City lowdown: Sydney

Australia’s financial capital has been about the most solid bet in global real estate in recent years, particularly its prime office sector, backed by nearly 30 years of steady economic growth.

However, the COVID-19 pandemic has thrown the Australian economy into chaos and the first recession in a generation. Meanwhile, Australia’s financial hub, whose skyline is on every postcard, has suffered lockdown and is set to be closed to overseas visitors until 2022.

Much analysis of the present crisis has noted that it has only accelerated existing trends or hastened the demise of companies or sectors. If this is true, Sydney should be fine in the longer run, as the city of 5.5 million citizens was steaming ahead until the virus hit. Inward migration, a strong financial services economy and a land mass naturally constrained by its coastal geography have supported Sydney real estate in previous years and should do in the future.

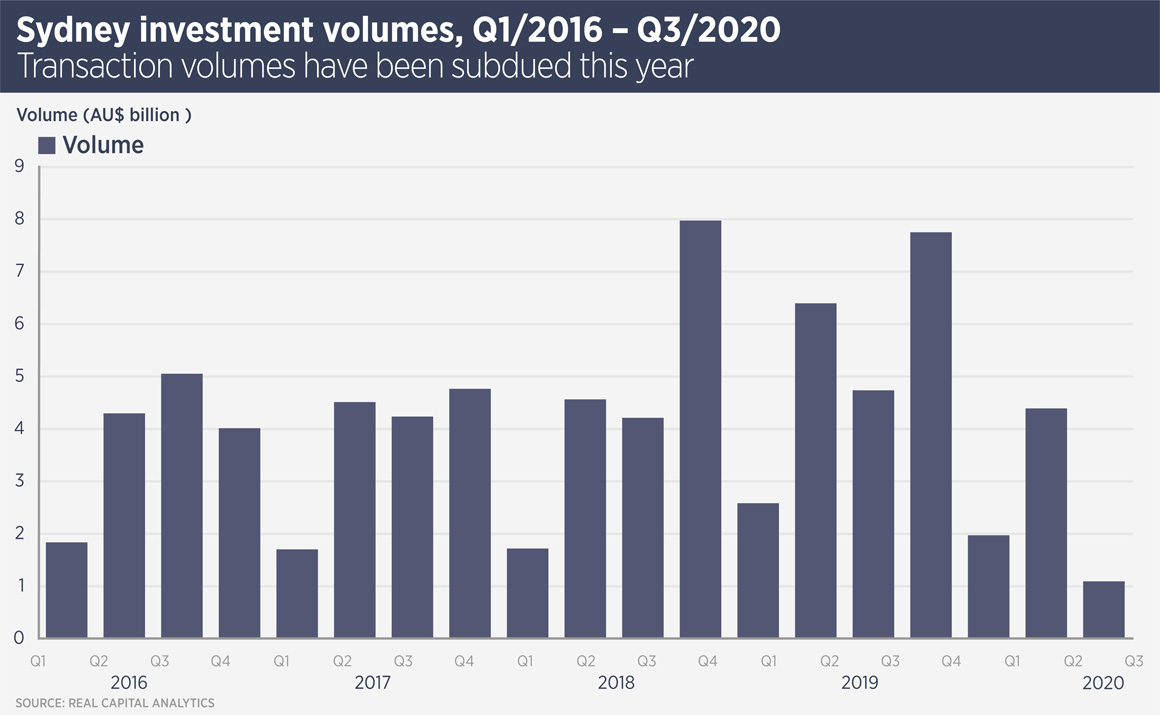

Throughout the pandemic, there has been continued demand for quality assets (particularly industrial and office) with long weighted average lease lengths and secure tenant covenants, with investors seeking both on and off market opportunities.

