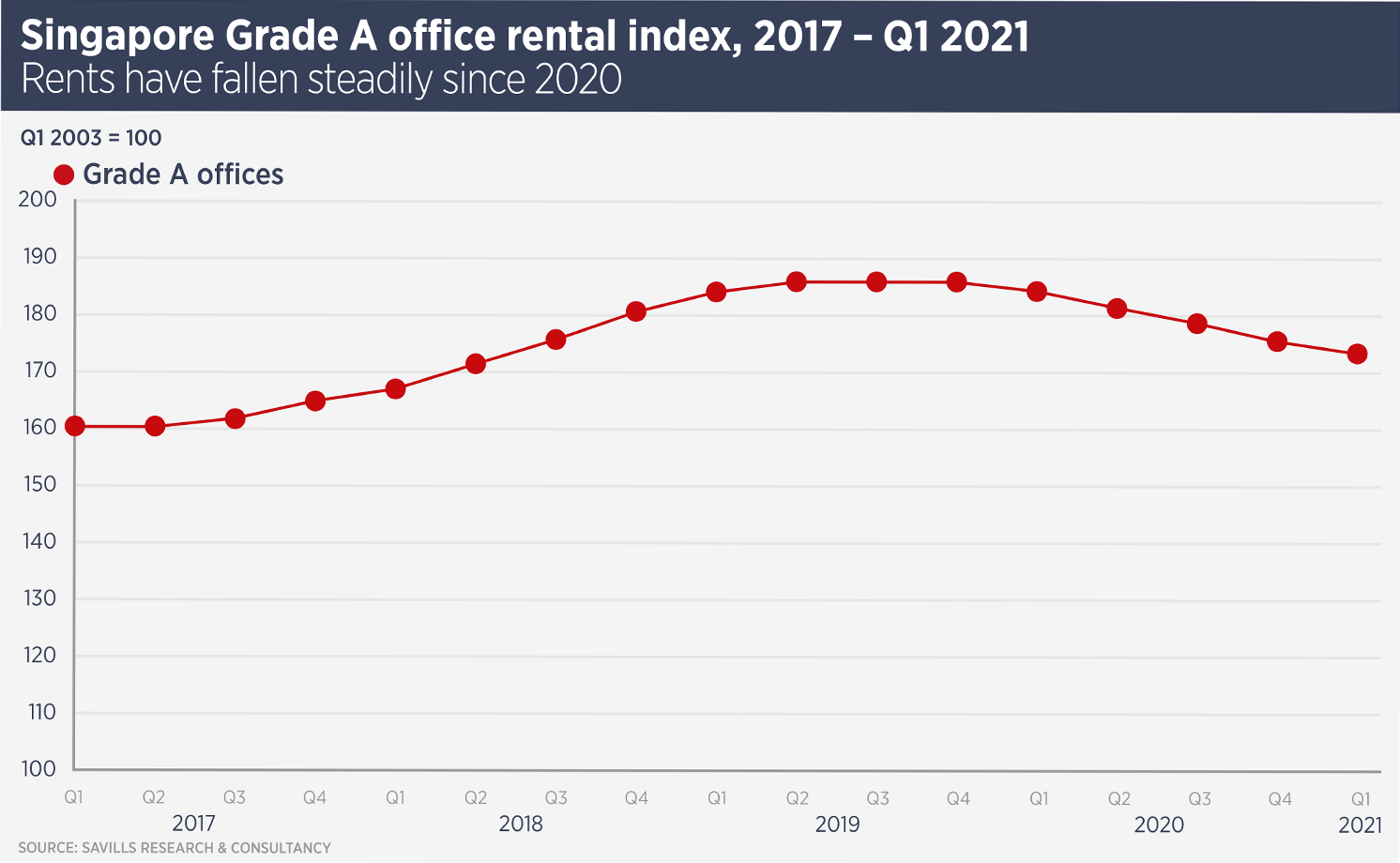

The Singapore office sector saw rents fall 5.6% in 2020, following a rise of 2.9% in 2019, Savills data show, and the company is predicting a similar fall in 2021, however head of Singapore research Alan Cheong says continued interest from tech and financial services firms could help the market bounce back quickly. “Over the next two years, given a rather constrained supply pipeline of CBD Grade A offices, the risk is on the upside,” he says.

In common with most cities in the region, office investment has been sluggish since the pandemic, however foreign investors remain active. Allianz Real Estate and Korea’s National Pension Service bought at 50% stake in the OUE Bayfront office tower for S$633.8m, while Blackstone Group bought the “Sandcrawler Building”, a business park office building occupied mainly by tech firms, for $176m.

Lake says: “The office sector is in limbo to a certain extent, as occupiers try to work out how much working from home will be a factor in their long-term decision making. However, based on my recent discussions, eight out of 10 institutional investors would still buy Singapore offices today. The fundamentals are positive and rental growth will most likely resume in the next 6 to 12 months, led by the Grade A stock.”

Business parks and logistics space are both popular with investors, due to their hardy performance during the pandemic. Savills data show factory and warehouse leasing increased on 2019, while prime business park rents held steady. The outlook is positive for logistics and high-tech manufacturing space, says Cheong, where “demand remains strong and is expected to stay healthy in line with the thriving technology, biomedical and electronics sectors”.

Singapore’s retail market is divided between the high end tourism-driven shops of Orchard Road and the CBD and suburban shopping centres with more non-discretionary retail. Both sectors have seen rents slide since 2008 as competition from online retail has intensified. However, Savills data show that the pandemic, which closed Singapore to visitors, caused Orchard Road rents to slide below suburban rents in 2020. In 2008, Orchard Road prime rents were 15% higher.

Cheong says: “The physical retail scene may emerge from this pandemic vastly transformed by the disruption caused by online platforms.” He suggests Orchard Road landlords may adjust their tenant mix to cater more to Singaporeans, providing more competition for suburban assets.

Further reading:

Savills Singapore Research

Contact us:

Jeremy Lake