City lowdown: Beijing

The Chinese capital is drawing interest from foreign investors, despite a slowing economy.

Beijing, with a population of 21.7m, is the political centre of China and also home to many of the nation’s best universities. Building on 3,000 years of history, the city is also one of China’s most popular tourist destinations.

As well as its historical and political functions, Beijing is an important tech centres and ranked 17th of Savills 30 Tech Cities. Beijing sees by far the greatest VC investment of any city in China, an average of $34 billion per annum in the last three years, with volumes higher even than New York and San Francisco. Some of China’s largest tech firms are headquartered in Beijing, in order to stay close to the regulators.

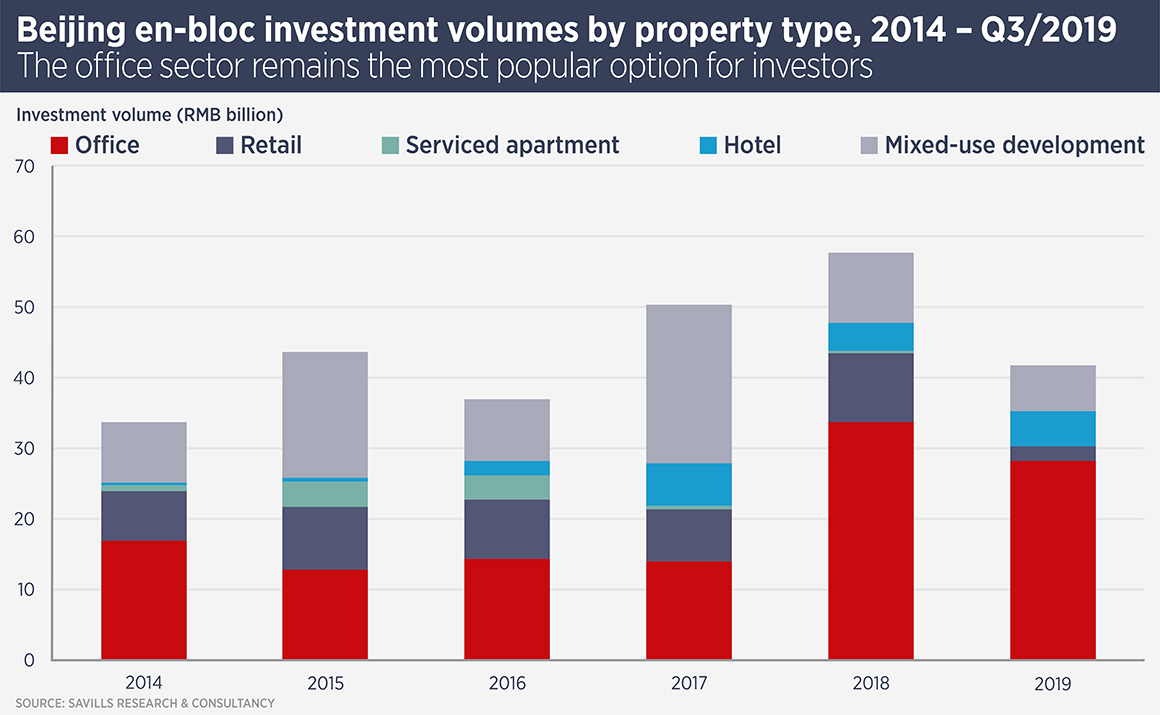

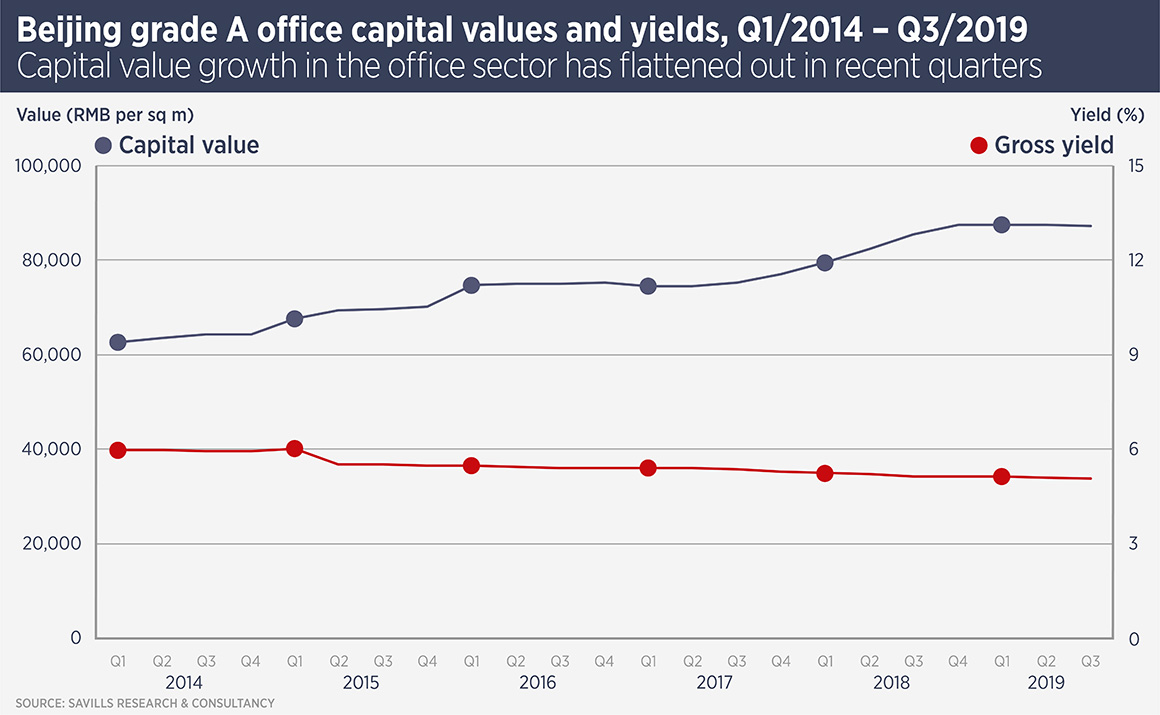

For overseas investors, the office sector is the major focus. Vincent Li, head of north China research at Savills, says: “Beijing’s office market experienced steady development since 2008, underpinned by Beijing’s strong economic fundamentals (e.g. the tertiary sector accounts for 80% of total GDP) as well as steady demand. For example, by the end of 2018, average rents had increased for six consecutive quarters and the figure marked a record high in the past decade.”

Beijing’s core office submarkets, including the CBD, CBD Vicinity and Zhongguancun, account for the majority of leasing and investment activity, but non-core markets such as Lufthansa, Asian-Olympic and Wangjing are attracting interest due to a lower cost base.