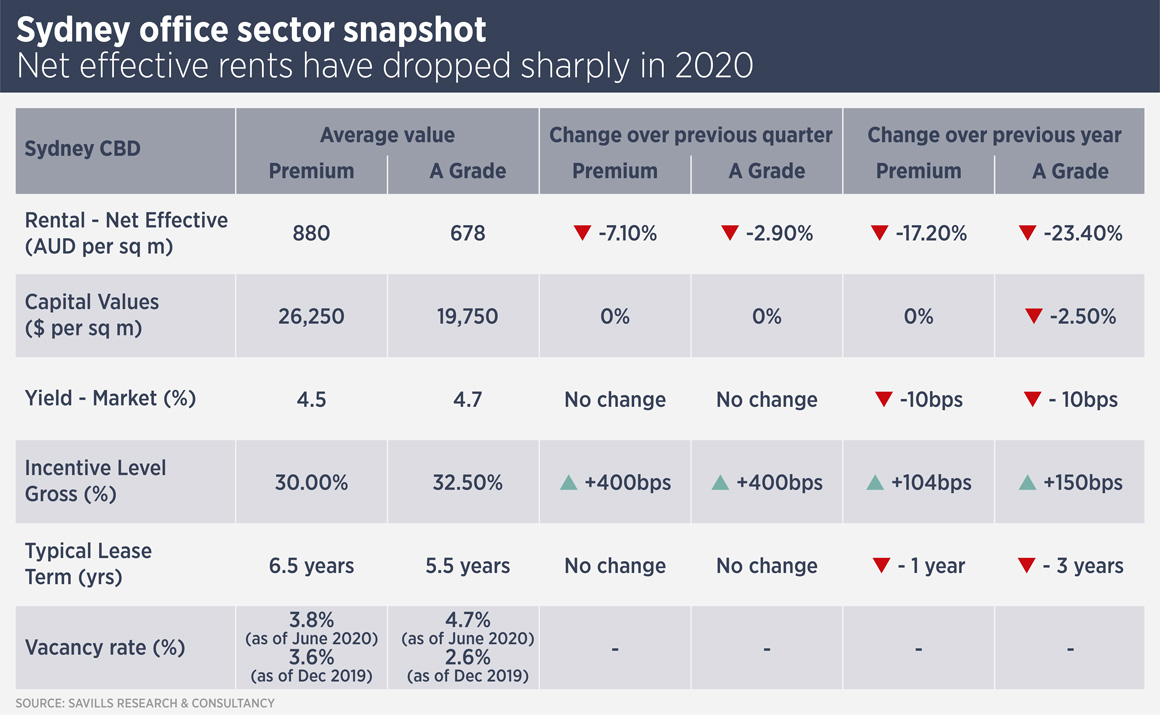

Nonetheless, the market is in something of a limbo, which is likely to continue until next year, when the longer-term economic impact of the pandemic is clearer. Government stimulus is supporting tenants, especially SMEs, and so far, asset owners have not needed to write down their holdings significantly. Incentives for leasing tenants have doubled (see table below) and vacancy rates have increased but predictions of 40% falls in net effective rents have yet to come to pass.

On the investment side, the Foreign Investments Review Board announced in May that all commercial real estate deals involving a foreign buyer would need to be reviewed. This measure, intended to prevent foreign buyers snapping up distressed Australian assets during the pandemic, has made foreign capital somewhat less attractive, as the approval process can take six months.

“We have not seen fire sales and valuers have been pretty cautious so far in how they treat assets,” says Ben Azar, national head of cross border investments at Savills Australia. “The big question for potential buyers is: what is your prognosis for the Sydney leasing market?”

The capital markets environment is benign, with all-in debt costs as low as 1.8%, however the major difference of opinions between buyers and sellers is leasing. Valuers have knocked around 5% off office values post-COVID, says Azar, and remain cautious in the absence of major investment or leasing transactions.

“Assets with long leases and good covenants are in high demand,” says Azar, “but owners are so far not prepared to significantly discount prime or Grade A assets with forthcoming vacancy.”

Recently, Chinese sovereign fund CIC agreed to buy a 50% stake in Dexus’s Grosvenor Place CBD office tower for around A$1 billion, a price understood to be within 5% of book value, despite forthcoming vacancy in the building. If the deal is approved, it would be a sign of confidence in the market’s long-term prospects from an investor with long time horizons.

Azar reports continued interest from overseas investors, especially from Hong Kong and Singapore. However, he notes that investors from outside Asia Pacific tend to take a more cautious view of the occupier market. “We see a lot of groups taking time to do the due diligence on assets, but they are looking for a bigger discount than sellers are prepared to give at the moment.” Some Australian developers and investment managers are looking to offload assets in order to fund their development pipelines, however he does not expect their price expectations to change unless there is more dramatic movement in the leasing market.

“The real pain in the leasing market will be felt by the B-Grade assets, as any movement in prime and A-Grade rents will give tenants the opportunity to upgrade. At the same time, investors will be making a similar flight to quality,” says Azar. “However, the pandemic aside, Australia’s economy looks strong in the longer term.”

Further reading:

Savills Sydney

Contact us:

Ben Azar