City lowdown: Hangzhou

Ancient history and high technology make Hangzhou a prime location for both tourists and real estate investors.

The port city lies at the southern end of The Grand Canal of China and on either side of the Qiantang River. It is famous for its West Lake and a history which stretches back 7,000 years.

More recently, Hangzhou’s flourishing high-tech industry has demonstrated China’s continuing transition from manufacturing to a value-added service-based and technology-driven economy. The city is now as famous for being the home of e-commerce giant Alibaba. It is also home to 26 ‘unicorn companies’, tech firms with a valuation of more than $1bn.

Hangzhou’s economy achieved 8% growth in 2017, with its GDP totalling RMB1,256 bn. The city’s population reached 9.47m, up by 3.05% YoY, and with an urban population of 7.27m.

The combination of a pleasant environment alongside business growth means Hangzhou is now one of the wealthiest cities in China with an estimated 153 people worth more than $300m and is home to 7.2% of China’s billionaires, despite having less than 1% of the nation’s population.

Hangzhou office market

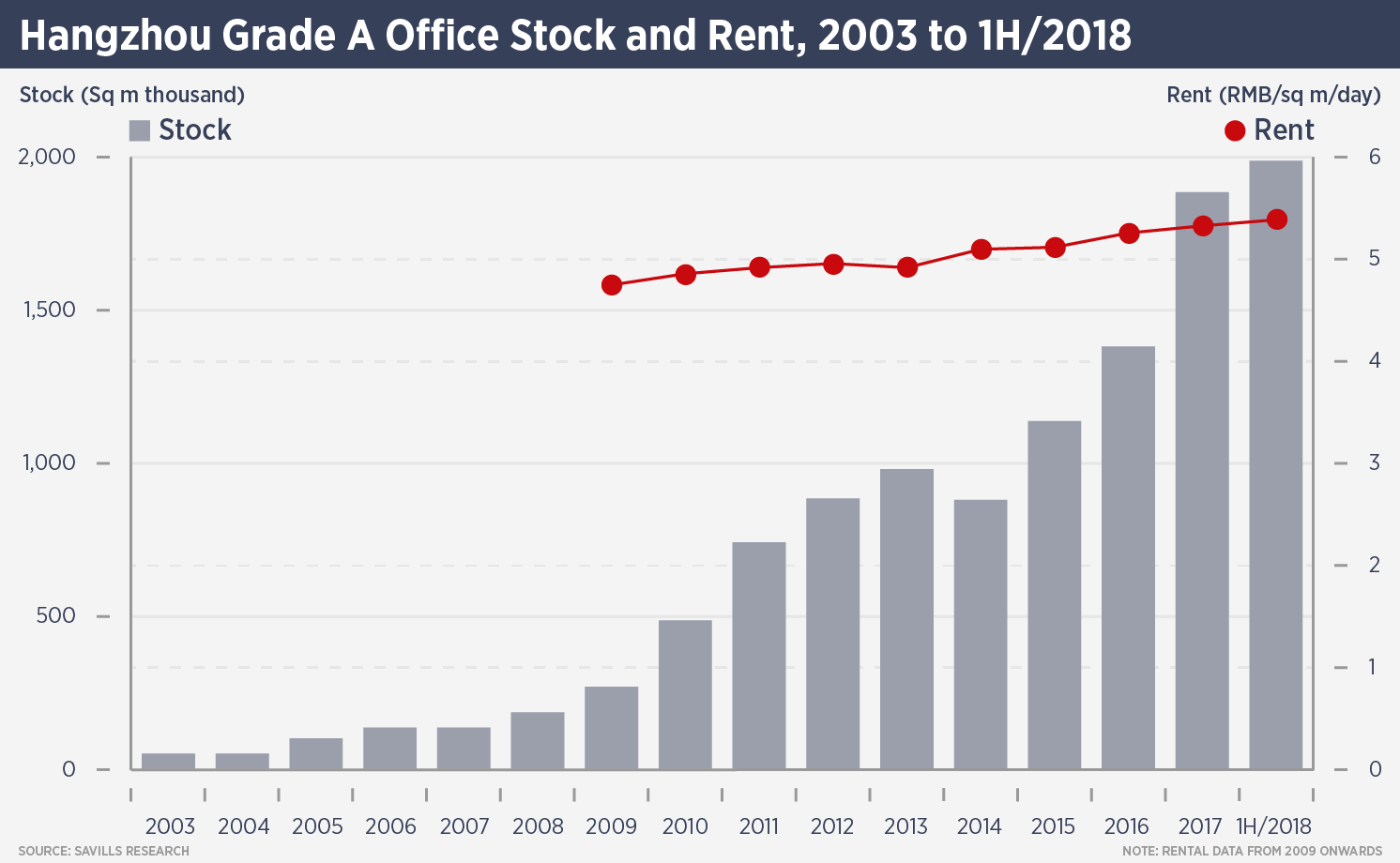

The Grade A office market has seen rapid growth in the past decade and now has total stock of 1.98m sq m by 1H/2018 with annual new supply averaging at 240,000 sq m over the past three years.

Before the development of the Qianjiang New City (QJNC) area, the city’s Grade A office stock was mainly in the two traditional CBD areas of Huanglong and Wulin. Since 2010, QJNC area has seen a number of high-quality commercial projects developed by well-known domestic and international developers such as Raffles City by CapitaLand, MixC Tower by China Resources and Oceanwide International Centre by Oceanwide.

