Evolution, not revolution for Singapore’s CBD

Singapore faces an uphill struggle to refocus its central business district as a more vibrant ‘live, work, play’ area.

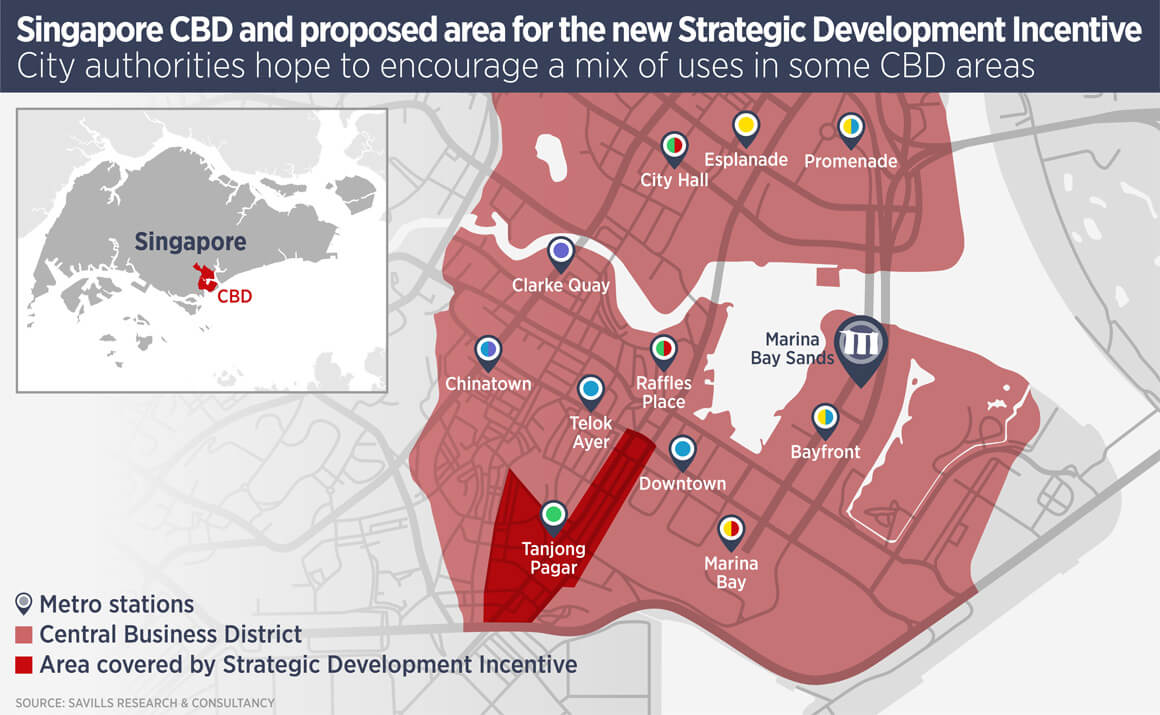

The city-state’s latest Draft Masterplan contains proposals designed to introduce a greater mix of uses in several areas of the Singapore CBD. Introducing the plan, the URA said: “To better support the continued growth and evolution of our CBD as a dynamic global hub, URA is introducing a new set of incentives to reposition our CBD as a 24/7 mixed-use district so that the CBD will not only be a place to work, but also a vibrant place to live and play in.”

The plans should also drive more decentralisation of office space, which is another target of the Singapore government. It hopes to boost employment in a number of non-CBD locations, which will reduce congestion and boost liveability.

However, despite getting an initially warm reception, the ambitious plans face a number of obstacles. Alan Cheong, head of Singapore research at Savills, says: “With these incentives the URA is attempting to bring back city living, something planners have been trying without much success since the 1970s.

“The incentives look attractive, but the actual opportunities to take advantage of them will be fairly limited; they are unlikely to lead to widespread redevelopment and a substantial change in character for these areas.”

Cheong explains that a prime reason for this is that many buildings are strata-titled, so developers would have to acquire 80% consent for a collective sale. This process could be long and expensive. Additionally, many buildings are privately owned by wealthy individuals and families, with no great incentive to sell or redevelop. Furthermore, developers will also have to take account of increased development charges.

“There will be assets where it makes commercial sense to redevelop under the new incentive scheme, but only a few,” says Cheong.

The proposals envision mixed-use neighbourhoods in the fringe CBD areas of Anson and Cecil Street, with more residential use. Meanwhile, a broader range of uses will be supported around Robinson Road, Shenton Way and Tanjong Pagar. The measures apply to the redevelopment of buildings more than 20 years old.

For example, office buildings in Anson and Cecil which are redeveloped will be allowed a plot ratio increase of 30% if the new building is residential with ground floor retail. The increase is 25% for hotels and for mixed commercial/residential projects.

Converting an office property in the Robinson Road, Shenton Way and Tanjong Pagar area to a mix of commercial and residential or to mixed-use with at least 40% non-commercial, will gain an increase of 25% in plot ratio.

The number of apartments in the CBD area has trebled over the past decade, according to the URA, but it is still primarily commercial. CBD apartments tend to be favoured by overseas buyers, which means developers need to take account of the 20% Additional Buyers Stamp Duty for foreigners when making their calculations.

Further reading:

Singapore Research

Contact us:

Alan Cheong