Foreign buyers warm to Japan hotels

Discover the trend of overseas real estate investors purchasing Japanese hotels due to the anticipated growth in the tourism market. Learn about the surge in cross-border investments and the contrasting decline in domestic acquisitions.

Overseas real estate investors are buying Japanese hotels in the expectation of steady improvement in the nation’s tourism market.

However, domestic investors have slowed their acquisitions as prices in the sector have recovered with the end of the pandemic.

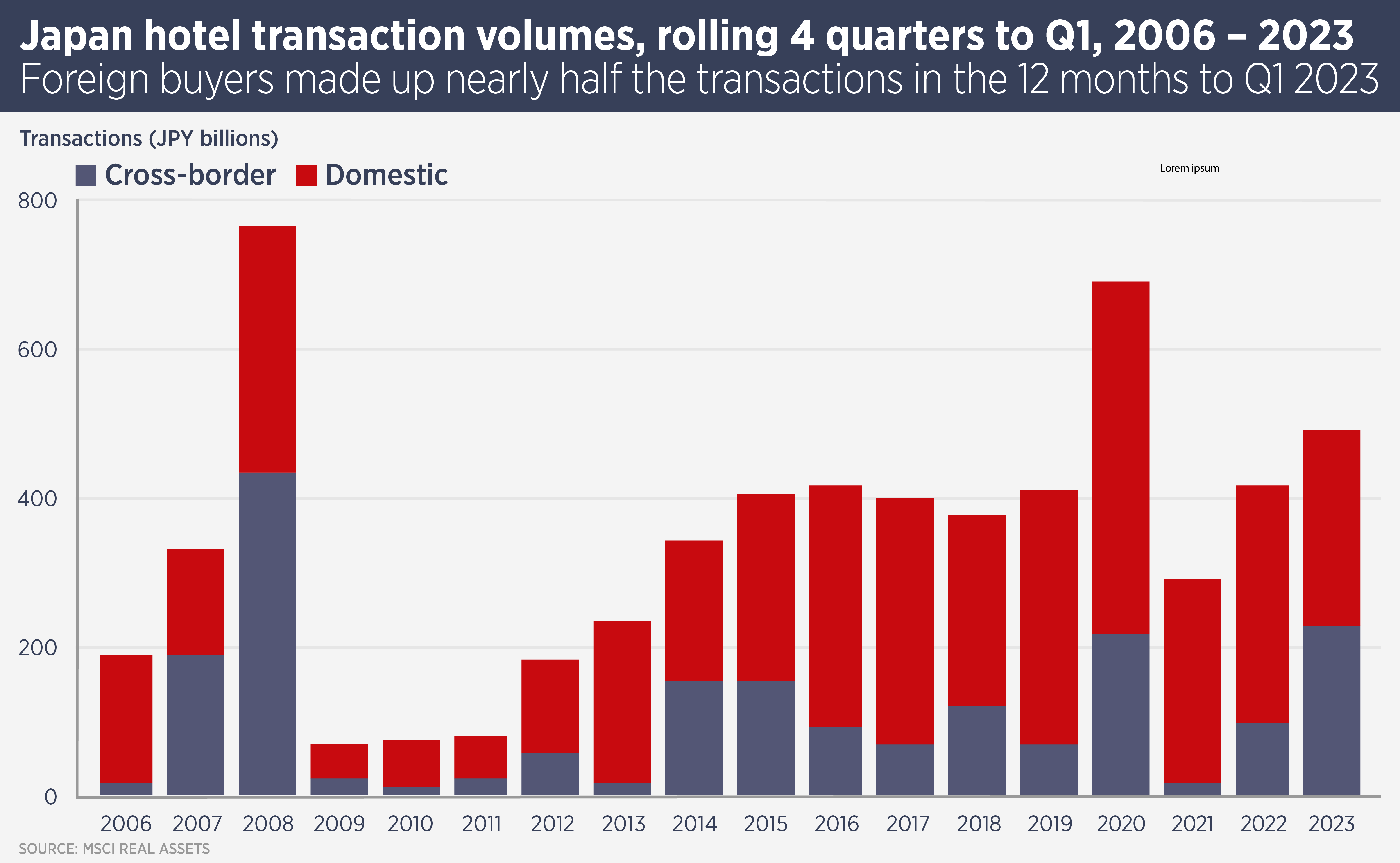

MSCI Real Assets data show cross-border inflows into the hotel sector reached ¥232 billion ($1.7 billion) over the 12 months to end-March. This was almost double the previous 12 months and also represents the second highest investment tally by overseas investors, even if somewhat exaggerated by a few large deals, such as the $403 million sale of the Rihga Royal Hotel in Osaka to BentallGreenOak.

However, domestic investment in hotels fell 30% in the 12 months through March 2023, a stark contrast with the 12 months through March 2020 when they were by far the more aggressive investor group, with a record amount of $4.4 billion invested. As a result, the domestic share of hotel sector activity dwindled and the cross- border share spiked to 47% for the past 12 months, a 15-year high.

Tetsuya Kaneko, Head of Research and Consultancy at Savills Japan, says: “Overseas investors were less active than they would have liked to be in Japan hotels from 2020-2022, while domestic investors were more active, so foreign buyers are now catching up a little.

“Many domestic investors already have significant hotel exposure, including their own developments and so have less incentive to buy now, unless there is keen pricing. However, with the return of tourism, there are no bargains on the market.”

Owners of Japanese hotels will be encouraged by the nation’s plan for a recovery to inbound tourism, which is yet to recover to pre-covid levels. Japan saw 1.8 million visitors in March, up a staggering 2,648% on 2022, but still a third less than received in March 2019.

However the Japanese government is reported to be planning to boost the spend per tourist by 25% to ¥200,000 ($1,500) rather than focusing on continually rising visitor numbers. The government is also planning to promote locations outside Tokyo and well-known cities, which could spark investor interest in new locations.

While Chinese tourists have not yet returned in numbers, Yen weakness has made Japan more attractive to travellers from further afield. For example, the number of Canadian visitors has doubled from 2019.

Kaneko says: “The Japanese government is keen to get tourism back on the upward trajectory it was on prior to the pandemic. If it keeps improving that will encourage more investment in hotels from overseas.”

Further reading:

Japan Hotel Market Report

Contact Us:

Tetsuya Kaneko