City lowdown: Jakarta

The bustling Indonesian capital is benefitting from infrastructure improvements, in particular the development of a much-needed MRT network, which will be a focus for real estate development and investment.

Jakarta has a population of nearly 11m people, while the population of Greater Jakarta is estimated at approximately 30 million people. The capital is Indonesia’s economic nerve centre, accounting for nearly 20% of the nation’s GDP and is also home to most of Indonesia’s wealthiest citizens. Jakarta’s economy depends highly on manufacturing and finance, while the city is also a popular tourist destination, ranked the 57th most visited city in the world in 2019.

To alleviate pressure on the city, the Indonesian government has begun moves to create a new capital city in East Kalimantan, to where the entire machinery of government will be moved over 10 years at a cost of $37 billion. The scheme requires parliamentary approval and is not expected to dent Jakarta’s status as Indonesia’s economic capital.

The city has been blighted by urban sprawl and severe congestion, however the city’s first MRT line opened last year and further rapid transit lines are under construction and will complement existing light rail and bus services. The next necessary stage for Jakarta is transport-oriented development (TOD), says Anton Sitorus, director of research for Savills Indonesia.

“Future residential developments in Jakarta should be integrated with public transportation networks in order to minimize the use of private vehicles,” he says. “Integrated residential developments will reduce traffic and in the long run, reduce further urban sprawl.

“We could see significant investment opportunities around these transport hubs, as maximizing the land use around the stations means developers would have opportunities to develop larger scale projects.”

Some developers have already begun working on TODs and more are expected to follow as the city builds out its transport infrastructure.

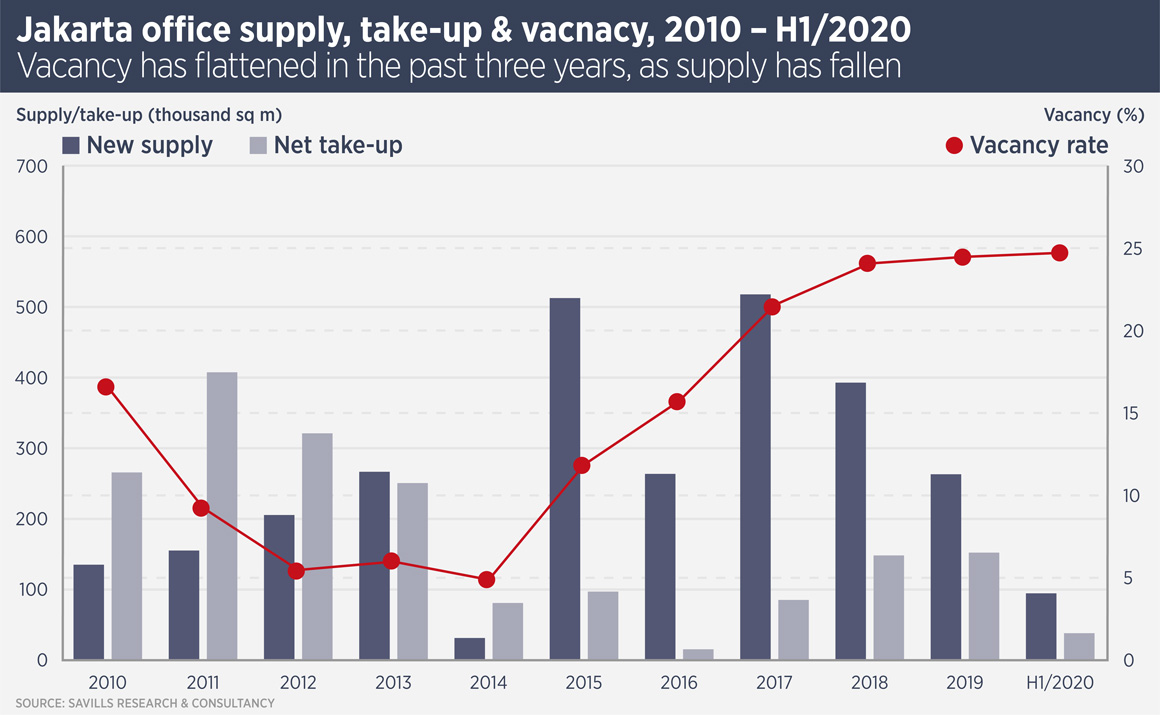

For real estate investors, Jakarta has tended to provide a rocky ride, with periods of high demand followed by over-development and higher vacancy. The office sector saw something of a development boom from 2015, which has created more vacancy as demand was adversely affected by slow economic growth. However, “expansion of e-commerce and tech companies has helped to support demand growth over the past three years, while recent demand has also been driven by co-working space operators,” says Sitorus.

Jakarta has a huge amount of retail space and this has been devastated by the pandemic, with foot traffic at only 20-25% of normal levels. “Until now, we haven’t seen much change in conditions. Tenants are reluctant to expand but fortunately, new and incoming projects are few, so the vacancy outlook should remain healthy,” says Sitorus. “However, if the pandemic continues into the second half of next year, we could see a steep rise in vacancy.”

The Jakarta residential sector boomed between 2012 and 2016 but this was followed by subdued sales as buyers stayed away and developers refused to discount. Jakarta had a luxury apartment pipeline of nearly 50,000 units between 2020 and 2023 but projects were being delayed even before the pandemic hit and, as in so many areas, investors are taking a ‘wait and see’ approach.

Overseas real estate investment in Indonesia is dominated by Japanese and Singaporean companies, which mostly focus on the residential sector. Other foreign players from China, Korea and Hong Kong are also active and foreign firms tend to form joint ventures with local developers. Active foreign investors include GIC, Mitsubishi, Mitsui Fudosan, Daiwa House, Tokyo Tatemono, Lotte and Keppel Land.

The Omnibus Law, which was recently approved by Indonesia’s Parliament, is expected to support the government’s efforts to attract more investment and create a more conducive business environment. It is a suite of legislation aimed at deregulation and thus has been opposed by unions. In the property sector, the new law includes provision for a relaxation of foreign ownership restrictions, which should boost growth in the luxury apartment market.

Further reading:

Savills Indonesia Research

Contact us:

Simon Smith