Progress in Perth’s office market

The Perth office market is rallying on the back of falling vacancy rates and a strong Western Australian economy.

The Perth office market is rallying on the back of falling vacancy rates and a strong Western Australian economy.

Despite global economic headwinds, overall vacancy has fallen since the peak of 19.9% in January last year and sits at 15.8% today – the only Australian CBD to record a decline in vacancy over the pandemic period i.e. since January 2020. Absorption in Perth to July 2022 was also the strongest in the country at 61,155sqm in the 12 months to July 2022.

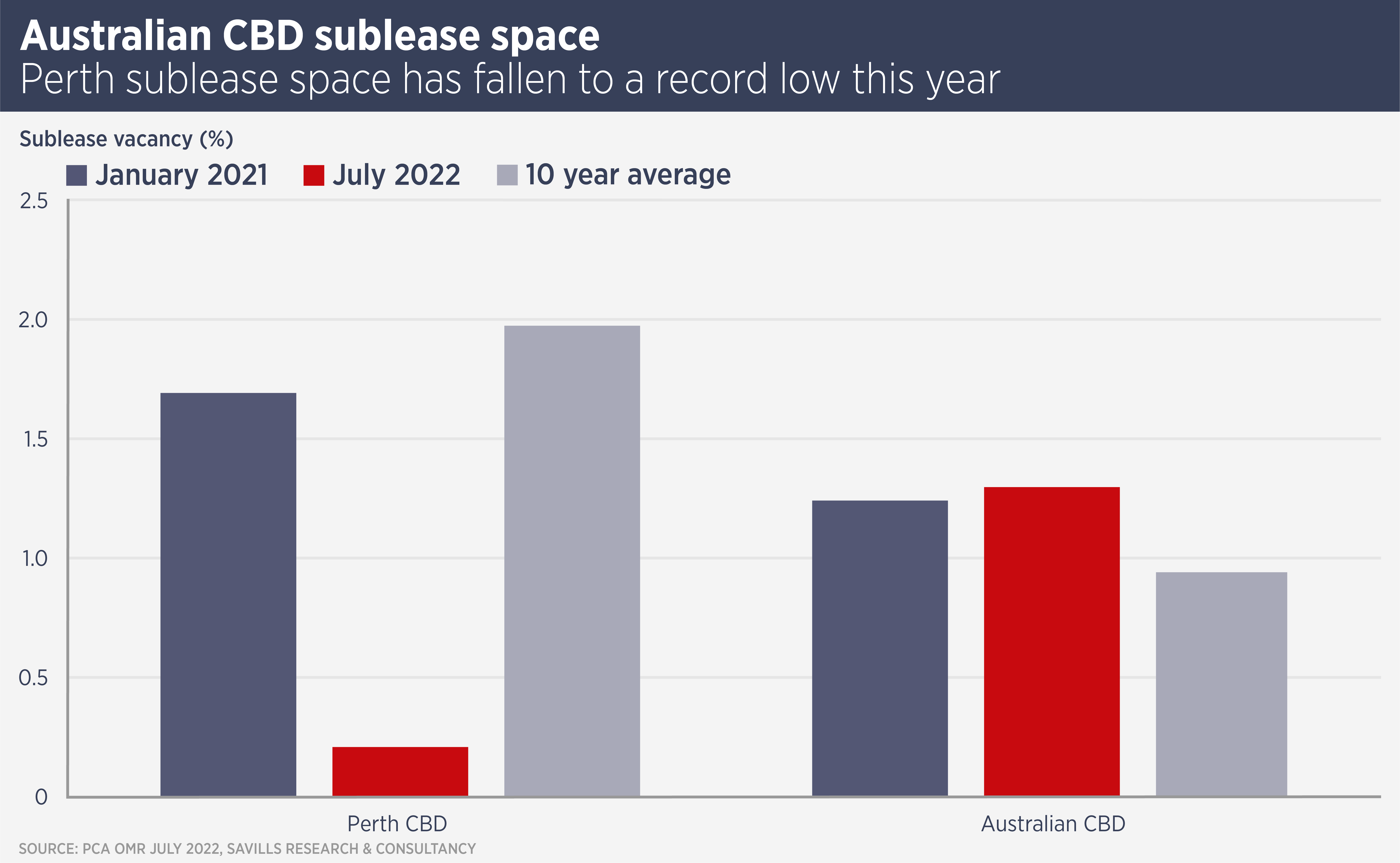

Furthermore, a short-term increase in sub-lease space evaporated as a result of some early opportunistic sub-lease transactions, but more recently as occupiers have taken back sublease space for their own requirements, a clear indication of more optimism.

Savills data now show the Perth CBD has the lowest sublease vacancy rate in the country – peaking at 1.7% in Jan 2021 and now down to 0.2%; its lowest level in over 10 years. Tenants have been withdrawing sublease space from the market in the expectation of growth.

Graham Postma, National Head of Office Leasing and Managing Director, Western Australia, says: “Pent-up demand released after Australia opened its borders, as well as strong local business confidence has been fuelling demand for office space.

“Some decision-making may be drawn out due to economic uncertainty. Enquiries and transactions during 2021 focused heavily on the sub-500 sq m market with particular success in the “spec suite” sector. In 2022 we have seen more larger users enter the market, with several large active mandates due to be concluded by the end of the year.”

The limited pipeline of new office supply in 2022 and first half of 2023, which is partially a consequence of rising construction costs, is expected to support the leasing market in the short to medium term.

The Western Australia economy has proved its resilience, with close to record low unemployment of 3.1%, the lowest of any Australian state. Chinese demand for iron ore, the state’s major export, has been subdued, but China is expected to begin a raft of growth-boosting infrastructure projects, which should increase demand for steel.

Meanwhile, Western Australia has benefitted from rising demand for liquid natural gas (LNG). The state is the world’s third largest producer of LNG. It is also a major producer of lithium, essential for batteries and thus for the decarbonisation efforts of major economies.

The resources sector is a key contributor to growth in capital expenditure and a major source of office leasing demand, particularly project space during the exploration phase.

Savills is seeing positive absorption of space in Perth from resource related occupiers and their suppliers, including firms involved in engineering and recruitment.

Minerals exploration spending in the state reached a new record of A$2.5 billion ($1.6 billion) in the last financial year, accounting for 64% of Australia’s total mineral exploration. The result reflects strong spending on this area targeting gold and other minerals, including lithium and rare earths as well as growth in iron ore.

There has been a rapid uptick in employment in the sector, with average employment numbers now surpassing pre-Covid levels.

Further reading:

Savills Perth

Contact us:

Simon Smith