City lowdown: Seoul

The South Korean capital is one of Asia Pacific’s most stable office markets and also a centre of culture for the region.

Everyone in the world knows “Gangnam Style”, – the official Youtube video for the song has been viewed more than 3bn times – but far fewer know that Gangnam is also one of Seoul’s major office districts.

Korean food, films and pop music are enormously influential across Asia, making the city a popular tourist destination, while Seoul’s status as a financial centre, based on the strength of its financial services industry and the might of Korean chaebols (conglomerates) makes it a popular investment destination.

Seoul is home to around 10m people, but the greater metropolitan area is home to 25m, nearly half the population of South Korea. The city’s main industries are finance, manufacturing and retail. It has some of the world’s fastest internet speeds and readily available pubic wifi.

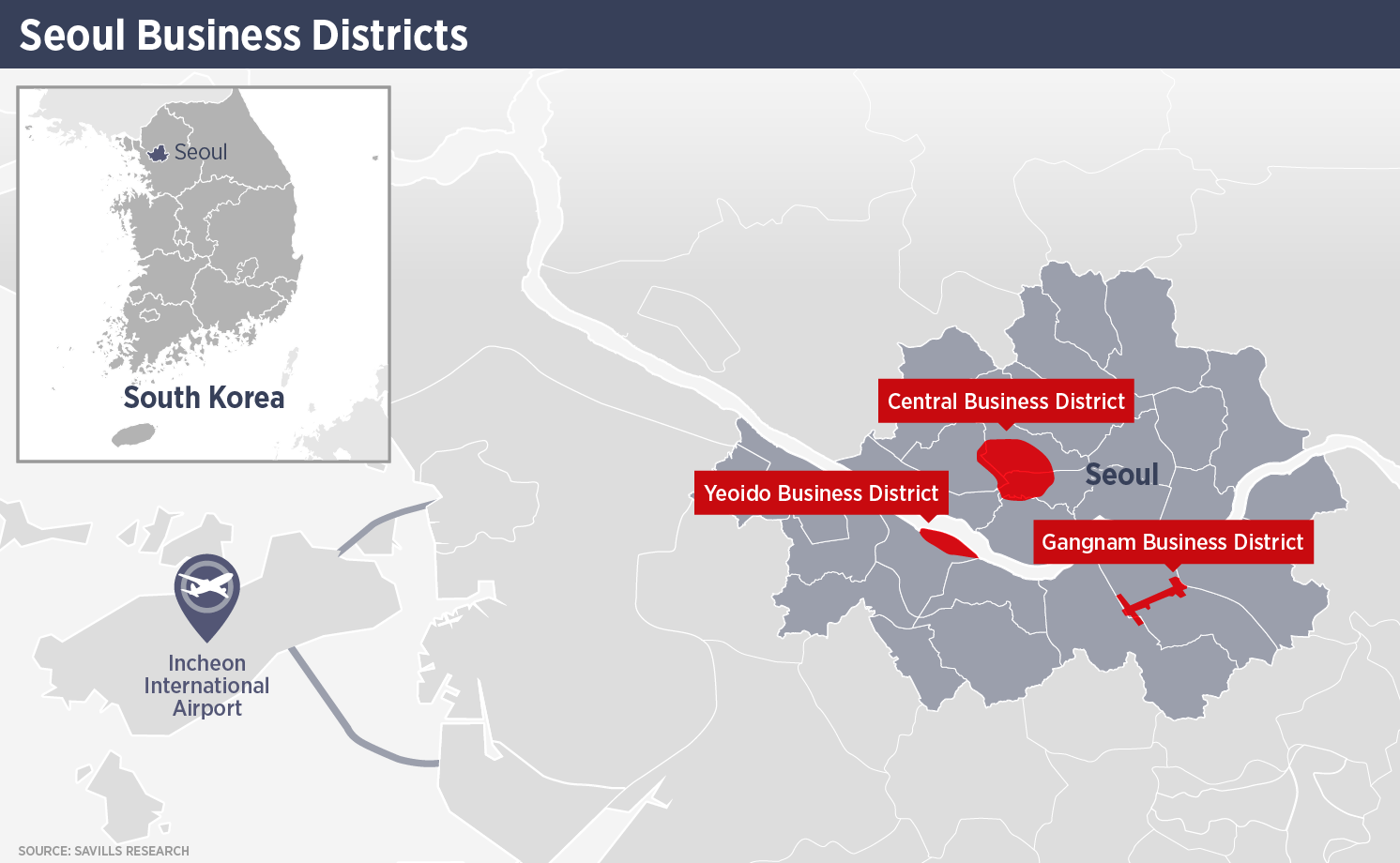

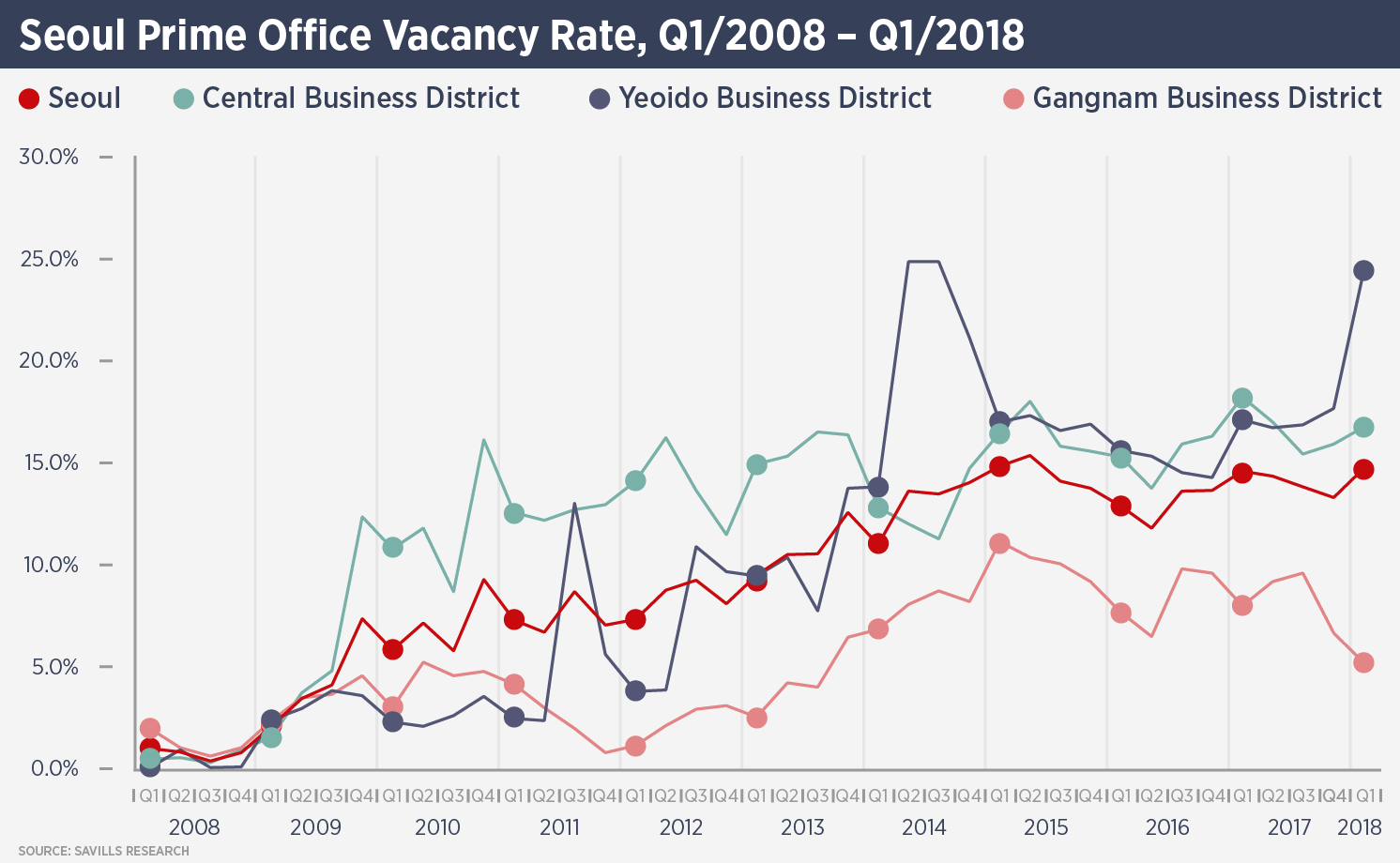

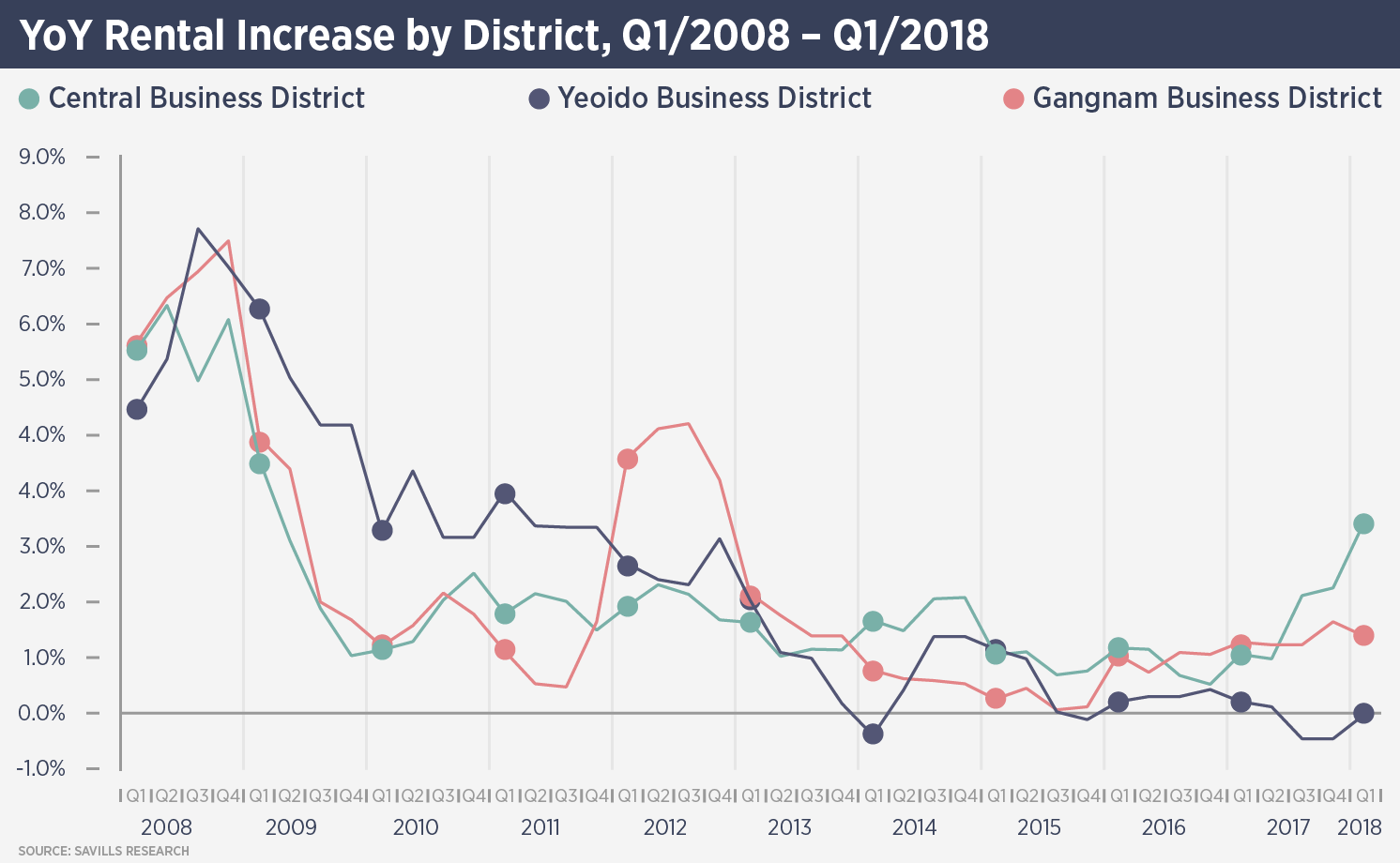

The city has three major office districts: the CBD, the Yeouido Business District (YBD) and the Gangnam Business District (GBD). The CBD is the city’s core and longest-standing business district, as well as the major shopping district of Myeong-dong and is host to a wide variety of businesses. Savills data show a CBD vacancy rate of 16.7%, but it has shown strong rental growth in recent months.

The YBD, located on a small island in the Han River, is known for financial occupiers – it is home to the Korea Stock Exchange – and media companies. More recently, it has become a centre for overseas companies, many of which have relocated to the Seoul IFC development, which comprises three office skyscrapers, a hotel and a shopping centre. Developed by AIG, it is now owned by Brookfield. The office market in the YBD is still digesting Seoul IFC’s office space and Q1 vacancy was 24.4%.

Gangnam is home to tech and media businesses and is also the Beverly Hills of Seoul. It is the most stable office market due to tight supply and vacancy of only 5.1%.