In spite of the last 10 years’ prosperity, Beijing’s office market has started to face a number of challenges and constraints this year. “Both tenants and landlords are increasingly concerned about the slowdown of the economy and the softening demand for office space as well as the Sino-US trade war,” says Li.

“Consequently, the rapidly changing market will require both landlords and tenants to be increasingly prepared and responsive in order to deal with fluctuations and challenges faced in the reminder of 2019 as well as the coming 2020.”

So far, investors have taken market softness as an opportunity to acquire assets. Real Capital Analytics data show $8.06bn of deals in the first three quarters of this year, up 134% on the same period in 2018.

A new challenge for Beijing

In November, Xiongan New Area held the first land auction since the new urban area was established in April 2017, marking a major new step in its development as an alternative urban centre to congested Beijing.

The winning bidder was fully owned by the government of Hebei Province, where Xiongan is located about 100km southwest of Beijing. The new urban area will be linked to the capital by a high-speed rail network and is part of plans to link Beijing, Hebei and Tianjin into a major conurbation, rivalling Guangdong’s Greater Bay Area. It will also be linked to the new Daxing airport.

Some of Beijing’s colleges, hospitals and “non-capital” public services will be relocated to the New Area. For example, Peking University’s Guanghua School of Management will establish a training centre in the Xiongan.

Once government functions have moved to the area, it is expected to attract more interest from corporations. The government proposes that Xiongan’s economy will be driven by high-tech industries.

Further reading:

Savills China

Contact us:

Vincent Li