City lowdown: Nagoya

Japan’s fourth largest city is seeing interest from yield-hungry overseas investors. Nagoya has seen overseas investment in the logistics, residential and office sectors in the past couple of years.

Nagoya is best known as a centre for Japan’s automotive industry, with aviation and technology also being important industries for the 10m people who live in the Greater Nagoya Area, 2.4m of whom live in the city itself. The prefecture’s GDP is estimated by the Brookings Institute to be $363bn, just below that of Singapore.

The city is located in central Honshu, 350km west of Tokyo and is home to Japan’s busiest port, the starting point for many Toyota cars’ first journey to export markets. As an industrial city, overseas tourism is a relatively small part of the economy, which has been something of a benefit since the COVID-19 pandemic shut down Japan’s previously-booming overseas tourism industry.

The city’s real estate market is small compared with that of Tokyo, however it has begun to attract interest from overseas investors seeking higher yields than are available in Tokyo.

Tetsuya Kaneko, head of research and consultancy at Savills Japan, says: “Nagoya offers a yield premium over Tokyo, which is attractive for investors, however the market is smaller and less liquid.”

Nagoya has seen overseas investment in the logistics, residential and office sectors in the past couple of years, with one of the largest acquisitions being BentallGreenOak’s $370m purchase of Hirokoji Cross Tower from Mitsubishi Real Estate.

The office sector in Nagoya has been somewhat weak in the past year, with investment-grade office rents falling by 0.6% year-on-year in 1H/2021, while vacancy rose sharply to 2.6%, from 0.8% during the same period.

Nagoya has one of the highest vacancy rates of Japan’s major cities, however much of this has come in a small number of office buildings in nonideal locations. The core office location of Meiki, close to Nagoya station, continues to see strong occupancy.

There is set to be an uptick in supply for the next three years, however Kaneko says: “Overall, new supply in Nagoya seems to be of good quality and well distributed across different locations and timings, and therefore is expected to be positively received by the market.”

As with Japan’s other major office markets, Nagoya saw strong cap rate compression after the global financial crisis ended, however this has flattened out.

Nagoya, in common with a number of larger Japanese cities, had been seeing population growth prior to the pandemic, as people moved from smaller cities in order to find work. This trend has somewhat reversed during COVID and it remains to be seen whether the pandemic will make city life less attractive. On the positive side, recovery in the world economy will boost Nagoya’s manufacturing sector and thus its attractiveness to migrants.