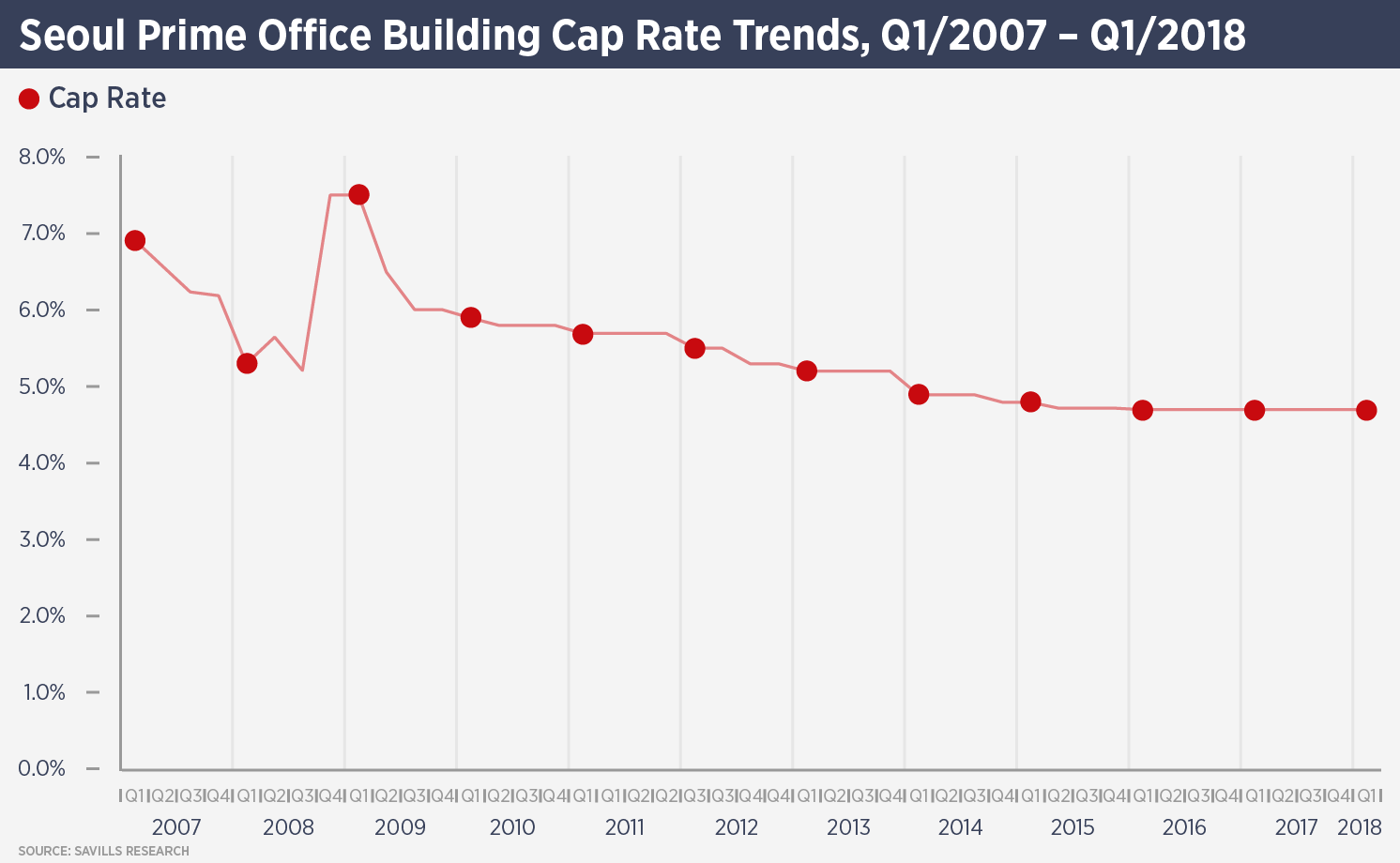

JoAnn Hong, head of South Korea research at Savills, says: “In the first quarter of 2018, the average prime office cap rate stood at 4.7%; calculated using asking rent and 90% occupancy. However, considering tenant incentives and actual occupancy rates, the effective cap rate is in the low-to-mid 4% range.

“At the end of March, the 5 year Treasury yield increased to 2.4%, meaning a prime office cap rate spread of approximately 230 bps. Typical LTV rates in Korea remain at approximately 55%.”

Frosty diplomatic relations with China dramatically hit Korean hotels in 2017, as visitor numbers from China halved, although rising visitor numbers from other Asian nations mitigated this. The five years to 2017 saw dramatic growth in hotel supply in Seoul, with the number of rooms doubling to 48,600. If relations with China improve this year, following the historic summit between the US and China ally North Korea, hotel performance should improve. Hong estimates around 40-50 hotels are owned by private equity funds and likely to hit the market as these funds mature in the next few years.

Lower tourist arrivals have hit Seoul’s retail property market, which has seen rents fall in 2017 and in the first quarter of this year. Rents in Myeong-dong fell 0.4% in the first quarter.

Seoul logistics has become a more important sector in recent years as investors and developers have vied to acquire the limited stock of modern logistics properties and develop more. The Seoul Metropolitan Area has 400 logistics centres of 10,000 sq m or larger and with 25% of total retail sales online, the sector is expected to outperform.

Capitalisation rates for logistics assets are 6-8%, at least 200 bps higher than prime offices.

Hong says: “Overseas investors active in 2017 included: M&G, Morgan Stanley, EPF, SC Capital, Blackstone, PAG, Kendall Square, KKR, Angelo, Gordon and Warburg Pincus.”

Further reading:

Savills Korea Research

Contact us:

JoAnn Hong