The city’s financial, information and professional services sectors remain the key demand drivers for the Grade A leasing market. As a city with a strong start-up culture, there has been substantial interest from coworking providers.

City-wide Grade A office rents increased to an average of RMB5.4 per sq m per day in the first half of this year, up by 1.6% on the previous six months. Grade A vacancy is 14.2% citywide, and 13.8% in the QJNC area.

A new area, Qianjiang Century City, will be the main location for the 2022 Asian Games and is home to a number of new development projects.

Hangzhou retail market

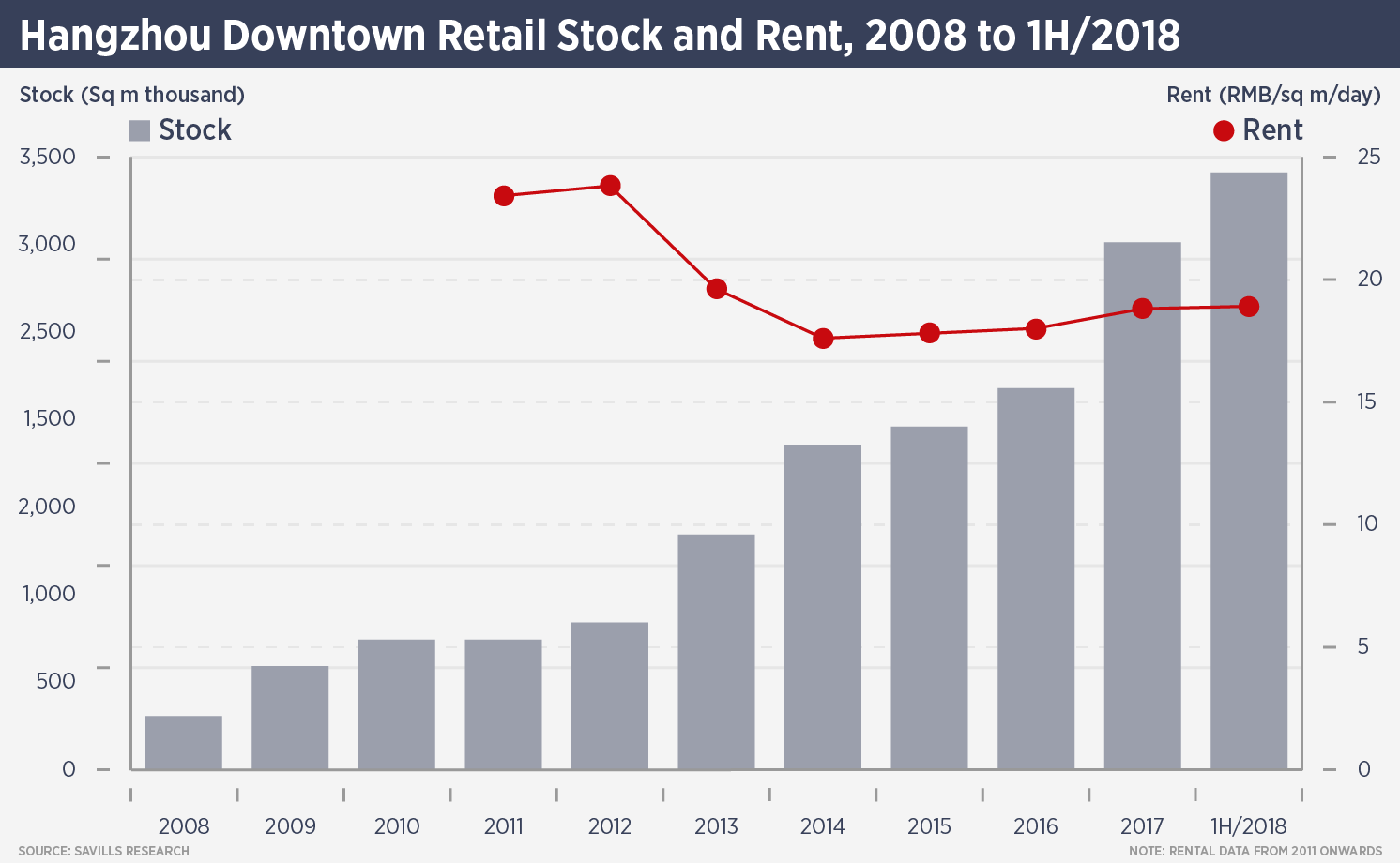

Hangzhou’s retail market has a total stock of over 3.4m sq m of high quality retail space, with only about 28% located in the city’s prime retail areas of Lakeside, Wulin and Qianjiang New City (QJNC). Located east of the city’s famous West Lake, the Lakeside and Wulin submarkets are the city’s core prime shopping areas. QJNC has also become a prime retail area in the past ten years.

However the retail market has seen a surge in supply over the past few years, mainly outside those prime areas. Total gross floor area added over the past three years was 1.5 million sq m, of which only one-fifth was located in prime areas.

Alibaba also recently opened its first offline mall, mainly to act as a support facility for employees (40% of the space will be F&B) and to act as a laboratory for new retail technologies.

Growing retail sales, boosted by the tourism industry have enabled the city to absorb new supply, keeping the overall city vacancy rate at around 10%. City-wide first-floor rents increased by 1% over the first half of the year to RMB19.0 per sq m per day.

Further reading:

Savills China Research Spotlight

Contact us:

Simon Smith