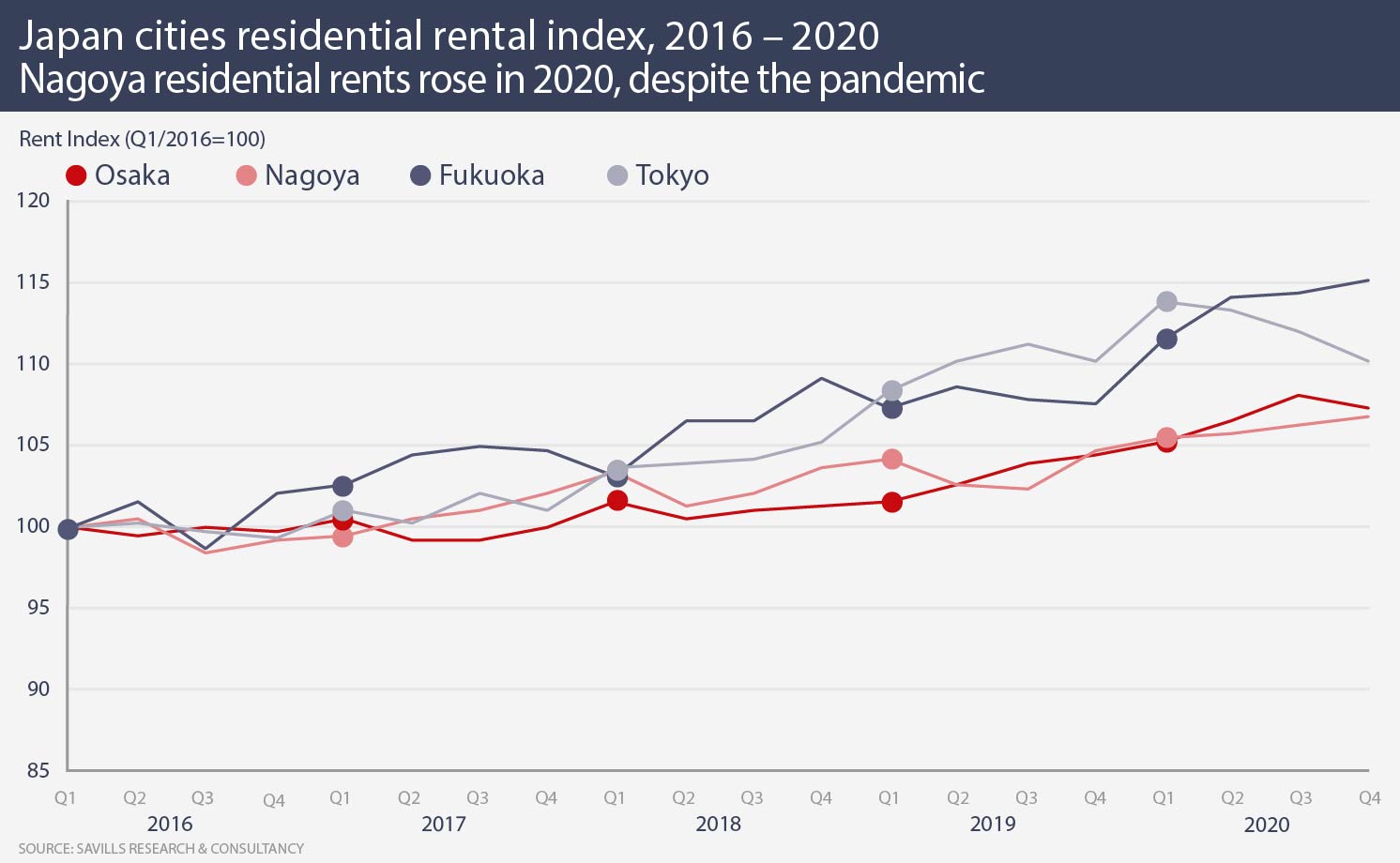

Japan multifamily residential has been one of the favoured sectors for global investors in recent years and cap rate compression in Greater Tokyo has pushed many investors into markets such as Nagoya. However, in 2020, Tokyo accounted for 42% of total residential transaction volumes. Nagoya residential has performed well in recent years, with steady rental growth, largely unaffected by the pandemic.

In the past two years, active overseas investors include AXA IM – Real Assets, which spent more than $500m last year, and Savills Investment Management, which bought a property in central Nagoya in 2021.

The logistics sector is also popular with overseas investors and Nagoya saw AXA and sector specialist ESR break ground on a $260m, 155,000 sq m distribution centre earlier this year. ESR already manages a number of logistics facilities around Nagoya, as do other overseas logistics real estate investors.

After a very quiet 2020 and 2021, Nagoya’s logistics sector is set to see increased supply next year, which is likely to send the vacancy rate above 10%; however the market is expected to absorb this new space steadily as the city still lacks modern logistics space.

Sakae, Nagoya’s main retail district has actually seen asking rents increase during the pandemic, although Kaneko notes these hikes reflect previously unavailable prime space coming back on to a weaker market. However, he says: “Sakae’s low dependence on inbound tourism has turned out to be a blessing in the current state-of-affairs, and consequently, the district is still faring notably better than its Tokyo and Osaka counterparts.”

Further reading:

Savills Japan Research

Contact us:

Tetsuya Kaneko